- United States

- /

- Electrical

- /

- NYSE:VRT

Vertiv (VRT): Reassessing Valuation After Caterpillar Alliance and Billion-Dollar AI Data Center Expansion

Reviewed by Simply Wall St

Vertiv Holdings Co (VRT) just doubled down on the AI data center boom by pairing a new Caterpillar alliance with a billion dollar cooling acquisition and upbeat guidance that points to accelerating demand across its infrastructure portfolio.

See our latest analysis for Vertiv Holdings Co.

That backdrop helps explain why Vertiv’s share price has climbed sharply in recent quarters, with a 90 day share price return of 44.26 percent and a three year total shareholder return above 1,160 percent. This performance signals powerful, still building momentum behind the AI infrastructure story.

If Vertiv’s run has you thinking about what else could ride the next wave of digital infrastructure demand, it is worth exploring high growth tech and AI stocks as a curated way to uncover more ideas.

Yet with the stock already up more than elevenfold in three years and now trading only modestly below analyst targets and some intrinsic estimates, is Vertiv still mispriced, or is today’s valuation already discounting years of AI fueled growth?

Most Popular Narrative: 8.1% Undervalued

With Vertiv last closing at $178.88 against a narrative fair value near $194.63, the most followed view points to upside that still hinges on aggressive growth and margin expansion assumptions.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.6x on those 2028 earnings, down from 59.0x today. This future PE is greater than the current PE for the US Electrical industry at 33.7x.

Want to see the math behind that higher earnings multiple and rich fair value? The narrative leans on powerful revenue growth and a profit reset that could transform Vertiv’s earnings profile. Curious which assumptions really carry the weight in this story and how sensitive the valuation is if they slip even slightly? Dive into the full narrative to unpack the exact forecasts driving that upside case.

Result: Fair Value of $194.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still real execution risks, ranging from ongoing supply chain disruption to potential hyperscaler vertical integration, that could quickly undermine these ambitious margin assumptions.

Find out about the key risks to this Vertiv Holdings Co narrative.

Another Way to Look at Value

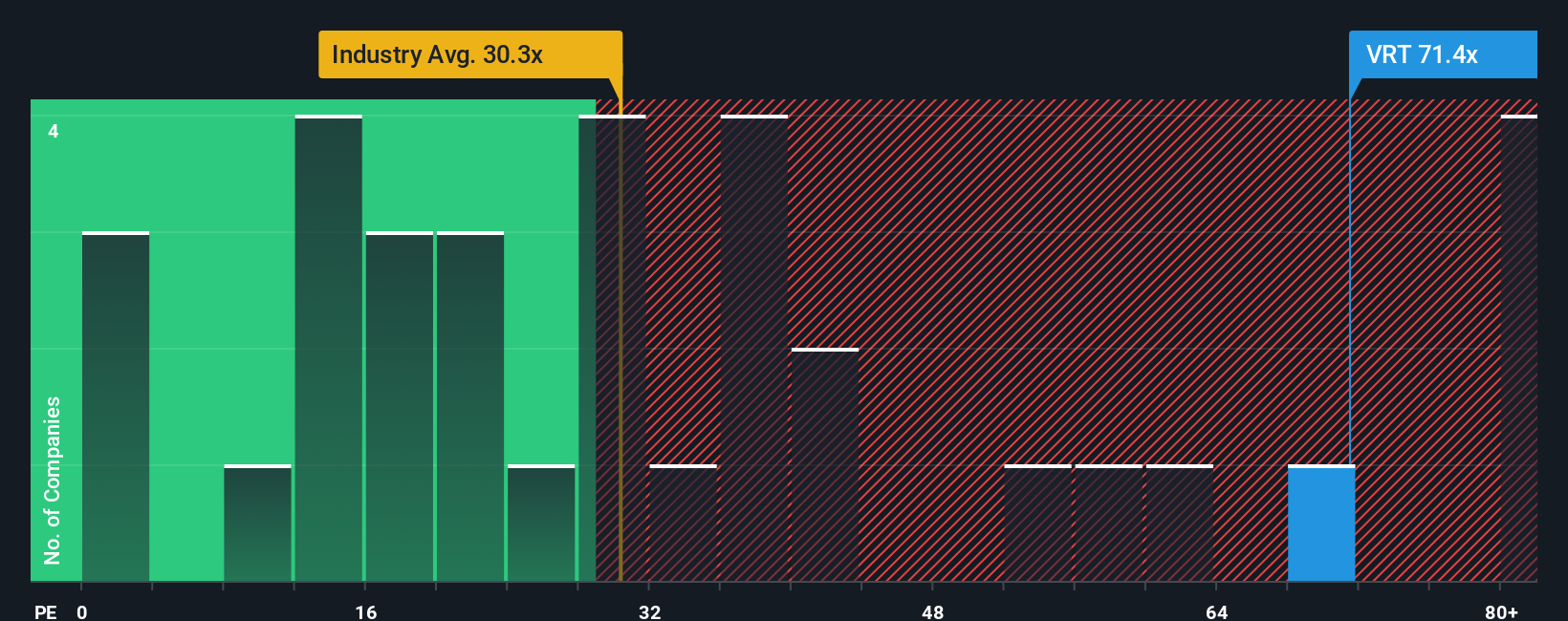

On simple earnings comparisons, Vertiv looks stretched, with a price to earnings ratio of 66.1 times versus 31.2 times for the US Electrical industry and 37.4 times for peers, and even above a fair ratio of 57.8 times. That premium suggests little room for execution missteps, so how comfortable are you paying up for perfection?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vertiv Holdings Co Narrative

If this perspective does not fully align with yours, or you would rather dig into the numbers independently, you can shape a custom view in under three minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vertiv Holdings Co.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover high conviction ideas other investors could be overlooking.

- Capitalize on fast moving themes by scanning these 25 AI penny stocks that are benefiting most from the surge in artificial intelligence adoption and infrastructure spending.

- Strengthen your core portfolio with these 919 undervalued stocks based on cash flows that trade below their estimated cash flow potential and may offer a margin of safety.

- Position yourself early in emerging trends through these 81 cryptocurrency and blockchain stocks gaining ground in digital payments, tokenization, and real world blockchain applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026