- United States

- /

- Machinery

- /

- NYSE:WOR

Worthington Enterprises (WOR): Evaluating Valuation Following Earnings Surge, Elgen Acquisition, and Building Products Momentum

Reviewed by Kshitija Bhandaru

Worthington Enterprises (WOR) delivered a strong quarterly update, highlighting meaningful gains in financial performance driven by higher sales volumes and growth in the Building Products segment. The recent Elgen acquisition also supports further expansion and diversification.

See our latest analysis for Worthington Enterprises.

After a stellar run earlier this year, Worthington Enterprises’ share price has slipped over the past month, down 13.7%. Even so, its year-to-date share price return is an impressive 41.3%. This momentum reflects optimism about stronger fundamentals following the Elgen acquisition and a robust balance sheet, but also suggests that some investors are recalibrating expectations as the broader economic outlook remains mixed. Over the long term, the stock’s 38.6% total return in the past year highlights solid performance, with exceptional gains of 121% in total return over three years.

If the recent moves at Worthington have you curious about other rising companies, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With recent gains, strong cash flow, and successful acquisitions now in the past, the big question becomes clear: is Worthington Enterprises still undervalued, or has the market already priced in its future growth potential?

Most Popular Narrative: 20.2% Undervalued

Worthington Enterprises closed at $55.04. The most popular narrative sees fair value above $69 per share. This notable gap emerges from optimism around strategic expansion, operational efficiency, and new products, all of which could drive future margin and earnings growth.

Worthington Enterprises is leveraging innovation to drive growth, as evidenced by the launch of new IoT-enabled and consumer products like SureSense and Balloon Time Mini, which are expected to increase revenues. The company is investing in operational efficiencies through facility modernization projects and automation, anticipated to improve net margins over time.

Want to know the bold forecasts that support this high valuation? This narrative centers on ambitious growth, game-changing margins, and a future earnings leap rarely seen in industrials. Click through to uncover which assumptions drive the optimism behind that eye-catching fair value target.

Result: Fair Value of $69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing trade disputes and softening steel prices could challenge Worthington’s growth narrative. These factors may potentially weigh on future revenue and profit margins.

Find out about the key risks to this Worthington Enterprises narrative.

Another View: What Do the Multiples Say?

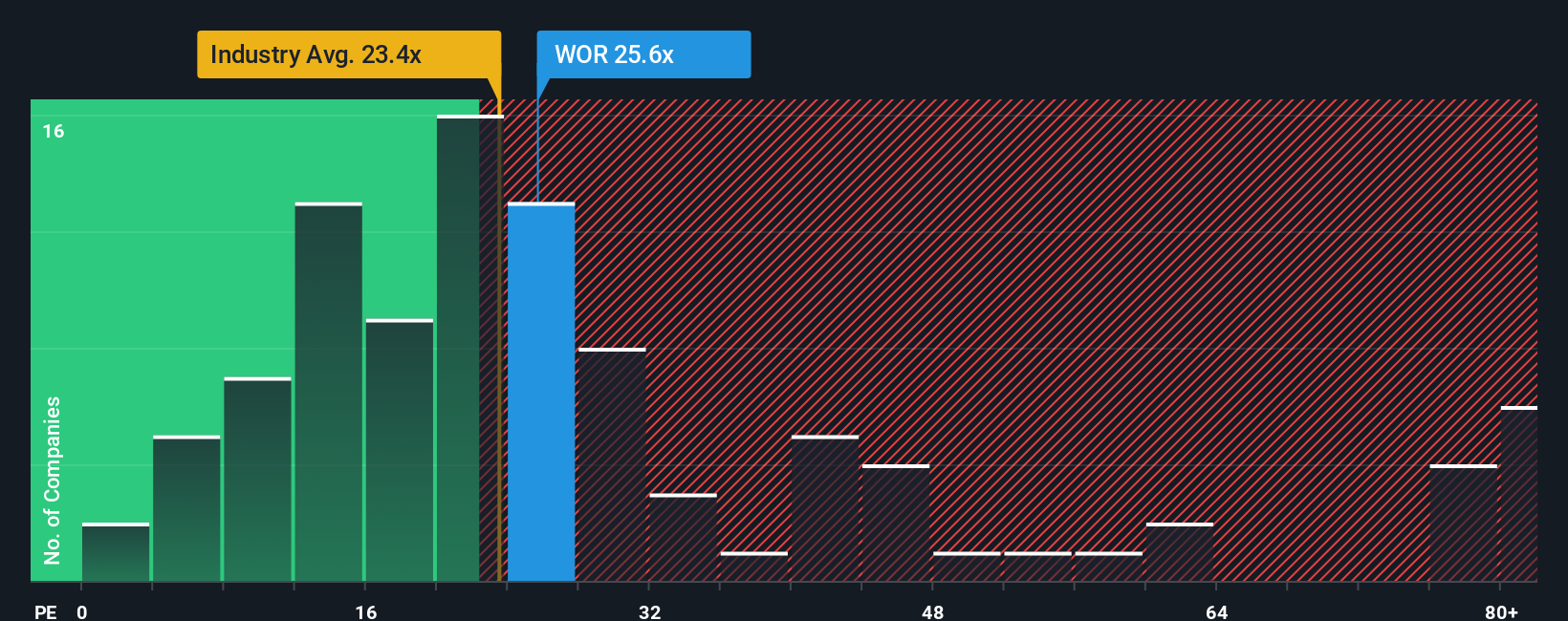

Looking at valuation through the lens of the price-to-earnings ratio, Worthington trades at 25.6 times earnings. This is above both the US Machinery industry average of 23.4x and its fair ratio of 25.1x, but below the peer average of 36.5x. This suggests that, while optimism is high, investors could be paying a premium that may not leave much room for disappointment. Does this premium reflect lasting quality or simply heightened expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Worthington Enterprises Narrative

If you’d like to dig into the numbers yourself or shape your own perspective, you can craft a personalized story in just a few minutes: Do it your way

A great starting point for your Worthington Enterprises research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Act quickly to uncover unique investment themes others may overlook. Your next big opportunity could be a click away with Simply Wall Street’s powerful screeners.

- Seize the potential of overlooked value by scanning these 891 undervalued stocks based on cash flows for stocks trading below their cash flow-driven worth.

- Tap into high-yield potential by targeting passive income opportunities through these 19 dividend stocks with yields > 3% offering yields above 3%.

- Step into the future of medicine and technology by finding leaders with these 33 healthcare AI stocks at the intersection of AI and healthcare innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Worthington Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WOR

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives