- United States

- /

- Construction

- /

- NYSE:VMI

Can Analyst Optimism on Valmont (VMI) Signal Sustained Strength in Its Earnings Consistency?

Reviewed by Sasha Jovanovic

- Valmont Industries recently announced it will release its third quarter 2025 financial results on October 21, 2025, followed by a webcast and conference call hosted by its CEO and CFO.

- Analyst sentiment has grown more optimistic following a series of positive earnings estimate revisions, highlighting Valmont’s efficient asset utilization and consistent track record of exceeding earnings expectations.

- With strong analyst commentary noting positive earnings estimate revisions and growth prospects, we’ll assess the impact on Valmont’s broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Valmont Industries Investment Narrative Recap

To invest in Valmont Industries, you have to believe in the enduring strength of global infrastructure and agriculture demand, as well as the company’s ability to consistently outperform through operational efficiency and product innovation. The upcoming third quarter results and management call are unlikely to materially change the near-term outlook, where strong momentum in infrastructure backlogs remains a key catalyst, while exposure to cyclical end-markets and commodity price fluctuations remains the largest risk to watch.

Among recent developments, the reaffirmation of full-year 2025 guidance stands out, providing clarity amid shifting economic conditions. By maintaining its net sales and earnings expectations, Valmont shows confidence in its diversified order book and margin discipline, key supports for the multi-year infrastructure spending cycle that underpins market optimism for the stock’s future.

Yet, despite these positives, investors should remain mindful of how shifts in infrastructure and agriculture cycles or abrupt changes in commodity prices could quickly reshape the story for Valmont’s profitability...

Read the full narrative on Valmont Industries (it's free!)

Valmont Industries' narrative projects $4.5 billion revenue and $462.5 million earnings by 2028. This requires 3.5% yearly revenue growth and a $244.8 million earnings increase from $217.7 million today.

Uncover how Valmont Industries' forecasts yield a $415.00 fair value, a 6% upside to its current price.

Exploring Other Perspectives

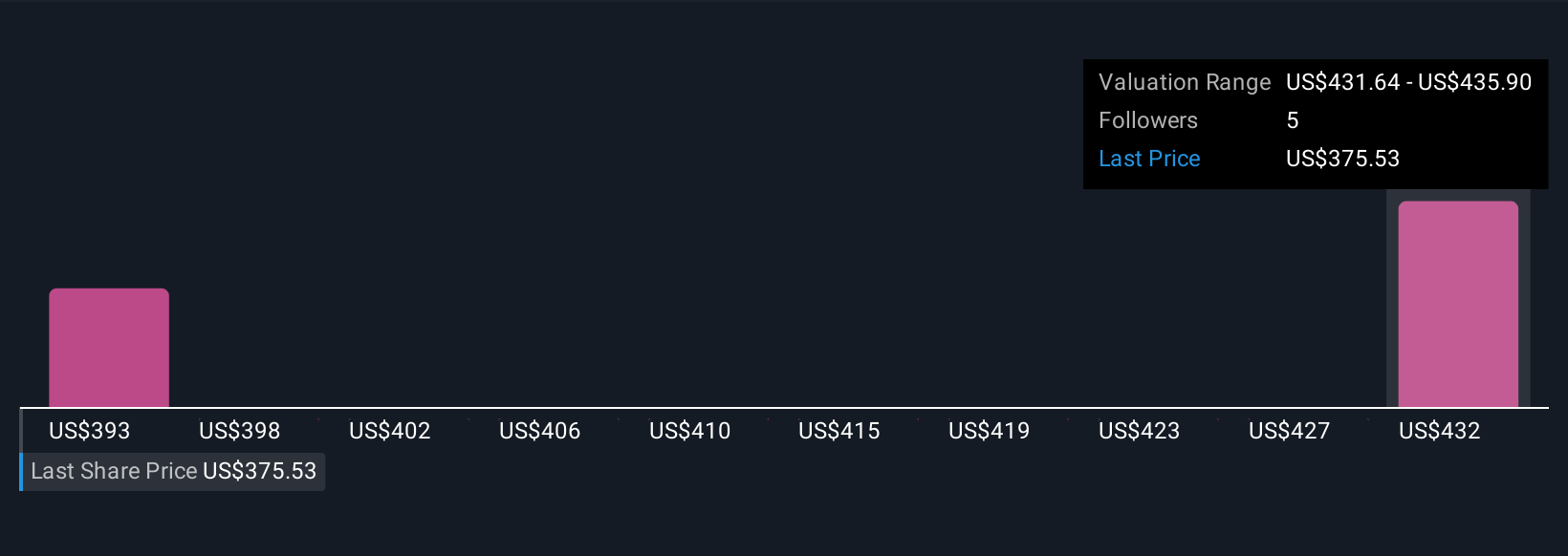

Two Simply Wall St Community members estimate Valmont’s fair value between US$415 and US$434.70, providing a focused yet slightly varied view on the stock. With infrastructure backlogs driving optimism, it’s clear investors weigh both short term catalysts and persistent volatility risks in their assessments.

Explore 2 other fair value estimates on Valmont Industries - why the stock might be worth just $415.00!

Build Your Own Valmont Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valmont Industries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Valmont Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valmont Industries' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VMI

Valmont Industries

Operates as a manufacturer of products and services for infrastructure and agriculture markets in the United States, Australia, Brazil, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives