- United States

- /

- Building

- /

- NYSE:TREX

Does Trex Offer Upside After 25% Drop and Resilient Q1 2025 Earnings?

Reviewed by Bailey Pemberton

If you’re wondering what to do with Trex Company stock, you’re definitely not alone. After all, who hasn’t noticed how the price has bounced around over the past year? Trex, known for its eco-friendly composite decking, has seen its share price dip by 25.7% year-to-date, and it’s still down more than 21% over the last twelve months. It’s not just short-term volatility, either. Over the past five years, the stock is off by an eye-catching 33.8%. This creates an interesting situation for some investors, as recent market trends have favored companies with perceived stability and cash flow. This has shifted attention away from more cyclical and growth-oriented names like Trex, which partly explains the sell-off.

In the last week, there has been a small uptick of 0.8%, but it’s hard to say whether this is the start of renewed momentum or just a pause in a longer-term downtrend. Notably, Trex’s current value score is 4 out of 6. The company is considered undervalued according to the majority of standard valuation checks, which could signal a mismatch between the market’s sentiment and Trex’s fundamentals.

The big question now is how the usual yardsticks for valuation stack up for Trex, and whether there is a smarter way to look at it. Let’s take a close look at each approach, but keep in mind that the best insight may come from what we discuss at the end of the article.

Why Trex Company is lagging behind its peers

Approach 1: Trex Company Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's true value by projecting future cash flows and discounting them back to today's value. This approach is designed to capture not just recent performance but also expected growth and profitability over time.

For Trex Company, the current Free Cash Flow is $6.52 million. Analysts estimate that Free Cash Flow will rise to $287.89 million by 2027, with further projections indicating a value of $501.32 million by 2035. These projections combine analyst insights for the next several years and extrapolations beyond that, which show an expected pattern of steady growth in operating cash flow.

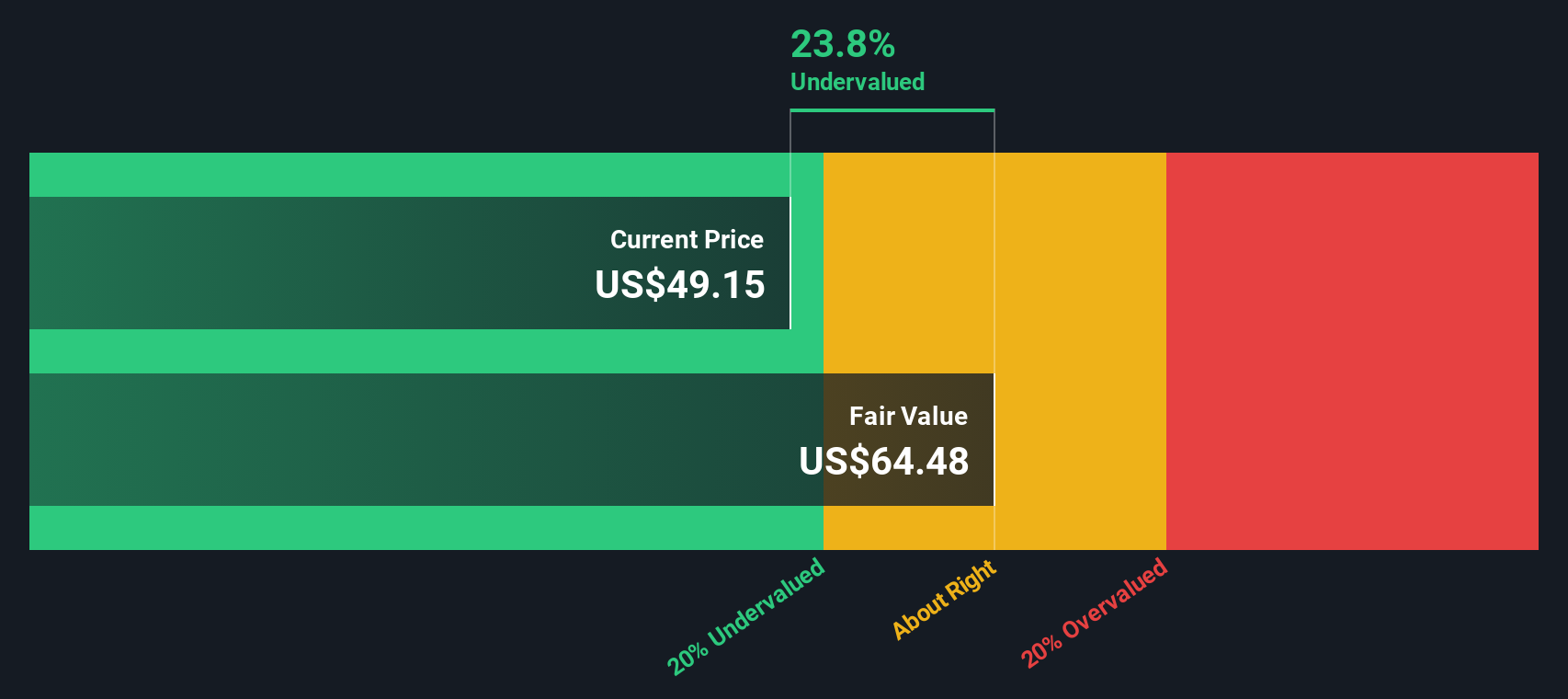

Based on these cash flow expectations and the 2 Stage Free Cash Flow to Equity valuation model, Trex's estimated intrinsic value is $66.18 per share. With the current share price trading at about a 23.4% discount to this estimate, the DCF model suggests the stock is undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Trex Company is undervalued by 23.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Trex Company Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used to value established, profitable businesses like Trex Company, as it relates the company’s share price directly to its current earnings. This makes it a straightforward way for investors to judge how much they are paying for each dollar of profit and to compare that price with other businesses in the same sector.

Of course, what qualifies as a “normal” or “fair” PE ratio depends on several factors. Companies that are expected to grow faster, or that have lower risk, often justify higher PE ratios. Conversely, slower-growing businesses or those that face more uncertainty tend to trade at lower multiples. Investors pay a premium for expansion and predictability.

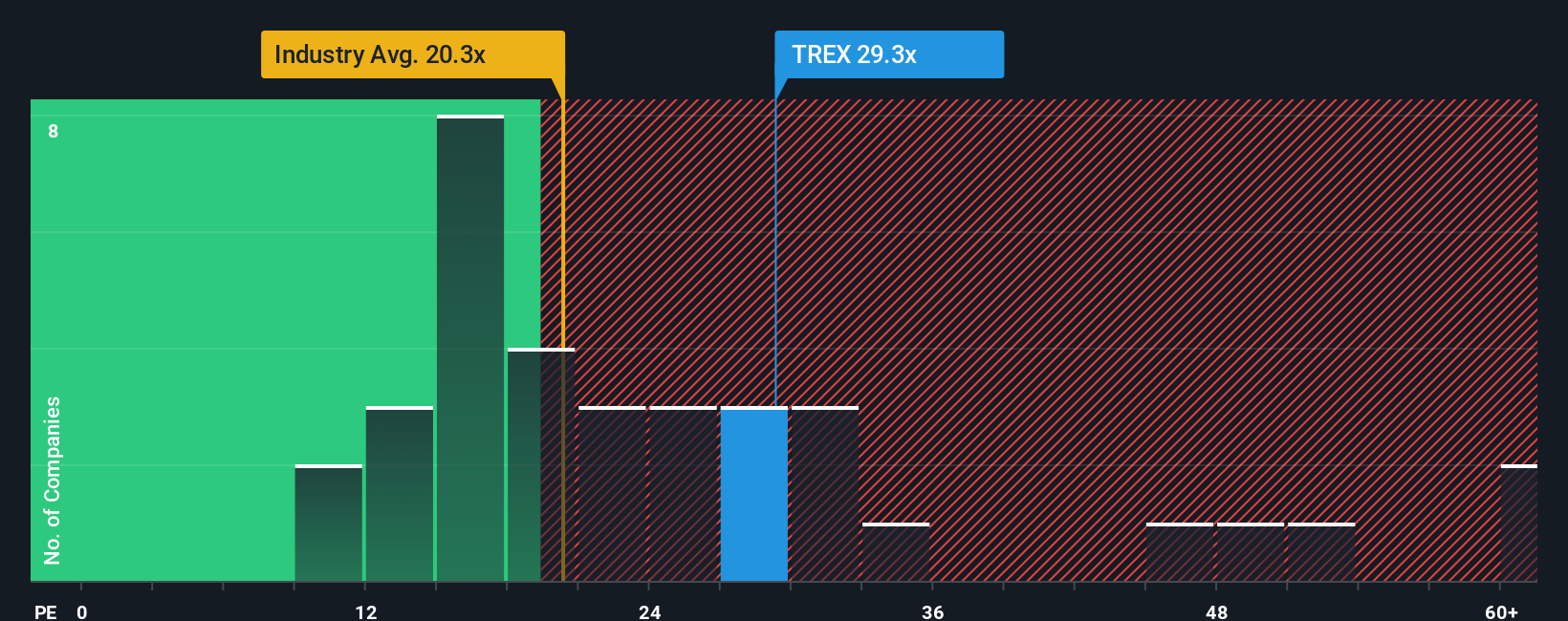

Right now, Trex’s PE ratio is 29x. This stands above the building industry average of about 20x and also higher than its peer average of 25x. To add extra context, Simply Wall St’s “Fair Ratio” proprietary metric balances out all the key valuation drivers such as growth, industry, profit margins, risk profile, and market cap to estimate a more customized benchmark. For Trex, the Fair PE Ratio is calculated at 29x, which matches almost exactly with its current PE. This suggests that while Trex looks expensive compared to its industry, its growth, market positioning, and quality justify the current valuation better than simplistic peer comparisons.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Trex Company Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a powerful, easy-to-use tool that lets you tell the story you see for a company by linking your own assumptions, such as expected revenue, earnings, and margins, to a financial forecast and then to a fair value. Instead of relying solely on rigid ratios or static price targets, Narratives help you shape your investment thesis, making your fair value calculation more dynamic and personal.

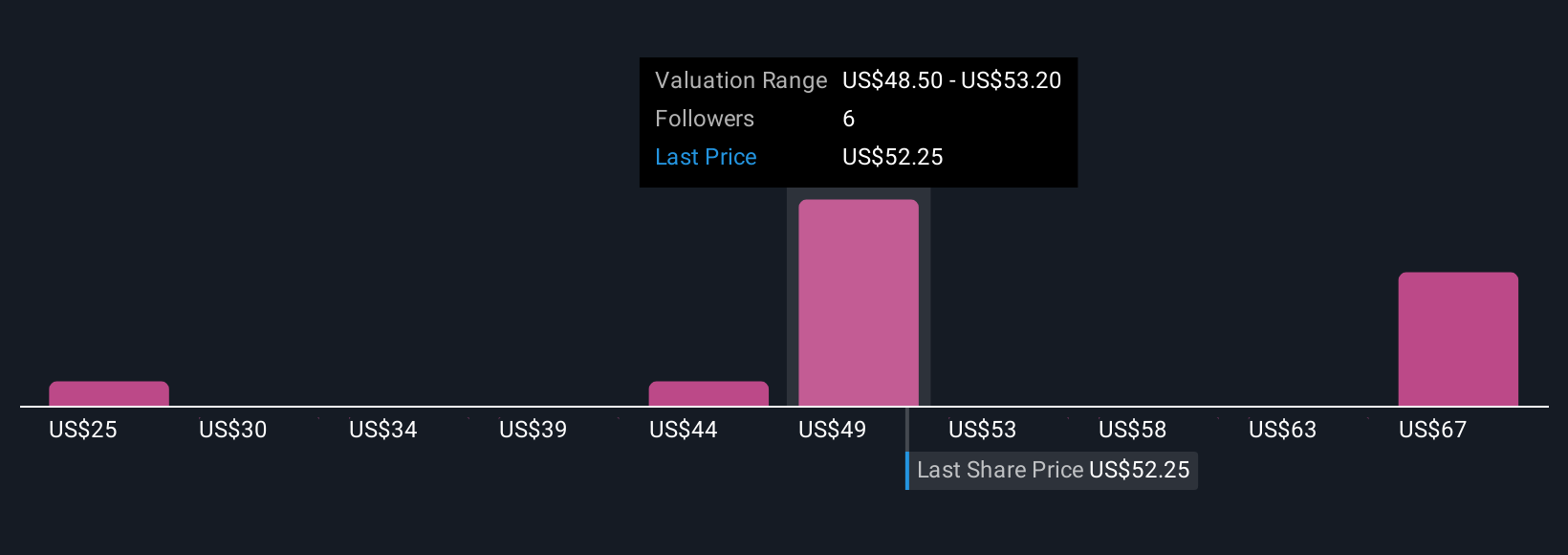

Narratives are available to millions of investors on Simply Wall St’s Community page and are continually updated as new information comes in, whether it is news, earnings, risks, or other key events. This empowers you to make smarter decisions by easily comparing the Fair Value your Narrative produces with Trex’s current share price, so you can see if the stock is overvalued or undervalued based on your perspective rather than just analyst consensus.

For example, one investor might create a bullish Narrative for Trex Company, projecting continued outperformance and a fair value as high as $92 per share. Another might take a more cautious view, factoring in industry risks and estimating fair value at $54. This demonstrates how Narratives put your conviction at the center of your investment decisions.

Do you think there's more to the story for Trex Company? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Trex Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TREX

Trex Company

Manufactures and sells composite decking and railing products in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)