- United States

- /

- Building

- /

- NYSE:TREX

Is a New CFO Appointment Reshaping the Investment Case for Trex Company (TREX)?

Reviewed by Sasha Jovanovic

- On September 30, 2025, Trex Company announced the appointment of Prithvi S. Gandhi as Senior Vice President and Chief Financial Officer, effective October 6, 2025, entrusting him with responsibility for all finance and accounting functions.

- This leadership change follows a period of declining profitability and heightened investor concerns regarding capital intensity and competitive challenges.

- We’ll now explore how the addition of an experienced CFO with a record in building products could impact Trex’s investment outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Trex Company Investment Narrative Recap

To be a shareholder in Trex Company, you need to believe in a sustained shift toward composite decking and the company's ability to capture growth through innovation and market share expansion, even as end-market softness and competitive pressures present real challenges. The appointment of Prithvi S. Gandhi as CFO brings relevant sector expertise, but his arrival alone is unlikely to materially change the immediate impact of heightened competition or recent margin compression, which remain the most important catalyst and risk, respectively.

Among recent announcements, Trex’s Q2 earnings release is especially relevant. While sales saw a modest year-on-year increase, the decline in net income and margins highlights how capital intensity and elevated competition continue to weigh on profitability. These financial trends provide essential context for assessing how new leadership might address near-term performance pressures.

On the other hand, investors should be aware of the risk that intensified price competition from rivals could...

Read the full narrative on Trex Company (it's free!)

Trex Company is projected to reach $1.5 billion in revenue and $333.1 million in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 10.2% and an earnings increase of $146.4 million from the current $186.7 million.

Uncover how Trex Company's forecasts yield a $72.00 fair value, a 37% upside to its current price.

Exploring Other Perspectives

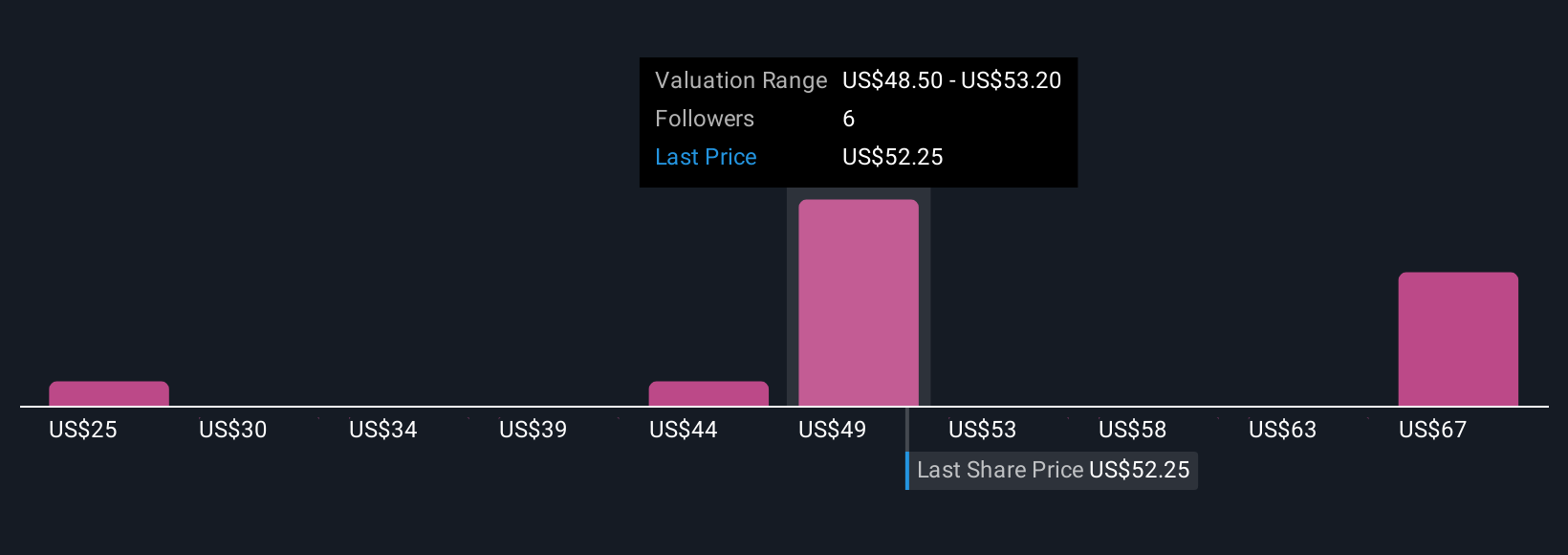

Four fair value perspectives from the Simply Wall St Community range widely from US$25 to US$72 per share. Despite this variety, earnings pressure and increased capital spending could weigh on future returns, so consider these diverse viewpoints as you form your own assessment.

Explore 4 other fair value estimates on Trex Company - why the stock might be worth less than half the current price!

Build Your Own Trex Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trex Company research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Trex Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trex Company's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trex Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TREX

Trex Company

Manufactures and sells composite decking and railing products in the United States.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives