- United States

- /

- Trade Distributors

- /

- NYSE:WCC

WESCO International (NYSE:WCC) Declares Dividends Amidst Robust Data Center Growth and Strategic Focus

Reviewed by Simply Wall St

Take a closer look at WESCO International's potential here.

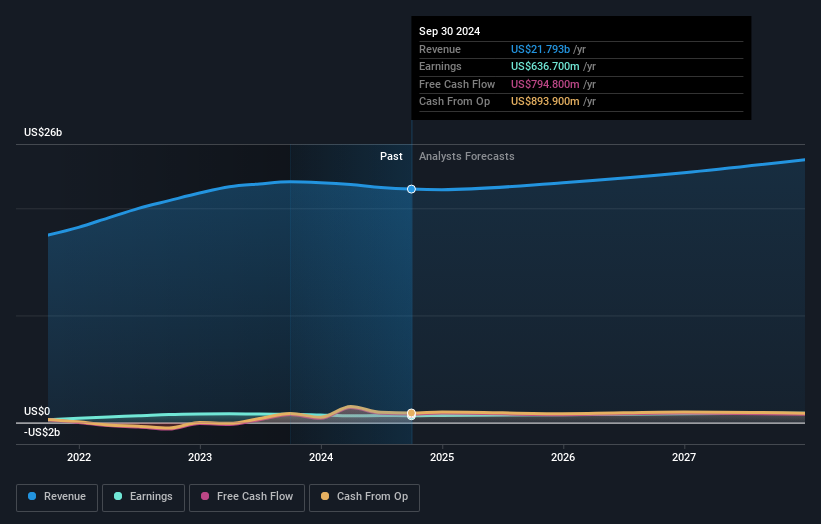

Key Assets Propelling WESCO International Forward

WESCO International has demonstrated significant growth in its data center business, with CEO John Engel noting a more than 40% increase driven by diverse customer segments. This performance underscores the company's strategic focus on high-demand areas. Additionally, CFO David Schulz highlighted the generation of $280 million in free cash flow, representing 145% of adjusted net income, which showcases effective financial management. The company's ability to consistently outperform market averages since mid-2021 further emphasizes its competitive edge. Moreover, WESCO's low payout ratio of 12.7% ensures that dividend payments are well-covered by earnings, indicating financial stability. The recent declaration of dividends on both preferred and common stock reflects the company's commitment to rewarding shareholders.

Strategic Gaps That Could Affect WESCO International

Challenges persist in WESCO's utility and broadband segments, as acknowledged by Engel, which have hindered potential organic growth. This issue highlights the need for strategic adjustments in these areas. Inventory management also remains a concern, with Schulz indicating that inventory days have not met targets, necessitating improved alignment with sales forecasts. Furthermore, the company's adjusted SG&A expenses have risen due to increased investments and operating costs, putting pressure on cost management. While WESCO's Price-To-Earnings Ratio of 15.9x suggests potential, it is currently trading above its estimated fair value, potentially indicating overvaluation relative to intrinsic worth.

Emerging Markets Or Trends for WESCO International

WESCO's commitment to strategic growth is evident in its plan to allocate 75% of cash flow to value-accretive M&A, as stated by Schulz. This initiative presents a significant opportunity for expansion and market positioning. The ongoing expansion in the data center segment, with continued strong growth, highlights the company's ability to capitalize on high-demand markets. Engel's emphasis on value creation through operational improvements and digital transformation aligns with long-term growth trends, offering substantial opportunities for WESCO to enhance its market share.

Market Volatility Affecting WESCO International's Position

The economic and regulatory environment poses challenges, particularly in the utility market, which is experiencing short-term softness due to customer destocking and lower project activity. Engel also pointed out the potential impacts of the upcoming U.S. election, which could influence investment priorities and market dynamics. Additionally, maintaining pricing power amidst stable yet competitive pricing pressures remains a concern, as noted by Engel. These factors underscore the need for WESCO to navigate external challenges effectively to sustain its market position.

Conclusion

WESCO International's growth in the data center sector, driven by diverse customer segments, highlights its strategic focus on high-demand areas, which is critical for maintaining its competitive advantage. The company's strong financial management, evidenced by generating $280 million in free cash flow, supports its ability to reward shareholders and invest in future growth. However, challenges in the utility and broadband segments necessitate strategic adjustments to unlock potential growth. While the company's stock is trading above its estimated fair value, suggesting it may be priced higher than its intrinsic worth, WESCO's commitment to strategic M&A and digital transformation positions it well for long-term market share enhancement. Navigating economic and regulatory challenges effectively will be essential for sustaining its market position and ensuring continued success.

Make It Happen

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WESCO International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WCC

WESCO International

Provides business-to-business distribution, logistics services, and supply chain solutions in the United States, Canada, and internationally.

Good value with mediocre balance sheet.