- United States

- /

- Machinery

- /

- NYSE:WOR

Worthington Enterprises (WOR): Assessing Valuation After a Choppy Three-Month Share Price Pullback

Reviewed by Simply Wall St

Worthington Enterprises (WOR) has been on a choppy stretch lately, with shares down about 15% over the past 3 months even as the stock still sits well ahead on a 1 year view.

See our latest analysis for Worthington Enterprises.

That pullback comes after a strong run, with the share price still showing a solid year to date gain and longer term total shareholder returns comfortably positive. This suggests momentum has cooled rather than completely reversing.

If Worthington has you rethinking your portfolio mix, it might be a good moment to explore fast growing stocks with high insider ownership for other under the radar growth stories with skin in the game.

With profits rising faster than revenue and shares still sitting below analyst targets, the recent pullback raises a key question: Are investors overlooking Worthington’s earnings power, or has the stock already priced in its next leg of growth?

Most Popular Narrative Narrative: 20.1% Undervalued

With Worthington Enterprises last closing at $55.14 against a narrative fair value of $69, the story leans toward upside and invites a closer look.

The company is investing in operational efficiencies through facility modernization projects and automation, anticipated to improve net margins over time. Strategic partnerships and new market entry, such as those with Tractor Supply and Walmart, are expected to expand distribution channels and support revenue growth.

Curious how margin expansion, disciplined growth, and a lower future earnings multiple can still support a higher value? The key assumptions might surprise you. Unlock the full narrative to see what is driving this upside case.

Result: Fair Value of $69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro uncertainty and softer consumer demand, along with any missteps integrating acquisitions, could quickly undermine the upbeat margin and growth narrative.

Find out about the key risks to this Worthington Enterprises narrative.

Another Angle on Valuation

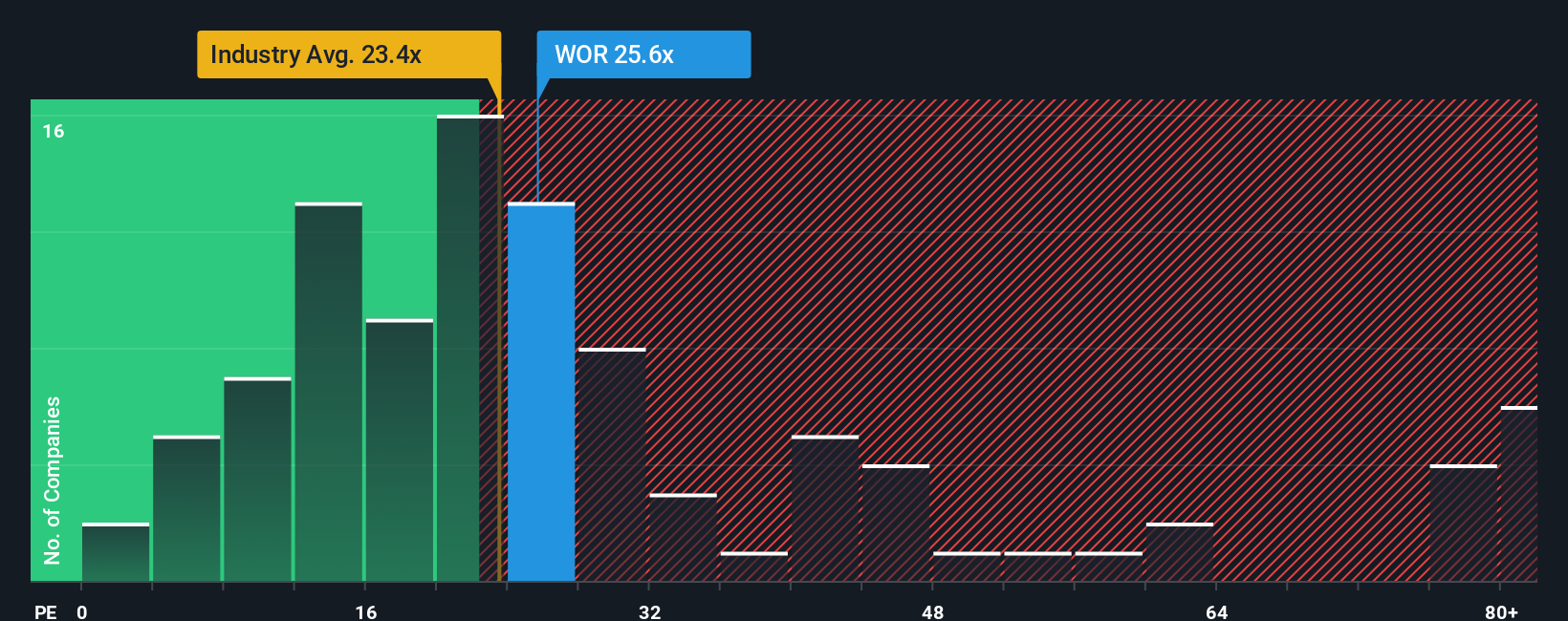

Multiples tell a more cautious story. Worthington trades on a P E of 25.6 times, slightly richer than the Machinery industry at 25.3 times and its own fair ratio of 24 times. This suggests there may be less margin of safety if growth or margins disappoint from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Worthington Enterprises Narrative

If you see the story differently or simply prefer to dig into the numbers yourself, you can build a custom view in just a few minutes, Do it your way.

A great starting point for your Worthington Enterprises research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with Worthington. Sharpen your edge by using the Simply Wall St Screener to uncover fresh, data driven opportunities that others are still missing.

- Capture value opportunities early by scanning these 908 undervalued stocks based on cash flows that strong cash flow analysis suggests may be trading below their true potential.

- Position ahead of the next tech wave by targeting these 26 AI penny stocks harnessing artificial intelligence to reshape entire industries.

- Strengthen your income stream by reviewing these 15 dividend stocks with yields > 3% that offer attractive yields supported by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Worthington Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WOR

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026