- United States

- /

- Machinery

- /

- NYSE:WAB

A Fresh Look at Wabtec (NYSE:WAB) Valuation Following Quarterly Revenue Miss and Sector Momentum

Reviewed by Kshitija Bhandaru

Westinghouse Air Brake Technologies (NYSE:WAB) recently posted quarterly results that fell short of revenue expectations by 2.5%, sparking a 7.8% pullback in the stock after the earnings release. While the industry is seeing wider gains and enthusiasm around automation and decarbonization investment, Wabtec finds itself balancing ongoing growth with some immediate demand and integration headwinds.

See our latest analysis for Westinghouse Air Brake Technologies.

Wabtec’s latest quarterly miss sent the share price sliding, with a 7.8% drop reflecting how quickly sentiment can shift when results disappoint. Even so, the stock shows persistent long-term strength, with a 2.13% one-year total shareholder return and a remarkable 131% gain over three years. This suggests underlying momentum remains in place despite recent turbulence.

If today’s volatility has you curious about what else is in motion, it’s a great time to broaden your investing search and discover fast growing stocks with high insider ownership

So given this mix of steady growth, sector optimism, and recent share price volatility, is Wabtec currently undervalued in the eyes of investors, or is the market already factoring in the company’s future gains?

Most Popular Narrative: 15.5% Undervalued

Compared to the last close price of $191.03, the most widely followed narrative sets Westinghouse Air Brake Technologies’ fair value at $226.12. This suggests significant upside that is grounded in sector-specific growth drivers.

Accelerating adoption of decarbonization and fuel-efficiency technologies by rail operators, driven by heightened regulatory and corporate sustainability priorities, is expected to boost demand for Wabtec's advanced locomotive solutions and modernization programs. This, in turn, could positively impact both revenue and higher-margin aftermarket/services streams.

Hungry for the details that power this valuation? Discover which growth levers and future profitability assumptions fuel these bold expectations. Big numbers, surprising sector moves, and one unique earnings forecast drive the narrative’s price target. Don’t miss out on what could move the market next.

Result: Fair Value of $226.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weakening North American demand and a shrinking freight backlog could challenge the upbeat outlook. This may potentially put pressure on Wabtec’s revenue and future earnings growth.

Find out about the key risks to this Westinghouse Air Brake Technologies narrative.

Another View: What Do Market Ratios Say?

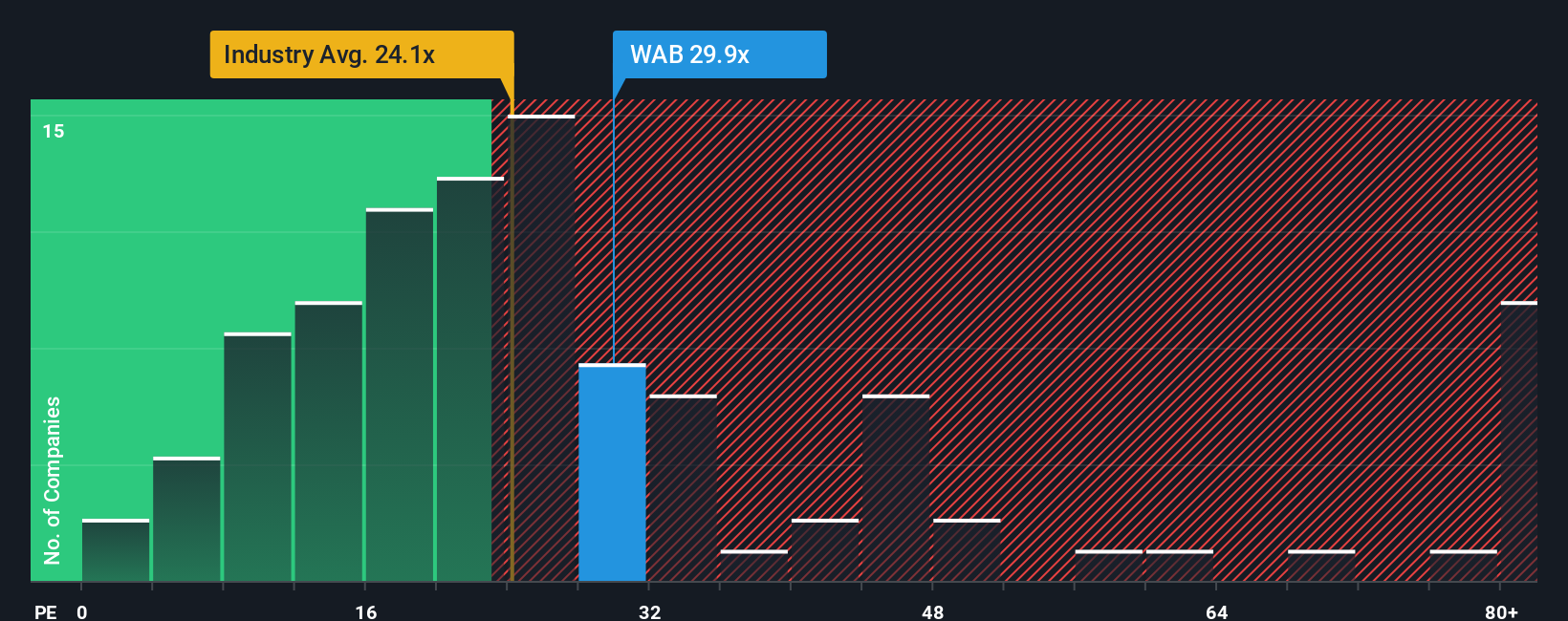

Looking through the lens of price-to-earnings, Westinghouse Air Brake Technologies trades at 28.4 times earnings, which is higher than both the Machinery industry average (23.8x) and its peer group (14x). The fair ratio, based on market trends, is 27.5x. This gap hints at a valuation risk if sentiment shifts. Could the market be overlooking something, or is caution now warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Westinghouse Air Brake Technologies Narrative

If you see the numbers differently or want to uncover your own investment angle, you can dig into the data and craft a personalized story in just a few minutes. Do it your way

A great starting point for your Westinghouse Air Brake Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Give your portfolio a new edge and stay ahead of the market. Check out hand-picked opportunities other investors are already searching for. You don't want to miss out!

- Tap into the booming world of artificial intelligence by screening these 24 AI penny stocks at the forefront of innovation and technological transformation.

- Target consistent income and long-term security by evaluating these 19 dividend stocks with yields > 3% offering reliable yields above 3% for your financial confidence.

- Position yourself early in emerging tech and discover potential with these 26 quantum computing stocks pushing the boundaries of computing power and real-world applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westinghouse Air Brake Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAB

Westinghouse Air Brake Technologies

Provides technology-based locomotives, equipment, systems, and services for the freight rail and passenger transit industries worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives