Teledyne Technologies' (NYSE:TDY) Problems Go Beyond Weak Profit

The subdued market reaction suggests that Teledyne Technologies Incorporated's (NYSE:TDY) recent earnings didn't contain any surprises. However, we believe that investors should be aware of some underlying factors which may be of concern.

See our latest analysis for Teledyne Technologies

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. In fact, Teledyne Technologies increased the number of shares on issue by 26% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out Teledyne Technologies' historical EPS growth by clicking on this link.

How Is Dilution Impacting Teledyne Technologies' Earnings Per Share? (EPS)

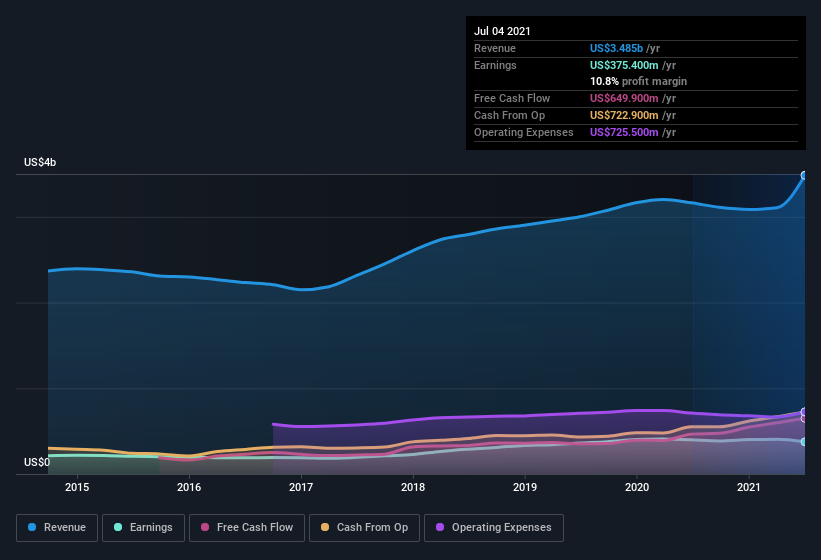

As you can see above, Teledyne Technologies has been growing its net income over the last few years, with an annualized gain of 29% over three years. Net income was down 5.5% over the last twelve months. Unfortunately for shareholders, though, the earnings per share result was even worse, declining 9.8%. And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

If Teledyne Technologies' EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

How Do Unusual Items Influence Profit?

On top of the dilution, we should also consider the US$158m impact of unusual items in the last year, which had the effect of suppressing profit. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If Teledyne Technologies doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On Teledyne Technologies' Profit Performance

Teledyne Technologies suffered from unusual items which depressed its profit in its last report; if that is not repeated then profit should be higher, all else being equal. But on the other hand, the company issued more shares, so without buying more shares each shareholder will end up with a smaller part of the profit. Given the contrasting considerations, we don't have a strong view as to whether Teledyne Technologies's profits are an apt reflection of its underlying potential for profit. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For instance, we've identified 3 warning signs for Teledyne Technologies (1 is a bit unpleasant) you should be familiar with.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Teledyne Technologies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Teledyne Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Teledyne Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:TDY

Teledyne Technologies

Provides enabling technologies for industrial growth markets in the United States and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives