- United States

- /

- Aerospace & Defense

- /

- NYSE:VOYG

Does Voyager Technologies Still Offer Upside After Shares Fall Nearly 50% in 2025?

Reviewed by Simply Wall St

Let’s talk Voyager Technologies, because if you’re wondering what’s next for one of the most watched stocks in the sector, you’re not alone. Plenty of investors are weighing whether to stay the course, buy the dip, or look for the next opportunity elsewhere. After all, Voyager’s stock closed at $29.60 and just posted a 0.6% bump over the last week, with a 1.1% gain over the past 30 days. But take a step back and you’ll see the shares are still down 47.6% year-to-date, a sobering reminder of the volatility that’s hit growth names recently.

Some of this turbulence may be attributed to shifting market sentiment around tech innovation and overall risk appetite, more than any one major company development. Over the last several months, the market has seen investors respond quickly to broader signals about inflation, rates, and demand for futuristic technologies. Voyager has ridden those waves, resulting in some sharp swings and a few optimistic bounces.

But let’s zoom in on valuation. Voyager’s current value score stands at just 1 out of 6, a sign it's undervalued by only one of the typical analysis checks. That’s not a knockout score, but it does add a thought-provoking wrinkle for anyone considering the stock’s true worth. Ready to dig into what those six valuation approaches actually say about Voyager, and, more interestingly, whether there’s a smarter way to measure the real value hidden beneath the surface? Let’s get into the details.

Voyager Technologies scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Voyager Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to their present value. This method is widely used for growth companies like Voyager Technologies, as it provides insight into the long-term earning potential based on likely future performance rather than just current profits.

For Voyager Technologies, the DCF model utilized is the 2 Stage Free Cash Flow to Equity approach. The company's latest twelve months of Free Cash Flow (FCF) stands at negative $37.35 million, reflecting significant cash outflows typical for high-growth, early-stage firms. Analyst estimates suggest FCF will turn significantly positive over the coming years, with a projection of $130.20 million by 2029. After 2029, further projections are extrapolated. However, investors should note that analyst forecasts become more speculative beyond that five-year mark.

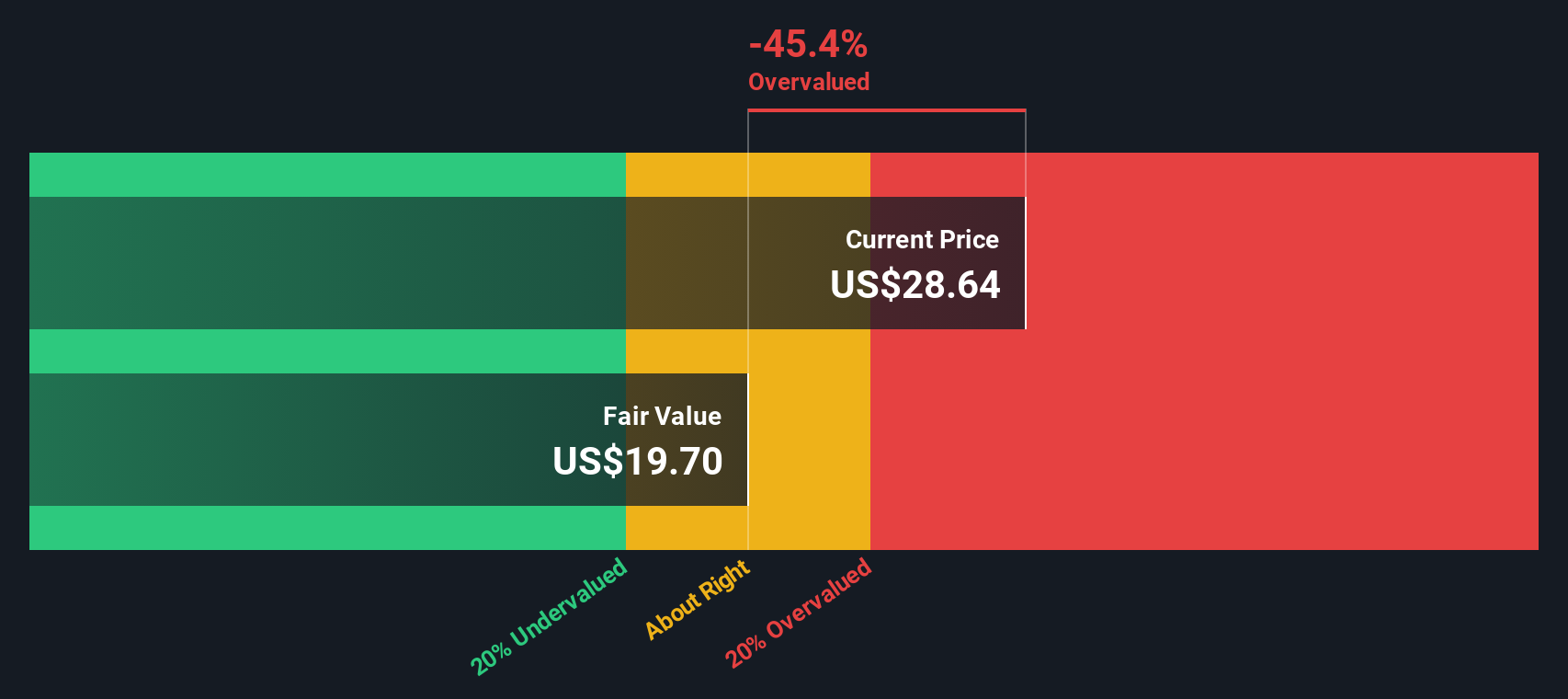

When the projected future cash flows are discounted back to today's dollar values, Voyager Technologies' estimated intrinsic value per share comes to $19.76. Compared to the current share price of $29.60, this indicates the stock is trading at a steep 49.8% premium to its fair value according to this model. As a result, it appears substantially overvalued.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Voyager Technologies.

Approach 2: Voyager Technologies Price vs Sales

Price-to-Sales (P/S) is commonly favored for valuing companies like Voyager Technologies, particularly in situations where profits are minimal or negative but revenue growth potential is strong. Unlike P/E, which relies on net income, P/S focuses on how much investors are willing to pay for each dollar of sales. This makes it a reliable gauge for early-stage or high-growth companies that are still working toward profitability.

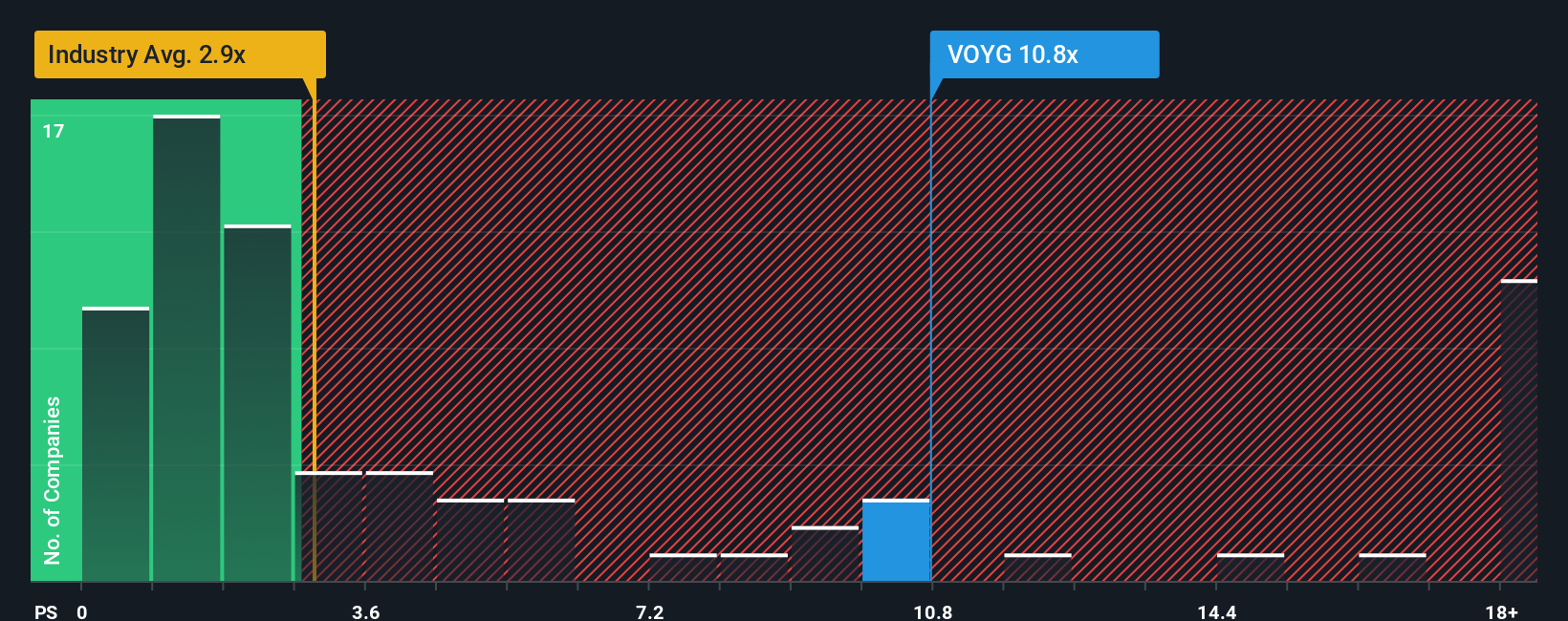

Standard industry practice is to assess a company’s current P/S ratio against that of its peers and the broader industry. Voyager’s P/S ratio stands at 11.08x, while the average for the Aerospace & Defense sector is 2.78x. Among peers, the average is even lower at 2.11x. At first glance, this suggests Voyager’s stock is considerably more expensive in terms of its sales base compared to typical competitors or industry norms. Growth expectations and perceived risk can justify higher multiples, but such a large gap usually raises eyebrows.

This is where the concept of a Fair Ratio comes in. Simply Wall St’s Fair Ratio for Voyager incorporates much more than just sector averages, considering the company’s sales growth, profit margins, market cap, and unique risk profile. This holistic approach means the Fair Ratio should offer a far more tailored indication of what is deserved, rather than simply comparing with industry or peer averages, which might not fully capture Voyager’s growth story or its risks.

When comparing Voyager’s actual P/S of 11.08x to its Fair Ratio, the difference is significant, indicating the market is expecting a lot from the company’s future. As such, based on this approach, Voyager’s stock currently looks overvalued on sales relative to its operational reality and sector context.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Voyager Technologies Narrative

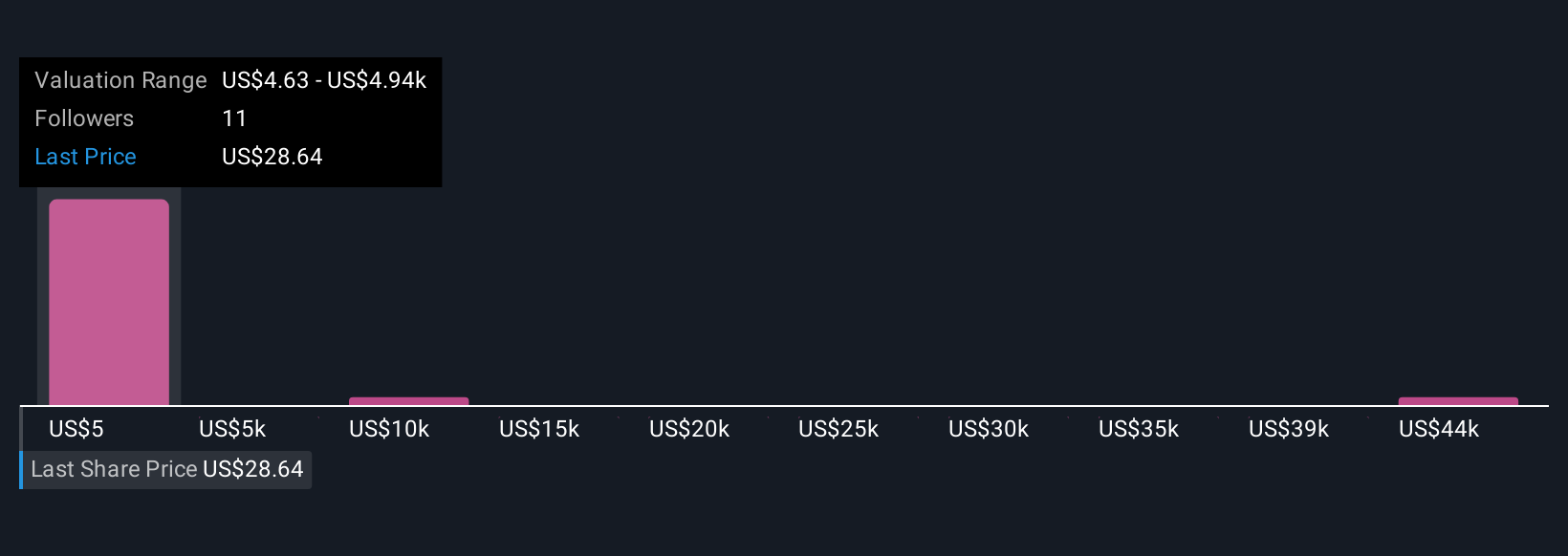

Earlier we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a dynamic, user-driven story that connects your outlook on a company’s future, covering estimates for revenue, profit margins, and fair value, with the numbers behind it. Rather than relying solely on ratios and historical data, Narratives enable investors to capture their perspective on what really matters and forecast what’s next. This approach links a company's story to a clear financial forecast and then to fair value.

Simply Wall St makes Narratives simple and accessible for everyone, offering them prominently within the Community page used by millions of investors. Narratives help you assess your investment choices by allowing you to directly compare your Fair Value estimate to the current market price. In addition, they update automatically whenever new information, such as earnings releases or news, becomes available, ensuring your view is always current. For Voyager Technologies, investors have created a variety of Narratives. The boldest see strong potential for future growth, while the most cautious expect continued volatility and lower fair value.

Do you think there's more to the story for Voyager Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VOYG

Voyager Technologies

Operates as a defense technology and space solutions company in the United States, Europe, the Middle East, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives