- United States

- /

- Trade Distributors

- /

- NYSE:WSO

Record Gross Margin Amid Revenue Pressures Might Change the Case for Investing in Watsco (WSO)

Reviewed by Sasha Jovanovic

- In its most recent results, Watsco reported third-quarter 2025 earnings that missed analyst expectations, with both earnings per share and revenues declining compared to the previous year due to pressures from the industry-wide transition to new refrigerant systems, softer consumer spending, and a housing market slowdown.

- Despite these top-line challenges, the company achieved record gross margin expansion thanks to effective pricing and a focus on optimizing its product mix, while management reiterated its commitment to ongoing digital transformation and technology platform investment.

- Now, we’ll consider how Watsco’s record gross margin performance and ongoing market headwinds might affect the company’s long-term investment outlook.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Watsco Investment Narrative Recap

For investors considering Watsco, the core belief centers on the company’s ability to benefit from the large-scale transition to higher-efficiency HVAC systems that are expected to drive long-term sales and profitability. The most recent earnings miss is unlikely to materially change the importance of the A2L refrigerant transition as the key near-term catalyst, though it highlights how industry headwinds, such as a sluggish housing market and changing regulations, remain the biggest immediate risk to results.

One recent announcement relevant to these results is management’s reaffirmation of their long-term goal to consistently generate operating cash flow exceeding net income, even amid market volatility. This commitment, paired with expanding investment in digital transformation, supports the company’s focus on sustaining margin improvement despite current economic uncertainty.

Yet for investors, it is important to keep in mind the potential downside if delays or complications arise with the A2L transition…

Read the full narrative on Watsco (it's free!)

Watsco's narrative projects $9.1 billion in revenue and $758.2 million in earnings by 2028. This requires 6.5% yearly revenue growth and a $262.7 million earnings increase from the current $495.5 million.

Uncover how Watsco's forecasts yield a $408.90 fair value, a 20% upside to its current price.

Exploring Other Perspectives

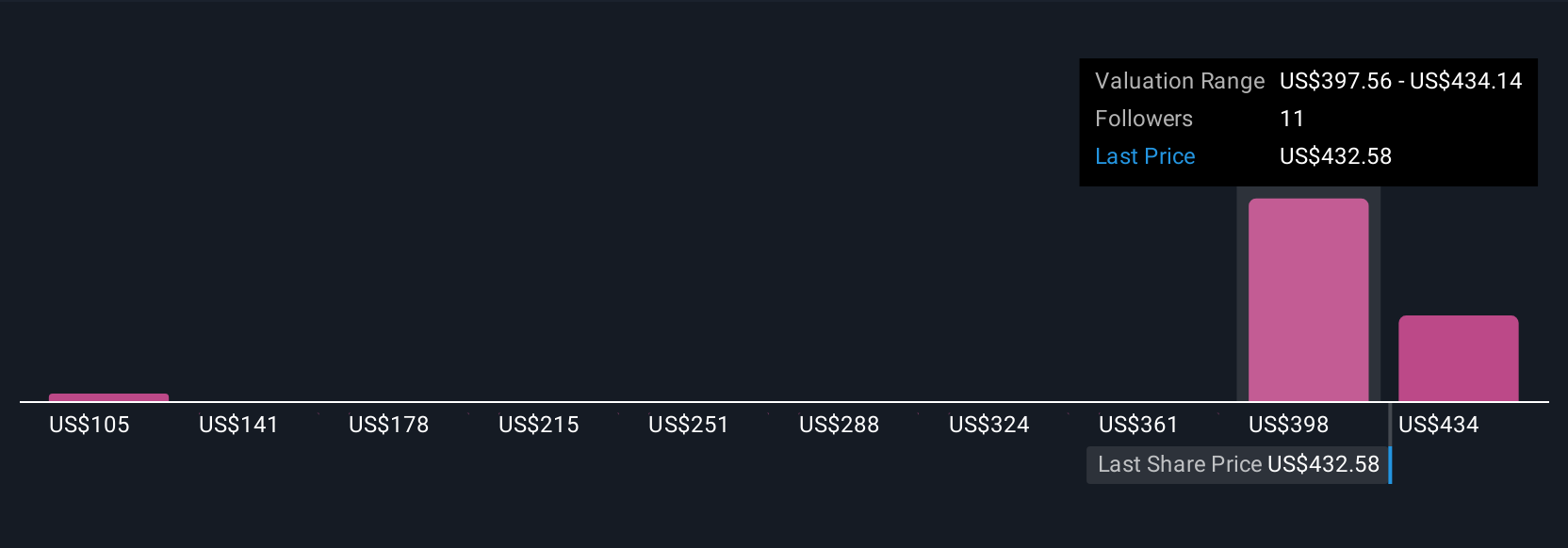

Three members of the Simply Wall St Community recently estimated Watsco’s fair value in a wide range from US$104.90 to US$522.09 per share. With A2L system transition pressures weighing on margins and revenue, consider how differing views on execution and timing could shape these outlooks for Watsco’s future performance.

Explore 3 other fair value estimates on Watsco - why the stock might be worth as much as 53% more than the current price!

Build Your Own Watsco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Watsco research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Watsco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Watsco's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Watsco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WSO

Watsco

Engages in the distribution of air conditioning, heating, and refrigeration equipment, and related parts and supplies in the United States, Canada, Latin America, and the Caribbean.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026