- United States

- /

- Machinery

- /

- NYSE:XYL

A Closer Look at Xylem (XYL) Valuation Following Recent Share Price Rally

Reviewed by Kshitija Bhandaru

Xylem (XYL) shares have climbed about 7% this month, catching investor attention amid steady gains in the capital goods sector. The company’s healthy pace of earnings and revenue growth remains a talking point as markets weigh its outlook.

See our latest analysis for Xylem.

Xylem’s recent 7% share price rally reflects growing optimism as the company builds on a year marked by consistent momentum. Alongside sector strength, investors seem encouraged by Xylem’s 13.6% total shareholder return over the past twelve months. Longer-term gains have shown steady resilience. Recent news has been relatively quiet, but these price moves suggest the market is taking another look at Xylem’s growth potential and underlying fundamentals.

If Xylem’s run has you wondering what else is gaining traction, it could be a great time to discover fast growing stocks with high insider ownership.

With shares not far from analyst targets and annual growth still strong, the question now is whether Xylem offers room for further upside or if the stock’s recent surge means future gains are already priced in.

Most Popular Narrative: 4.1% Undervalued

With Xylem’s narrative fair value set at $156.24, just above the most recent close, the current market price sits within striking distance of consensus expectations. This valuation reflects optimism about upcoming growth catalysts and long-term profitability improvements.

Continued market and regulatory push for advanced water treatment, nutrient removal, and zero-liquid-discharge solutions is expanding Xylem's addressable market. Recent acquisitions (Vacom, Envirex) have added higher-value, differentiated offerings, supporting long-term revenue and margin expansion.

Curious what drives this premium price? Analysts are betting on lasting momentum from technology upgrades, recurring service revenue, and margin improvements not often seen in this industry. What bold numbers power the narrative’s conviction?

Result: Fair Value of $156.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent economic headwinds in developing markets or delays in infrastructure funding could challenge Xylem’s growth momentum and affect future earnings visibility.

Find out about the key risks to this Xylem narrative.

Another View: Market Ratios Signal a Premium

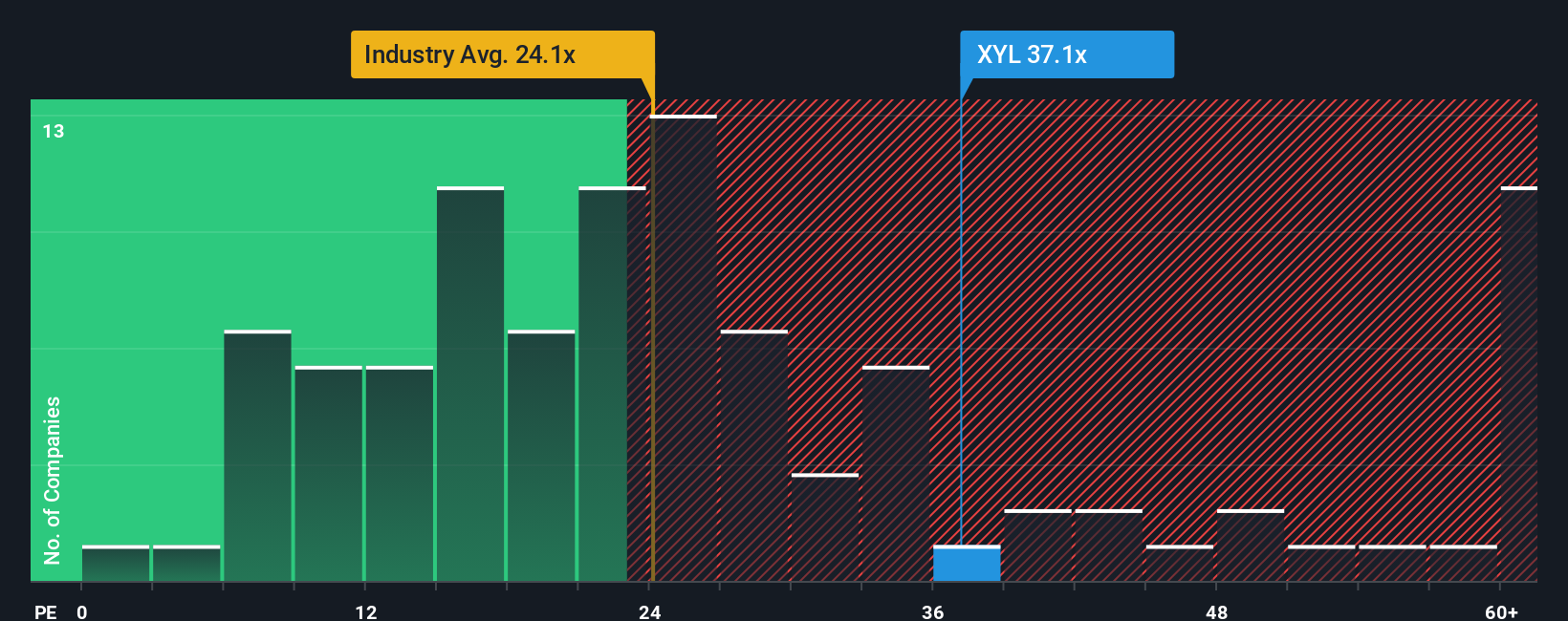

While the narrative approach suggests Xylem is undervalued, a look at market ratios tells a different story. Xylem currently trades at a price-to-earnings ratio of 38.9x, noticeably higher than both its peer average (31.8x) and the broader US Machinery industry average (24.3x). Compared to the fair ratio, set at 27.4x, Xylem appears priced for perfection. Such a premium could reflect conviction in the company’s future growth, or it could mean there is little room for error. Do investors risk overpaying for growth that is already factored in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xylem Narrative

If these perspectives do not match your own or you prefer a hands-on approach, you can build your own data-driven view quickly and easily, your way: Do it your way.

A great starting point for your Xylem research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let your momentum stop here. Tap into fresh opportunities with these handpicked themes that could strengthen and energize your portfolio now.

- Boost your income potential and uncover stable cash flow by checking out these 19 dividend stocks with yields > 3% offering solid yields above 3%.

- Unlock the next wave of artificial intelligence breakthroughs by seeing which companies are at the frontier with these 24 AI penny stocks.

- Ride the industry's tech evolution and spot undervalued opportunities before the market catches on through these 901 undervalued stocks based on cash flows based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYL

Xylem

Engages in the design, manufacture, and servicing of engineered products and solutions for utility, industrial, and residential and commercial building services settings worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives