- United States

- /

- Machinery

- /

- NYSE:WAB

A Look at Westinghouse Air Brake Technologies’s Valuation Following Strong Q3 Results and Insider Selling

Reviewed by Simply Wall St

Westinghouse Air Brake Technologies (WAB) delivered third-quarter results that beat expectations and raised its guidance for 2025. The company highlighted both expanding international demand and strength in locomotive fleet upgrades. At the same time, several top executives sold shares, creating some debate around investor sentiment.

See our latest analysis for Westinghouse Air Brake Technologies.

Following upbeat third-quarter results and raised earnings forecasts, Westinghouse Air Brake Technologies saw its stock maintain solid momentum, with a 5.03% share price return over the last month. Although the recent spike in insider selling sparked some debate, the company’s three-year total shareholder return of nearly 108% shows that long-term investors have been well rewarded as modernization and international expansion build confidence in future growth.

If you’re curious to see what other companies are capturing investor attention, this is a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With analysts raising their price targets, but insider selling tempering optimism, investors are left to consider whether recent gains still leave Westinghouse Air Brake Technologies undervalued or if the market is already pricing in its next stage of growth.

Most Popular Narrative: 11.9% Undervalued

With Westinghouse Air Brake Technologies closing at $203.92 and a most-followed narrative estimating fair value at $231.50, the narrative points to significant upside from here. The consensus is shaped by strong recent deals and a multi-year outlook on earnings, setting the stage for key assumptions and projections that drive this favorable view.

Strategic, accretive acquisitions (Inspection Technologies, Frauscher, DeLiner Couplers) are expanding Wabtec's technological capabilities and global market share. Management expects both immediate and substantial incremental EBITDA, margin expansion, and realization of cost and growth synergies to drive improved net margins and free cash flow over the next several years.

Want to see the numbers fueling this bullish narrative? The path to higher valuation hinges on rapid margin expansion and a profit trajectory that turns rivals green with envy. What’s the wildcard behind these bold assumptions? Uncover which financial levers are powering the narrative’s optimistic price target.

Result: Fair Value of $231.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in North American freight demand and rising integration risks from ongoing acquisitions could pose challenges to Westinghouse Air Brake Technologies’ growth trajectory.

Find out about the key risks to this Westinghouse Air Brake Technologies narrative.

Another View: Is the Price Tag Too Heavy?

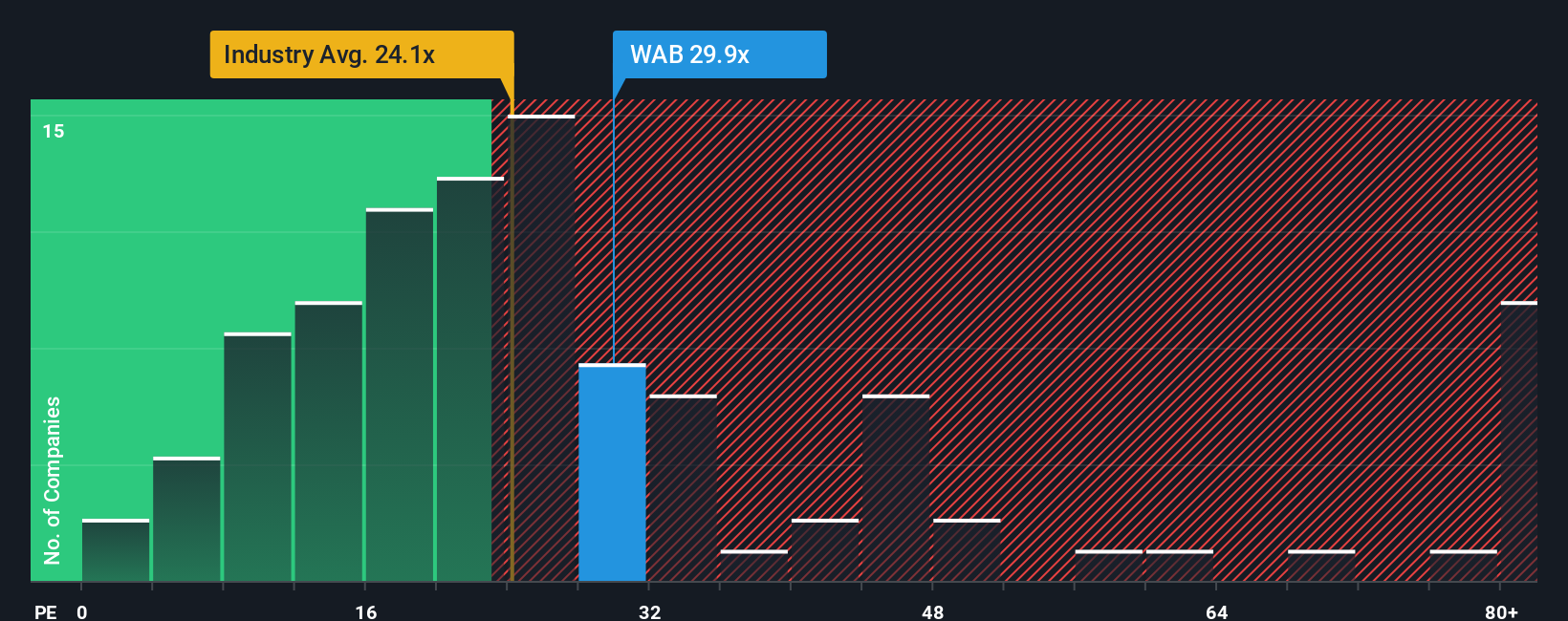

While analysts see upside, a closer look at the price-to-earnings ratio paints a more cautious picture. Westinghouse Air Brake Technologies trades at 29.6 times earnings, which is well above both its industry peers at 16 times and the US Machinery average of 23.9 times. Even compared to its fair ratio of 30, it appears only fairly priced, leaving limited room for error if growth slows. Does this premium suggest investors are betting too heavily on future gains?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Westinghouse Air Brake Technologies Narrative

If you think the story looks different from your perspective or would rather dive into the data personally, you can shape your own view in just a few minutes. Do it your way

A great starting point for your Westinghouse Air Brake Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investing Opportunities?

Smart investors never stop at one idea. Make your next move with these handpicked screens and unlock fresh possibilities that others may overlook.

- Uncover high yields and stable returns by reviewing these 16 dividend stocks with yields > 3% with payouts above 3%. This option is ideal for building a resilient income portfolio.

- Capitalize on the AI boom by checking out these 26 AI penny stocks that are shaping the future with machine learning, automation, and data-driven breakthroughs.

- Get ahead of the curve in frontier tech by examining these 26 quantum computing stocks pushing the boundaries with next-generation computing and revolutionary hardware.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westinghouse Air Brake Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAB

Westinghouse Air Brake Technologies

Provides technology-based locomotives, equipment, systems, and services for the freight rail and passenger transit industries worldwide.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives