- United States

- /

- Machinery

- /

- NYSE:XYL

A Look at Xylem’s (XYL) Valuation Following High-Profile Amazon Partnership on Smart Water Solutions

Reviewed by Kshitija Bhandaru

If you’re wondering what’s driving the recent attention around Xylem (NYSE:XYL), it’s all about their ambitious partnership with Amazon. The companies are rolling out Xylem Vue, a data-driven software platform designed to tackle water leaks and improve supply in Mexico City and Monterrey. By promising to save over a billion liters of water collectively every year for these cities, Xylem is not just making headlines but also underlining its expertise in applying technology for real-world infrastructure challenges. For investors, this kind of high-profile project in collaboration with a globally recognized partner like Amazon is a signal that Xylem is serious about scaling its smart water solutions internationally.

Zooming out, Xylem’s announcement comes at a time when momentum is already building for the stock. Over the past year, shares have delivered a 7% total return, with an impressive 23% gain year-to-date and almost 65% over the past three years. This new project dovetails with other developments, including ongoing expansion into digital water management and rising financial performance. Net income grew 13% last year on 5% revenue growth. The company continues to make the case that its growth story is far from tapped out.

So with the stock drifting upward and this international partnership shining a fresh spotlight on Xylem, the question is clear: Is there room for more upside, or is the market already banking on future growth?

Most Popular Narrative: 8.5% Undervalued

The latest consensus narrative views Xylem as undervalued, suggesting the current stock price leaves room for additional upside under the right conditions.

Significant and increasing investment in aging water infrastructure, notably in the U.S. and U.K., supports a strong multi-year backlog (greater than $5 billion). Anticipated order rebounds as funding cycles and regulatory timelines normalize are expected to contribute to steady revenue growth and greater earnings visibility.

Curious about the formula powering Xylem's projected jump in value? There is a calculated mix of ambitious growth assumptions and forward-looking profit targets that few would expect. Behind this bullish outlook lies a crucial financial lever that could shape Xylem’s path for years to come. Want to unravel their surprising blueprint for margin expansion and bold earnings goals? Keep reading for the details that analysts are betting on.

Result: Fair Value of $156.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent funding delays or renewed economic weakness in key overseas markets could quickly undermine these positive growth projections for Xylem.

Find out about the key risks to this Xylem narrative.Another View: Are Investors Overpaying?

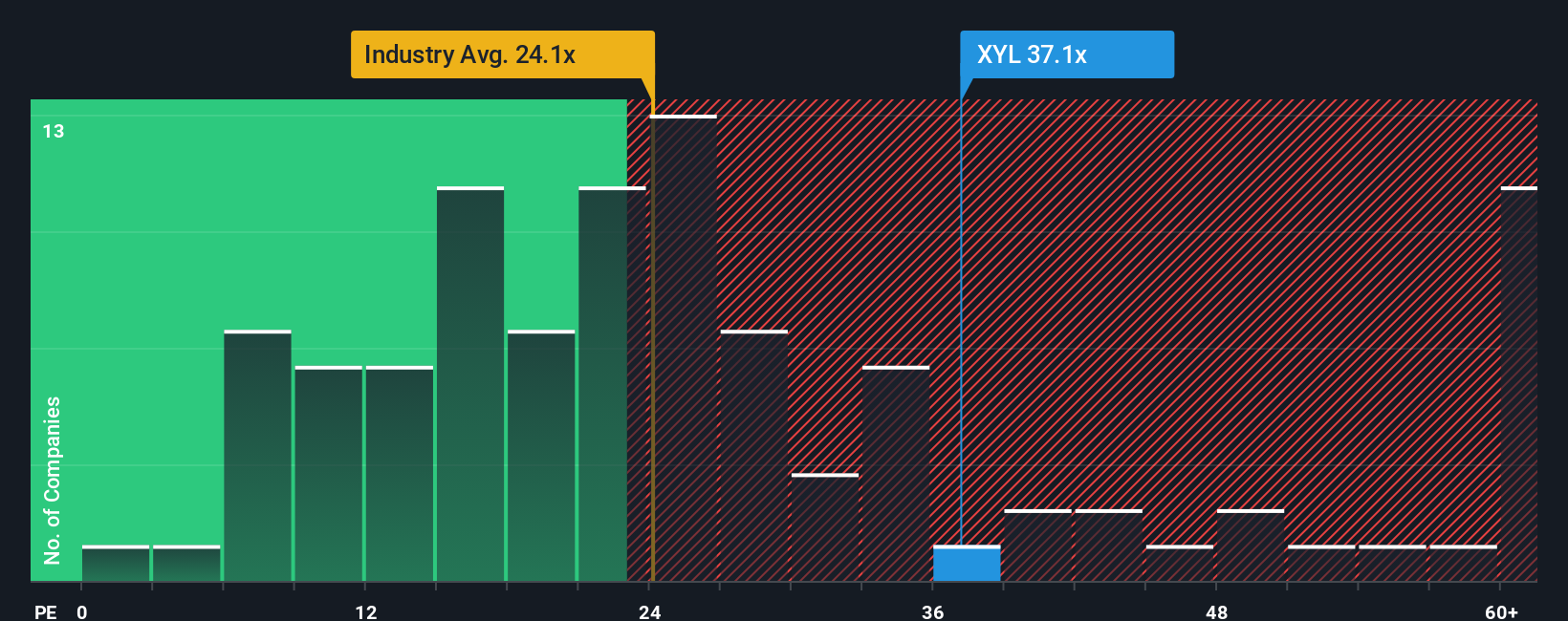

Looking from a different angle, the current market price suggests Xylem may actually be expensive compared to the industry norm for similar companies. This approach, based on earnings, challenges the idea that the shares are truly undervalued. Could optimism be getting ahead of reality here?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Xylem to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Xylem Narrative

If you see the story playing out differently, or you're ready to dig into the numbers your own way, you can build your personal take in just minutes. Do it your way.

A great starting point for your Xylem research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit your search. These fresh themes could help you uncover overlooked gems and untapped opportunities in the market, so why miss your chance?

- Spot high-potential companies shaking up financials when you check out our penny stocks with strong financials.

- Tap into tomorrow’s biggest gains by browsing undervalued stocks based on cash flows that the market may be missing right now.

- Supercharge your portfolio with steady income by finding dividend stocks with yields > 3% delivering attractive, reliable yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYL

Xylem

Engages in the design, manufacture, and servicing of engineered products and solutions for utility, industrial, and residential and commercial building services settings worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives