- United States

- /

- Machinery

- /

- NYSE:WOR

A Fresh Look at Worthington Enterprises (WOR) Valuation Following Analyst Concerns About End-Market Challenges

Reviewed by Kshitija Bhandaru

Worthington Enterprises (WOR) has come under the spotlight after recent analyst commentary pointed to ongoing headwinds in its key end-markets. Sales are trending lower and returns on capital are under pressure. Wall Street’s cautious tone reflects heightened concerns about the company’s operating environment.

See our latest analysis for Worthington Enterprises.

Momentum has cooled recently for Worthington Enterprises, with a 30-day share price return of -7.44%. However, the bigger picture tells a more resilient story. The stock is still up 45% for the year to date, and long-term investors have benefited from a remarkable 111% total return over three years, even as operational headwinds persist.

If you’re weighing your next move, this could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership.

With shares trading at a notable discount to analyst targets and robust long-term returns, investors are left wondering whether Worthington Enterprises is undervalued or if the market has already accounted for future growth prospects.

Most Popular Narrative: 18.1% Undervalued

Worthington Enterprises recently closed at $56.52, well below the narrative's fair value estimate of $69. This gap highlights the optimism among followers about upcoming growth catalysts and stronger profits on the horizon.

Worthington Enterprises is leveraging innovation to drive growth, as evidenced by the launch of new IoT-enabled and consumer products like SureSense and Balloon Time Mini. These products are expected to increase revenues. The company is investing in operational efficiencies through facility modernization projects and automation, which are anticipated to improve net margins over time.

What is the secret behind this bullish outlook? The narrative hinges on rapid expansion of new tech products, higher earnings projections, and a major turnaround in profit margins. To discover what fuels these bold assumptions and whether they hold up, curiosity is a must.

Result: Fair Value of $69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro uncertainties and shifts in consumer sentiment could quickly dampen the future earnings potential for Worthington Enterprises.

Find out about the key risks to this Worthington Enterprises narrative.

Another View: Is There More to the Story?

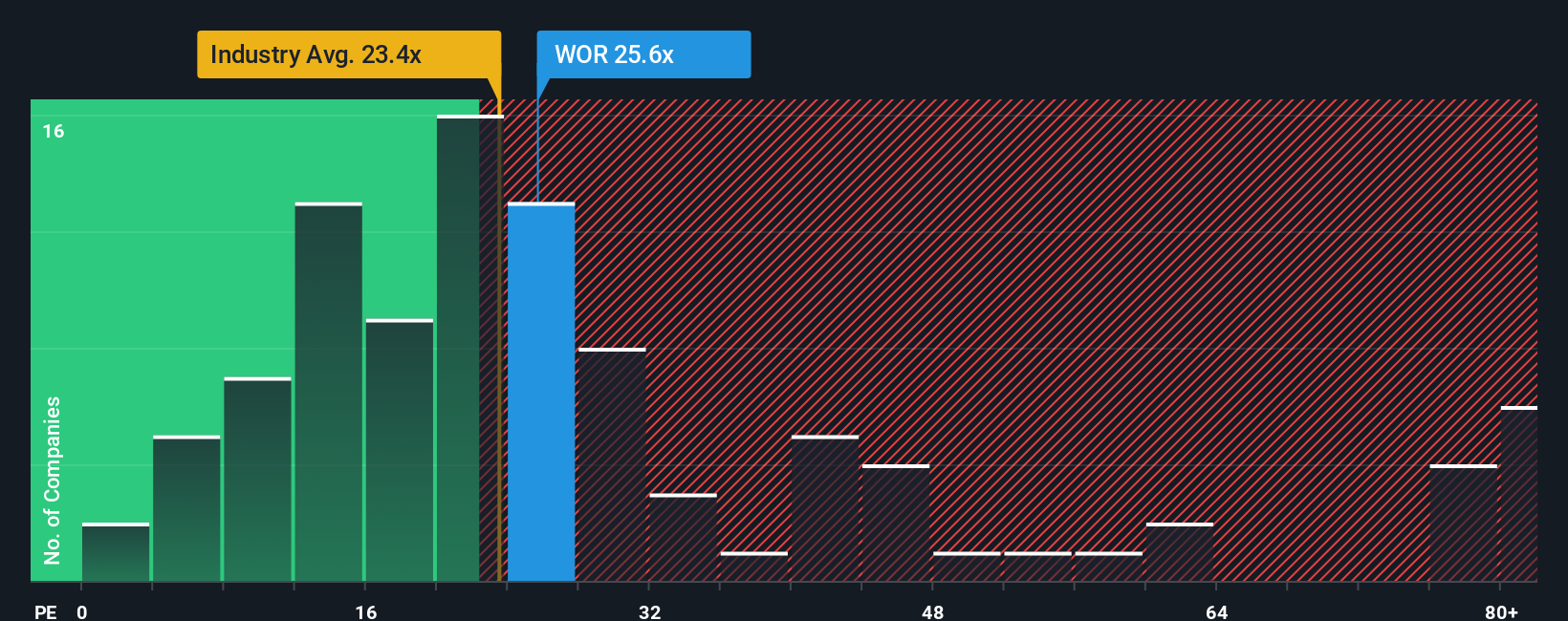

Looking at valuation through another lens, Worthington Enterprises’ current price-to-earnings ratio stands at 26.2 times. This is slightly higher than the industry average of 24.2 times and just above the fair ratio of 25.2 times. While this suggests the stock is more expensive compared to its peers and what the market could settle at, it does reflect recent strong profit growth. Does this premium signal untapped upside or heightened valuation risk if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Worthington Enterprises Narrative

If the current story does not align with your outlook or you prefer hands-on analysis, you can craft your own perspective in just a few minutes. So why not Do it your way?

A great starting point for your Worthington Enterprises research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity slip by. With all eyes on Worthington Enterprises, take charge and find the next breakout with Simply Wall Street’s powerful screens:

- Accelerate your search for hidden potential by scanning the market for these 3596 penny stocks with strong financials, where overlooked gems could deliver surprising growth.

- Secure powerful income streams by targeting these 18 dividend stocks with yields > 3%, which offer solid yields and the stability investors crave in volatile times.

- Fuel your curiosity about tomorrow’s breakthroughs as you analyze the companies shaping healthcare innovation with these 33 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Worthington Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WOR

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives