- United States

- /

- Machinery

- /

- NYSE:TTC

Toro (TTC): Assessing Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

Toro (TTC) has quietly slipped about 5% over the past month and roughly 13% in the past 3 months, even though earnings and revenue are still edging higher year over year.

See our latest analysis for Toro.

The recent pullback fits a longer stretch of softer momentum, with the share price now at $70.23 and the 1 year total shareholder return sitting at a negative mid teens while earnings keep grinding higher. This suggests sentiment is lagging fundamentals rather than collapsing.

If Toro’s slower momentum has you thinking about where else capital could work harder, this could be a good moment to explore fast growing stocks with high insider ownership.

With earnings still growing, a value score at the midpoint, and the stock trading at a sizable discount to analyst targets, is Toro quietly undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 24.2% Undervalued

Compared to Toro’s last close at $70.23, the most widely followed narrative sees fair value notably higher, pointing to meaningful upside if its roadmap plays out.

Acceleration of the AMP productivity program, with $75 million in run rate cost savings and a longer term target of $100 million+, is enhancing operating leverage and margins, while ongoing portfolio optimization and selective divestitures streamline core operations for improved future profitability.

Want to see what powers that upside view? The narrative leans on rising margins, steady top line growth, and a future earnings multiple that quietly resets expectations. Curious which specific profit and revenue steps justify that higher valuation path?

Result: Fair Value of $92.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside view depends on a residential rebound and more normal weather patterns, both of which could easily disappoint and pressure margins.

Find out about the key risks to this Toro narrative.

Another View: What The Market Multiple Is Saying

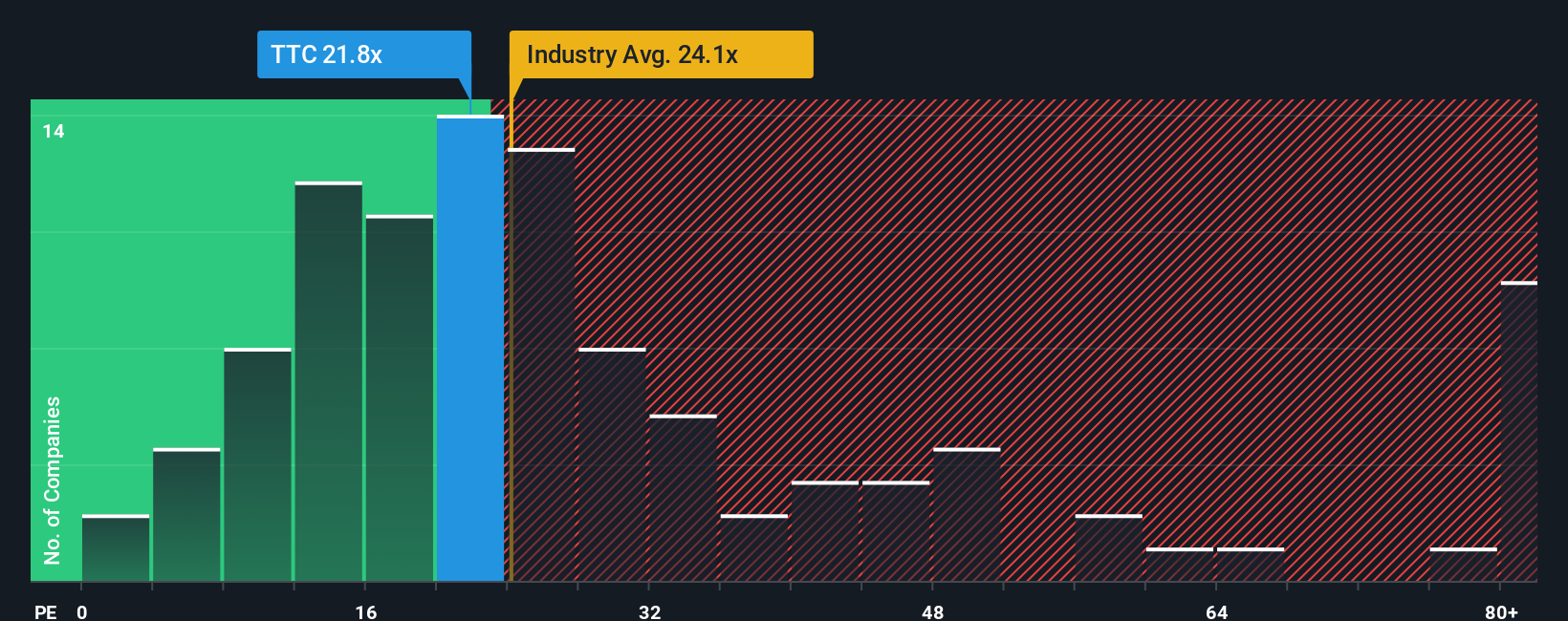

On earnings, Toro looks a little stretched, trading at 20.6 times profit versus peers at 18.4 times, even though our fair ratio suggests the market could justify closer to 23.7 times. This raises the question: does that premium signal crowding out upside, or a still underappreciated story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Toro Narrative

If this view does not quite match your own, or you prefer to dig into the numbers yourself, you can build a personalized storyline in just a few minutes: Do it your way.

A great starting point for your Toro research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore additional opportunities beyond Toro by using the Simply Wall St Screener to focus on growth, income, and structural market shifts.

- Identify potential innovators early by scanning these 3581 penny stocks with strong financials for smaller companies that are already supporting their ambitions with real financial strength.

- Gain exposure to the machine learning theme by reviewing these 25 AI penny stocks involved in software, hardware, and data infrastructure.

- Find potential portfolio income by reviewing these 14 dividend stocks with yields > 3% that combine dividend yields with balance sheets designed to support ongoing payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TTC

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026