- United States

- /

- Aerospace & Defense

- /

- NYSE:TDG

TransDigm Group (NYSE:TDG) Sees 3% Decline Over Last Quarter Amidst Robust Financial Performance

Reviewed by Simply Wall St

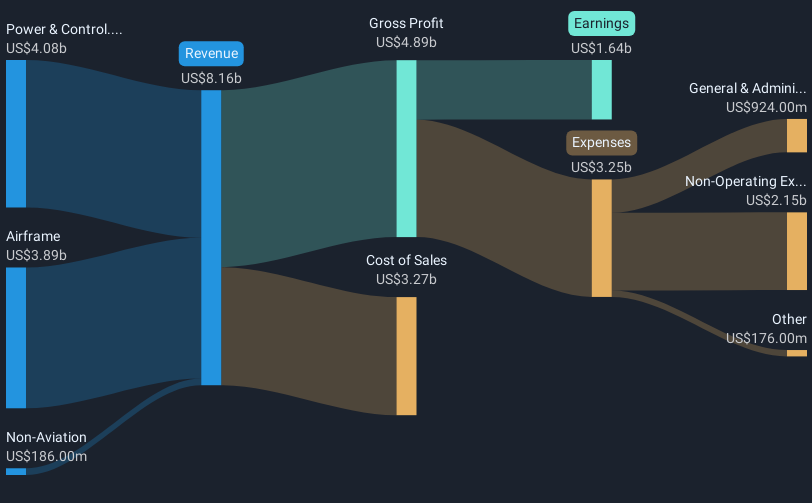

TransDigm Group (NYSE:TDG) reported a 2.96% decline in its share price over the last quarter, amidst a period marked by both positive and negative developments. Despite the company's robust financial performance, highlighted by an increase in sales and net income, the broader market experienced significant turmoil, with the Dow plunging 7% and Nasdaq entering bear market territory. This overall market decline likely contributed to TransDigm's share price performance. Additionally, the company's ongoing share repurchase program and pursuit of mergers and acquisitions may have provided some cushioning against a more pronounced share price drop.

Over the past five years, TransDigm Group achieved a total return of 304.46%, combining share price appreciation and dividend payouts. This performance is commendable, considering the broader aerospace industry's complexities. Key drivers include a consistent focus on proprietary products and high-margin aftermarket revenues, positioning the company favorably amid an aerospace sector recovery. Furthermore, strategic capital allocation through share repurchases has enhanced EPS while maintaining financial flexibility for acquisitions.

The company's significant share repurchase activity, notably the repurchase of 1.74 million shares worth US$1.23 billion, supported share price stability. Although TransDigm aimed at acquisitions, the emphasis remains on small to midsize businesses to align with their revenue model. Additionally, the company's dividend policy, with substantial special cash dividends, added to shareholder returns. Despite challenges in OEM segments, a ramp-up in major aircraft production rates could further stabilize revenue growth moving forward.

Our valuation report here indicates TransDigm Group may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade TransDigm Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TransDigm Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDG

TransDigm Group

Designs, produces, and supplies aircraft components in the United States and internationally.

Acceptable track record low.

Similar Companies

Market Insights

Community Narratives