- United States

- /

- Electrical

- /

- NYSEAM:KULR

KULR Technology Group (KULR): Evaluating Valuation After Launch of Advanced Battery Management System for Defense and Space

Reviewed by Kshitija Bhandaru

KULR Technology Group (KULR) just rolled out its next-generation battery management system, the kBMS, with a focus on mission-critical markets such as defense and space. This launch emphasizes reliability, safety, and flexible configurations.

See our latest analysis for KULR Technology Group.

After a stretch of range-bound trading, KULR’s recent kBMS launch has added fresh momentum to the story. While the share price return has slipped slightly year-to-date, long-term total shareholder return stands positive at 1.3% over the past year. This hints at a gradual shift toward renewed optimism around its growth and innovation themes.

If the new defense and space focus piqued your interest, it might be time to explore other leaders in aerospace and defense with our See the full list for free.

With shares trading at a steep discount to analyst price targets and impressive revenue growth on the books, investors are left to wonder whether KULR is undervalued or if the current price already reflects its future potential.

Most Popular Narrative: 81.8% Undervalued

With the most popular narrative pegging KULR’s fair value far above its last close of $5.46, there is a striking gulf between consensus forward expectations and the market’s current stance. This sets the stage for a story of bold expansion and premium product positioning.

Regulatory demand for advanced battery safety, circularity, and compliance continues to intensify across markets, creating a tailwind for KULR's proprietary safety solutions (ballistic proof batteries, certified packaging, tested screening) and broadening its total addressable market in logistics, energy storage, and e-mobility sectors. This points to long-term recurring revenue growth and potential for above-industry-average net margins.

What if KULR’s premium battery tech and surging demand really do unlock exponential growth? Discover which high-stakes assumptions drive this narrative’s striking fair value. The rest might just surprise you.

Result: Fair Value of $30.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on equity funding or unpredictable product-driven revenue could stall momentum and undermine even the most optimistic growth projections.

Find out about the key risks to this KULR Technology Group narrative.

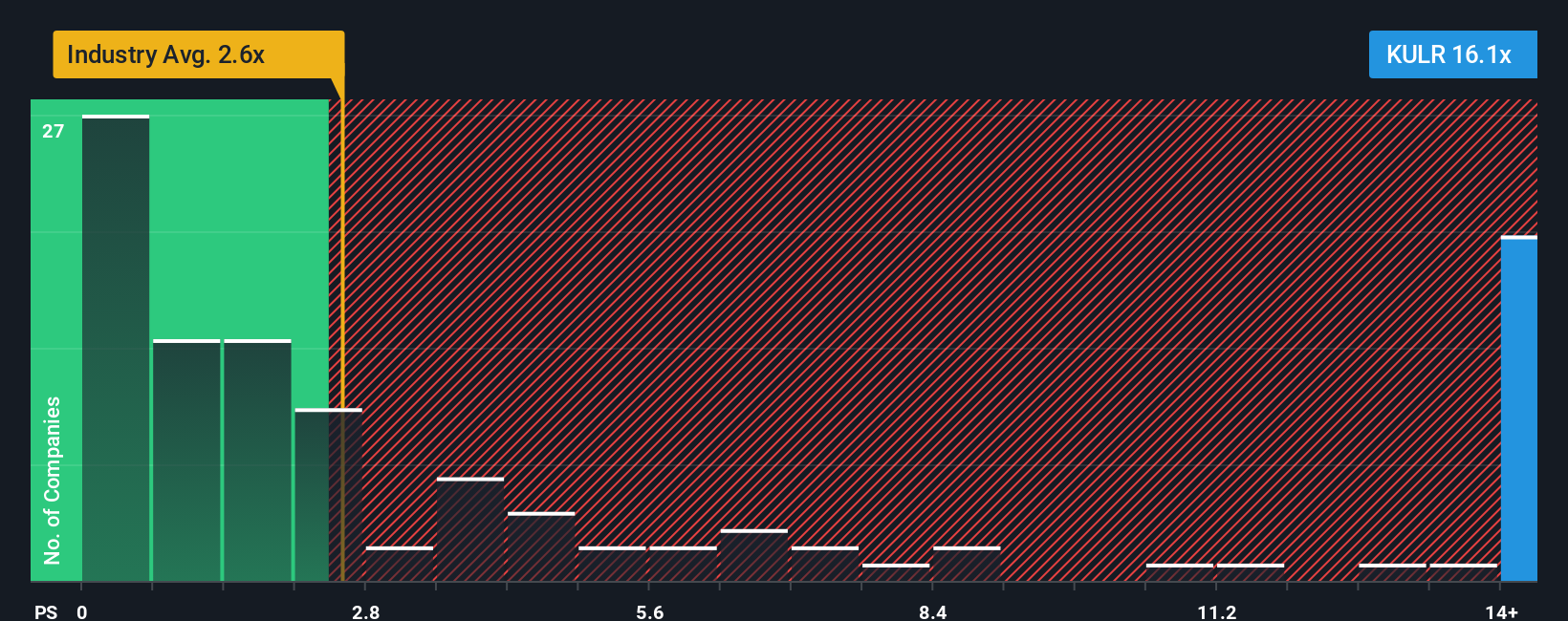

Another View: The Price Ratios Challenge

Looking through the lens of price-to-sales ratios, KULR trades at 17.3x, which is much more expensive than both its peer average of 8.7x and the wider US Electrical industry at just 2.2x. Even the fair ratio of 16.6x suggests limited upside compared to its current level, raising concerns about valuation risk. Does this premium price reflect genuine future growth, or is the market getting ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KULR Technology Group Narrative

If you want to dig into the numbers and shape the story yourself, you can build your own KULR narrative in just a few minutes. Do it your way

A great starting point for your KULR Technology Group research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Stock Ideas?

Don’t miss out on the chance to supercharge your portfolio with unique opportunities chosen for their standout growth, innovation, or defensive traits. Take action now and get ahead with premium stock screeners built to spot tomorrow’s winners today.

- Unlock bargains with upside potential by checking out these 896 undervalued stocks based on cash flows to see which companies are priced below their true worth.

- Capture the momentum of artificial intelligence advancements by following these 24 AI penny stocks for solid innovation stories and high-growth prospects.

- Boost your income while benefiting from defensive market plays by reviewing these 19 dividend stocks with yields > 3% for reliable dividend payers yielding over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KULR Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:KULR

KULR Technology Group

Through its subsidiary, KULR Technology Corporation, develops and commercializes thermal management technologies for electronics, batteries, and other components applications in the United States.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives