- United States

- /

- Construction

- /

- NYSE:TPC

Is It Too Late To Consider Tutor Perini After Its 175% 2025 Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether Tutor Perini at around $66 a share still offers value after its huge run, you are not alone. That is exactly what we are going to unpack here.

- The stock has cooled slightly in the very short term, with returns of -1.6% over 7 days and -2.6% over 30 days, but those moves sit on top of a 175.1% year to date gain and a 145.5% jump over the last year, with the 3 year and 5 year returns up 793.4% and 397.2% respectively.

- Recent headlines around infrastructure spending, large civil and transportation projects, and shifting expectations for construction backlogs have all helped reframe how investors see Tutor Perini, especially its exposure to long duration public works. At the same time, coverage has increasingly focused on how efficiently the company can convert that backlog into cash flow, which is where valuation becomes a key consideration.

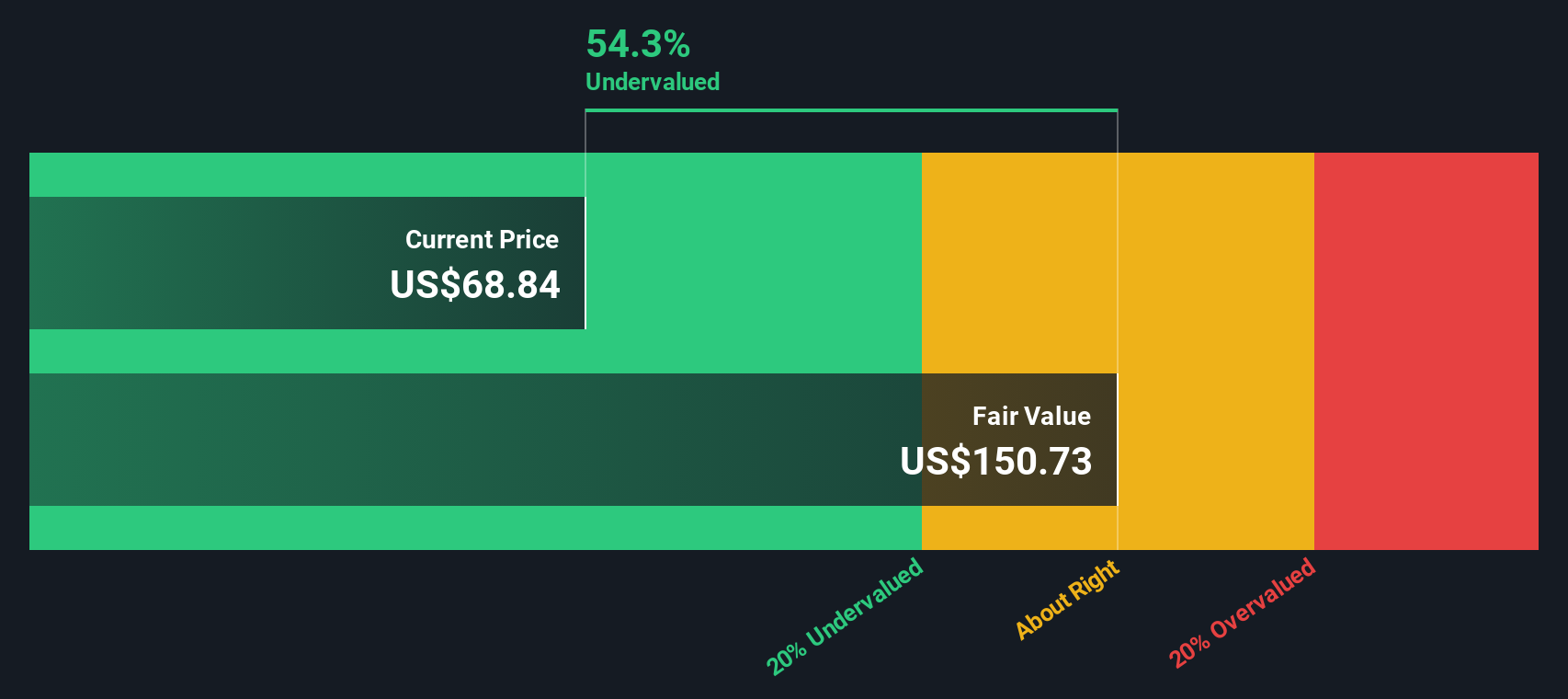

- Even after this surge, Tutor Perini scores a 5/6 on our valuation checks, suggesting the market may not fully be pricing in its fundamentals. Next we will walk through the main valuation approaches investors are using, before finishing with a more holistic way of judging what the stock may be worth.

Approach 1: Tutor Perini Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth by projecting its future cash flows and then discounting those back to today in dollar terms. For Tutor Perini, the model starts with last twelve months free cash flow of about $821.2 million, then applies a 2 stage Free Cash Flow to Equity approach using analyst estimates where available and extrapolating further years.

Analysts currently see free cash flow of around $500 million in 2026, with Simply Wall St extending this path over the following decade. Those longer term projections gradually taper to roughly $264.4 million by 2035 as growth normalizes. All of these cash flows are discounted back to the present and combined with a terminal value to arrive at an estimated intrinsic value of about $79.69 per share.

Compared to the current share price around $66, this output indicates Tutor Perini is trading at roughly a 16.6% discount to its DCF based fair value. This suggests the market may be underestimating its long term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tutor Perini is undervalued by 16.6%. Track this in your watchlist or portfolio, or discover 929 more undervalued stocks based on cash flows.

Approach 2: Tutor Perini Price vs Sales

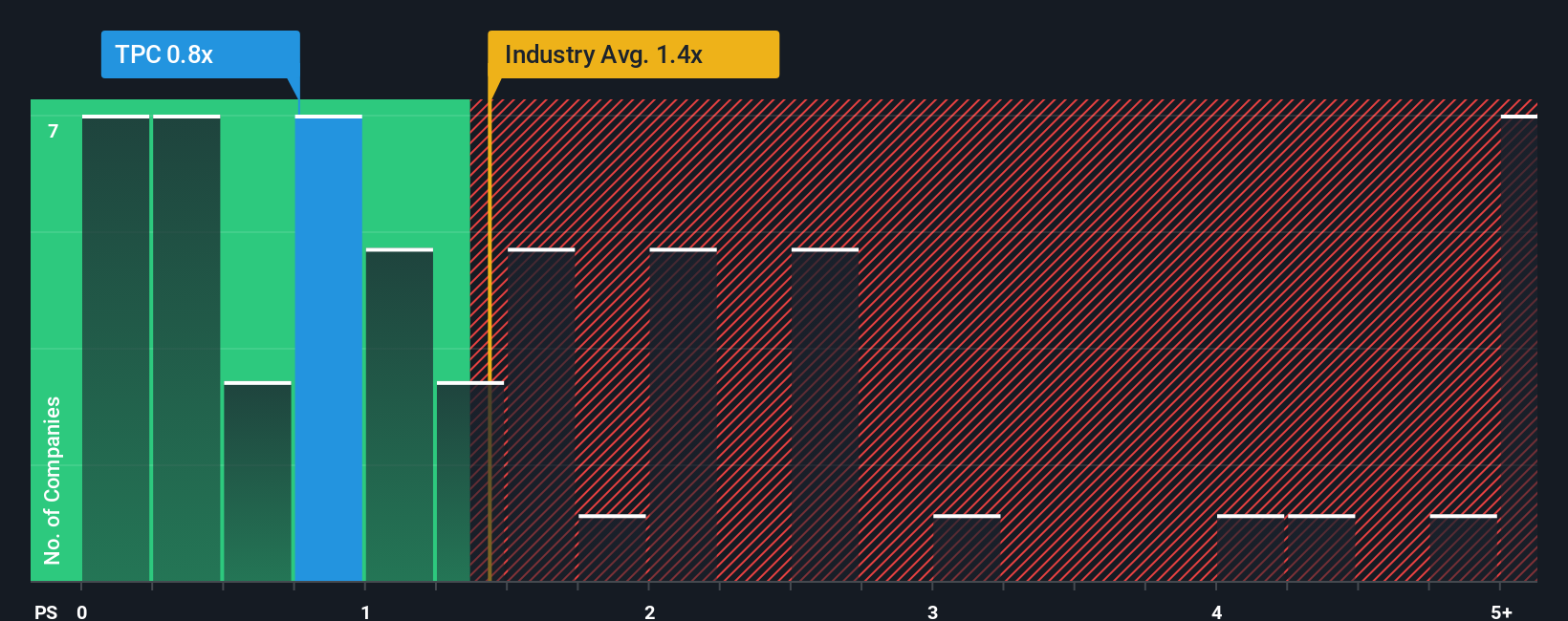

For companies like Tutor Perini where earnings can be volatile from project timing and accounting, the price to sales ratio is often a cleaner way to judge valuation. It focuses on how much investors are paying for each dollar of revenue, which tends to be more stable than profits in construction businesses. In general, faster growing and lower risk companies can justify a higher sales multiple, while slower, riskier names deserve a discount.

Tutor Perini currently trades on a price to sales ratio of about 0.69x, compared with roughly 1.27x for the broader Construction industry and 1.24x for its peer group. Simply Wall St’s Fair Ratio for the stock is 1.18x, which is its proprietary estimate of what a normal multiple should be once you factor in Tutor Perini’s growth outlook, margins, risk profile, industry and market cap. This tailored yardstick is more informative than a simple peer or industry comparison because it adjusts for the company’s specific strengths and weaknesses.

With the actual price to sales ratio sitting well below the 1.18x Fair Ratio, the multiple based view aligns with the DCF work and indicates potential upside from the current level.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tutor Perini Narrative

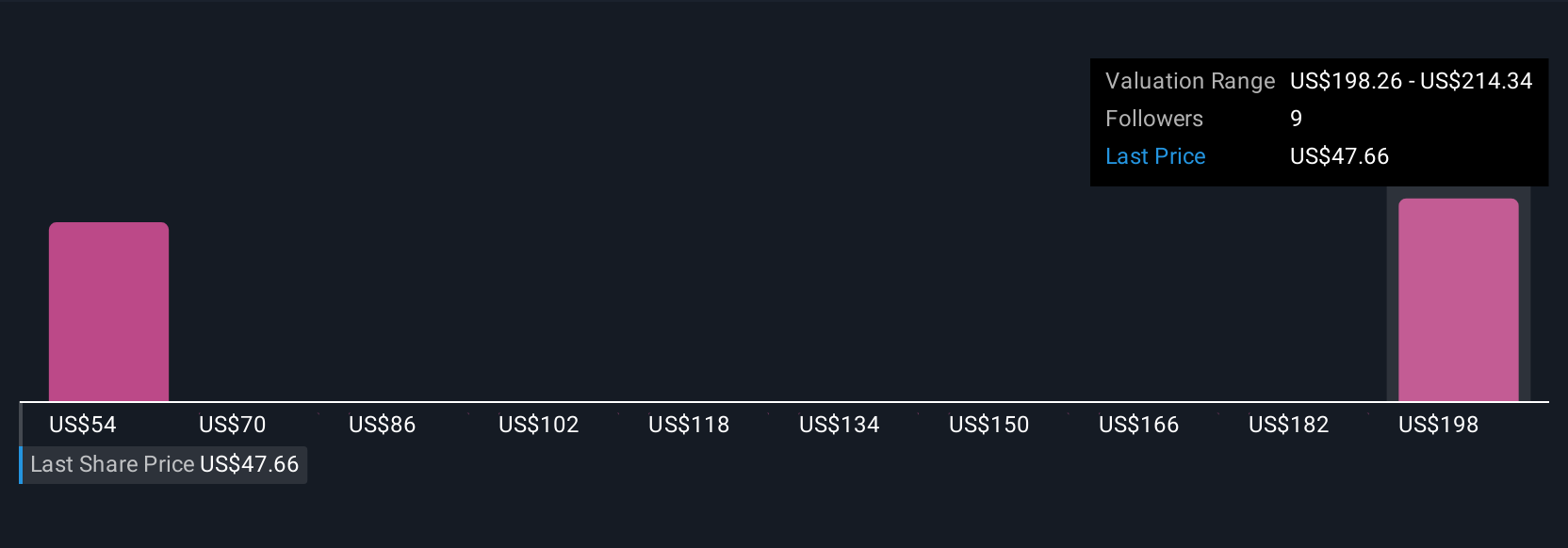

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company, combined with your assumptions about its future revenue, earnings, margins and fair value.

A Narrative connects three things in a straight line: what you believe about the business, how that belief translates into a financial forecast, and what that forecast implies a share should be worth today.

On Simply Wall St, Narratives are an easy, guided tool inside the Community page that millions of investors use to turn their views into numbers, then compare the resulting fair value with the current price to decide whether they want to buy, hold or sell.

Because Narratives are updated dynamically when new information, like fresh earnings or major contract news, comes in, your fair value view can evolve in real time without you having to rebuild everything from scratch.

For Tutor Perini, for example, one investor might build a bullish Narrative closer to a fair value of about $89 based on strong backlog, cleaner legal risk and higher margins. A more cautious investor might anchor nearer $67, reflecting concerns about mega project execution and earnings volatility, and both perspectives can coexist side by side on the platform.

Do you think there's more to the story for Tutor Perini? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tutor Perini might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPC

Tutor Perini

A construction company, provides diversified general contracting, construction management, and design-build services to private customers and public agencies worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026