- United States

- /

- Machinery

- /

- NYSE:XYL

Did Xylem’s (XYL) Raised Outlook and Strong Quarter Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, Xylem reported a 6% year-over-year revenue increase and raised its outlook for both revenue and earnings per share following strong quarterly results.

- Increased institutional investor interest in response to Xylem’s improving fundamentals and revised guidance has highlighted momentum in its water and wastewater treatment operations.

- We'll explore how Xylem's raised guidance, underpinned by strong quarterly performance, could influence the company's broader investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Xylem Investment Narrative Recap

To be a shareholder in Xylem, you need to believe in the long-term case for global water and wastewater infrastructure investment, and view the company’s move toward high-value, recurring digital offerings as a competitive strength. While the recent revenue increase and upward guidance may reinforce confidence in the short-term outlook, the largest risk remains Xylem's reliance on public sector funding cycles in developed markets, this news does little to change that core uncertainty. Among the recent announcements, Xylem's raised full-year 2025 revenue guidance stands out for its relevance, reflecting the tangible impact of resilient demand, project execution, and success in integrating new digital and advanced treatment solutions. This updated guidance is important, as it directly addresses a key catalyst for Xylem: adoption of smart metering and digital infrastructure upgrades driving margin and revenue growth. Yet, despite robust current trends, investors should keep in mind that potential shifts in government infrastructure funding cycles can still create...

Read the full narrative on Xylem (it's free!)

Xylem's outlook anticipates $10.2 billion in revenue and $1.4 billion in earnings by 2028. This reflects a 5.2% annual revenue growth rate and an earnings increase of $462 million from current earnings of $938.0 million.

Uncover how Xylem's forecasts yield a $157.89 fair value, a 8% upside to its current price.

Exploring Other Perspectives

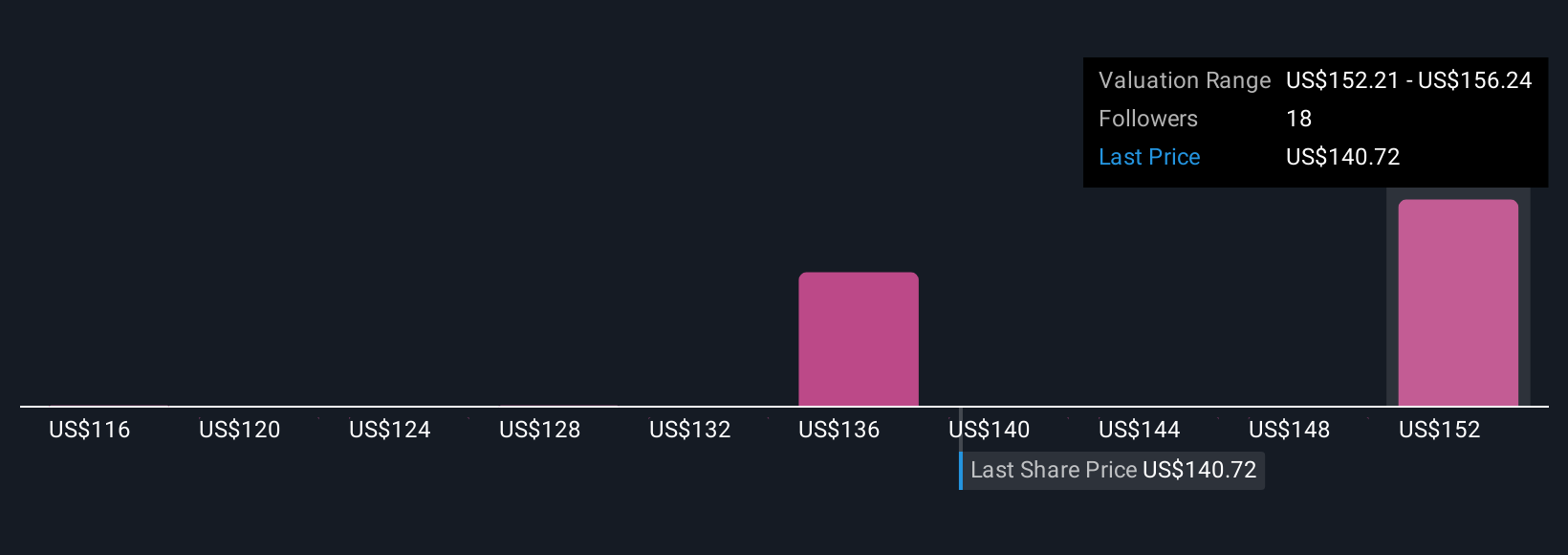

Four fair value estimates from the Simply Wall St Community span a wide range, from US$116 to just under US$158 per share. These diverse views appear alongside analyst attention to Xylem’s margin expansion efforts and ongoing reliance on developed market funding cycles, reminding you to weigh a range of perspectives on the company’s future performance.

Explore 4 other fair value estimates on Xylem - why the stock might be worth 20% less than the current price!

Build Your Own Xylem Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Xylem research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Xylem research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Xylem's overall financial health at a glance.

No Opportunity In Xylem?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYL

Xylem

Engages in the design, manufacture, and servicing of engineered products and solutions for utility, industrial, and residential and commercial building services settings worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives