- United States

- /

- Machinery

- /

- NYSE:TWI

Earnings Working Against Titan International, Inc.'s (NYSE:TWI) Share Price Following 30% Dive

Unfortunately for some shareholders, the Titan International, Inc. (NYSE:TWI) share price has dived 30% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 19% in that time.

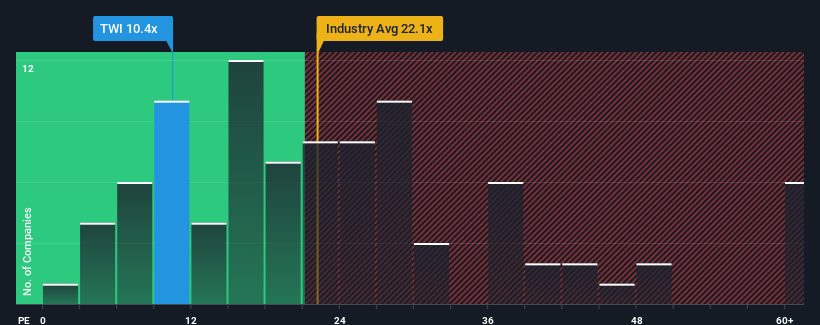

After such a large drop in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may consider Titan International as an attractive investment with its 10.4x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Titan International has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Titan International

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Titan International would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 70% decrease to the company's bottom line. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 8.7% during the coming year according to the dual analysts following the company. Meanwhile, the broader market is forecast to expand by 13%, which paints a poor picture.

With this information, we are not surprised that Titan International is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Titan International's P/E

Titan International's P/E has taken a tumble along with its share price. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Titan International maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 3 warning signs for Titan International that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Titan International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TWI

Titan International

Manufactures and sells wheels, tires, and undercarriage systems and components for off-highway vehicles in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives