- United States

- /

- Diversified Financial

- /

- NasdaqGS:ACTG

Does Acacia Research (NASDAQ:ACTG) Have A Healthy Balance Sheet?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Acacia Research Corporation (NASDAQ:ACTG) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Acacia Research

What Is Acacia Research's Debt?

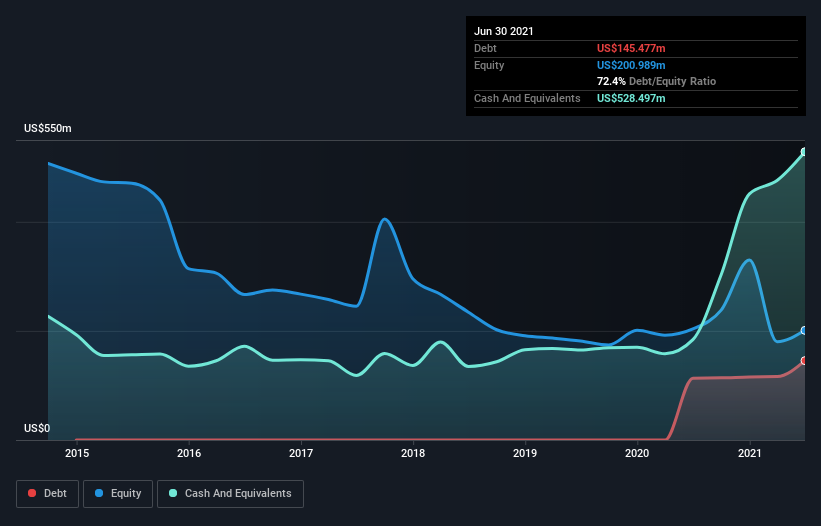

The image below, which you can click on for greater detail, shows that at June 2021 Acacia Research had debt of US$145.5m, up from US$113.4m in one year. However, its balance sheet shows it holds US$528.5m in cash, so it actually has US$383.0m net cash.

A Look At Acacia Research's Liabilities

We can see from the most recent balance sheet that Acacia Research had liabilities of US$171.4m falling due within a year, and liabilities of US$255.4m due beyond that. On the other hand, it had cash of US$528.5m and US$12.8m worth of receivables due within a year. So it can boast US$114.5m more liquid assets than total liabilities.

This surplus liquidity suggests that Acacia Research's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. Having regard to this fact, we think its balance sheet is as strong as an ox. Simply put, the fact that Acacia Research has more cash than debt is arguably a good indication that it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Acacia Research's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Acacia Research wasn't profitable at an EBIT level, but managed to grow its revenue by 465%, to US$47m. That's virtually the hole-in-one of revenue growth!

So How Risky Is Acacia Research?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year Acacia Research had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of US$30m and booked a US$50m accounting loss. While this does make the company a bit risky, it's important to remember it has net cash of US$383.0m. That kitty means the company can keep spending for growth for at least two years, at current rates. The good news for shareholders is that Acacia Research has dazzling revenue growth, so there's a very good chance it can boost its free cash flow in the years to come. High growth pre-profit companies may well be risky, but they can also offer great rewards. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 1 warning sign with Acacia Research , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Acacia Research or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:ACTG

Acacia Research

Operates as an acquirer and operator of businesses across industrial, energy, and technology sectors in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026