- United States

- /

- Trade Distributors

- /

- NYSE:URI

Market Participants Recognise United Rentals, Inc.'s (NYSE:URI) Earnings

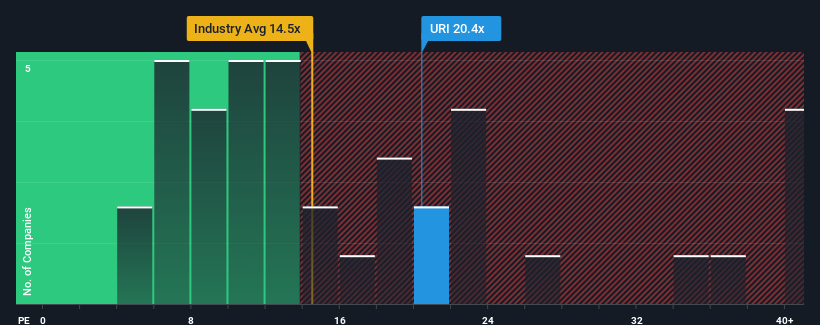

With a median price-to-earnings (or "P/E") ratio of close to 18x in the United States, you could be forgiven for feeling indifferent about United Rentals, Inc.'s (NYSE:URI) P/E ratio of 20.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been pleasing for United Rentals as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for United Rentals

Is There Some Growth For United Rentals?

There's an inherent assumption that a company should be matching the market for P/E ratios like United Rentals' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 15% gain to the company's bottom line. Pleasingly, EPS has also lifted 180% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 12% per year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 10% per annum, which is not materially different.

With this information, we can see why United Rentals is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On United Rentals' P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of United Rentals' analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Before you take the next step, you should know about the 1 warning sign for United Rentals that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:URI

United Rentals

Through its subsidiaries, operates as an equipment rental company.

Fair value with acceptable track record.