- United States

- /

- Aerospace & Defense

- /

- NYSE:SPR

Is Spirit AeroSystems Attractive After Strong Multi Year Share Price Gains in 2025?

Reviewed by Bailey Pemberton

- If you are wondering whether Spirit AeroSystems Holdings is a smart buy at today’s price, you are not alone. This breakdown will help you decide whether the current price tag makes sense.

- The stock is now trading around $39.50, with returns of 9.3% over the last week, 8.2% over the last month, and 17.8% year to date, building on a 19.9% gain over the past year and 50.0% over three years.

- Recent moves in the share price have been driven by shifting expectations around commercial aircraft demand and Spirit’s role in key aerospace programs. Investors are also reacting to ongoing discussions with major customers and partners that could reshape both its growth profile and its risk picture.

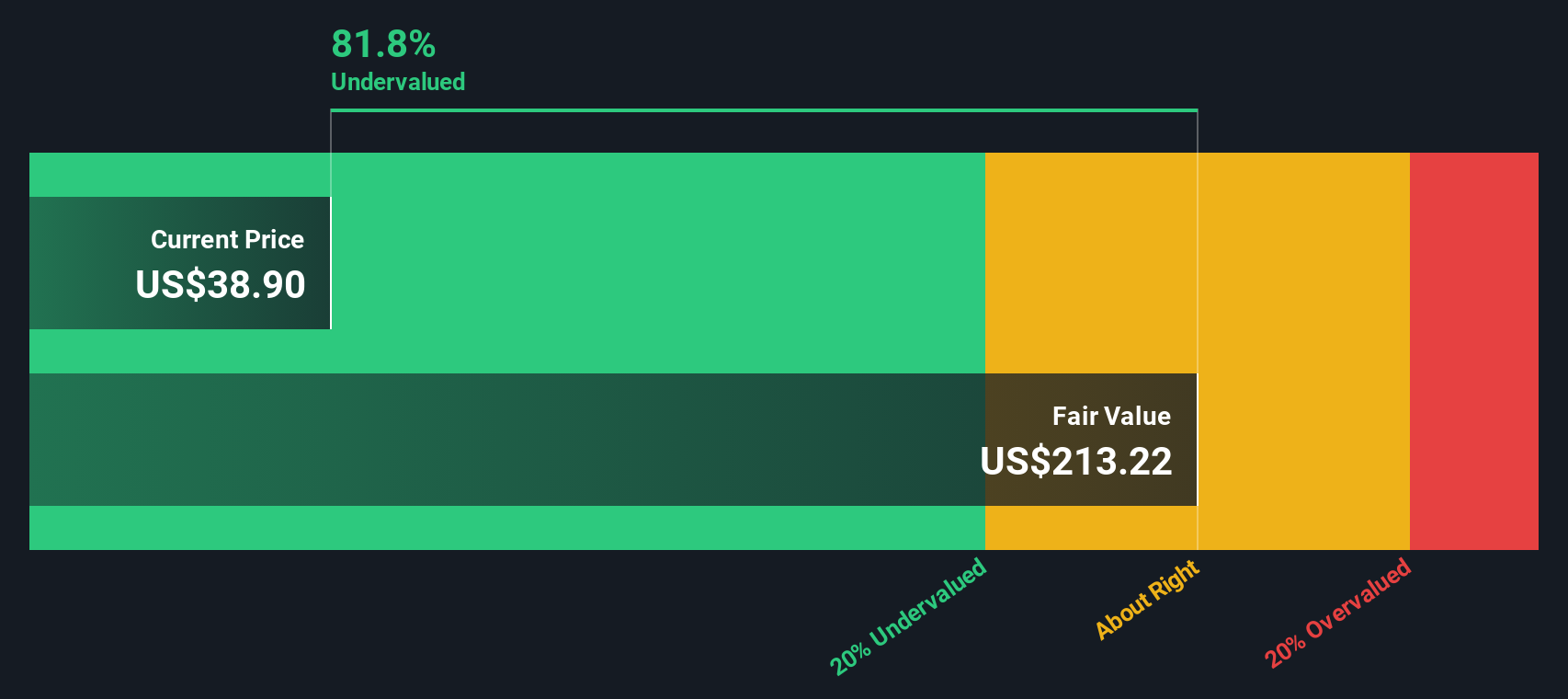

- On our valuation checks, Spirit AeroSystems Holdings scores a 4/6 for being undervalued, which is a promising starting point. We will unpack how different valuation methods line up and finish by looking at a more practical way to think about what the stock might be worth.

Approach 1: Spirit AeroSystems Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and discounting them back to the present.

For Spirit AeroSystems Holdings, the latest twelve month free cash flow is around -$781.2 million, reflecting current challenges. Analysts then expect free cash flow to turn positive and climb to about $433.8 million by 2027, with Simply Wall St extending those forecasts further so that projected free cash flow reaches roughly $4.8 billion by 2035. These projections are based on a 2 Stage Free Cash Flow to Equity model that captures a ramp up in cash generation before growth moderates.

When all those future cash flows are discounted back, the model arrives at an estimated intrinsic value of about $312.4 per share. Compared with the current share price near $39.50, the DCF suggests the stock is roughly 87.4% undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Spirit AeroSystems Holdings is undervalued by 87.4%. Track this in your watchlist or portfolio, or discover 910 more undervalued stocks based on cash flows.

Approach 2: Spirit AeroSystems Holdings Price vs Sales

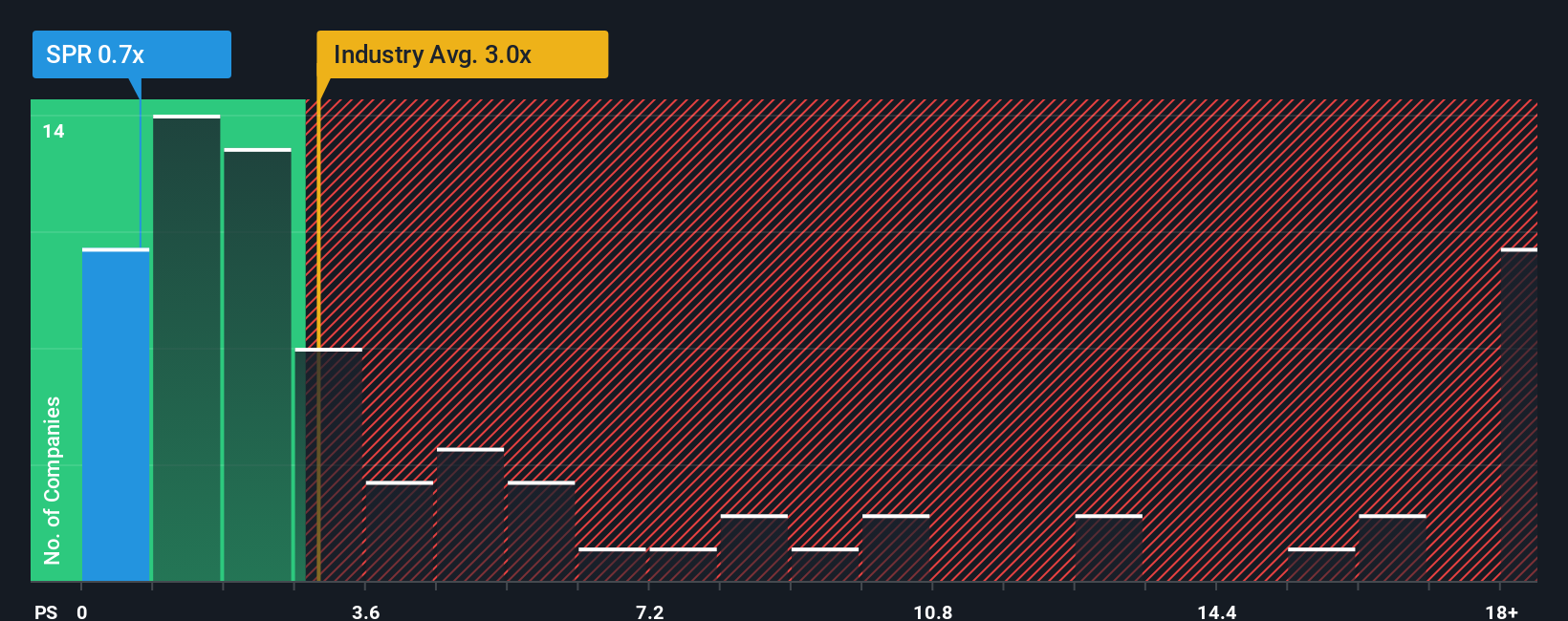

For companies that are not yet consistently profitable, the Price to Sales ratio is often a more reliable yardstick than earnings-based measures because it focuses on what the business is actually bringing in through the door, rather than volatile or negative profits.

In general, faster revenue growth and lower perceived risk justify a higher valuation multiple, while slower growth or higher risk call for a lower, more conservative multiple. Spirit AeroSystems Holdings currently trades on a Price to Sales ratio of about 0.73x, which is well below both the Aerospace and Defense industry average of roughly 3.02x and the peer group average of around 2.96x.

Simply Wall St’s Fair Ratio is a proprietary estimate of what a reasonable Price to Sales multiple should be for Spirit, given its growth outlook, profitability profile, industry, market cap and specific risks. This is more tailored than a simple peer comparison because it blends company-specific strengths and weaknesses with broader sector context. Spirit’s Fair Ratio is estimated at about 0.35x, which is lower than its current 0.73x Price to Sales, suggesting the market is pricing in a more optimistic scenario than the model implies.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Spirit AeroSystems Holdings Narrative

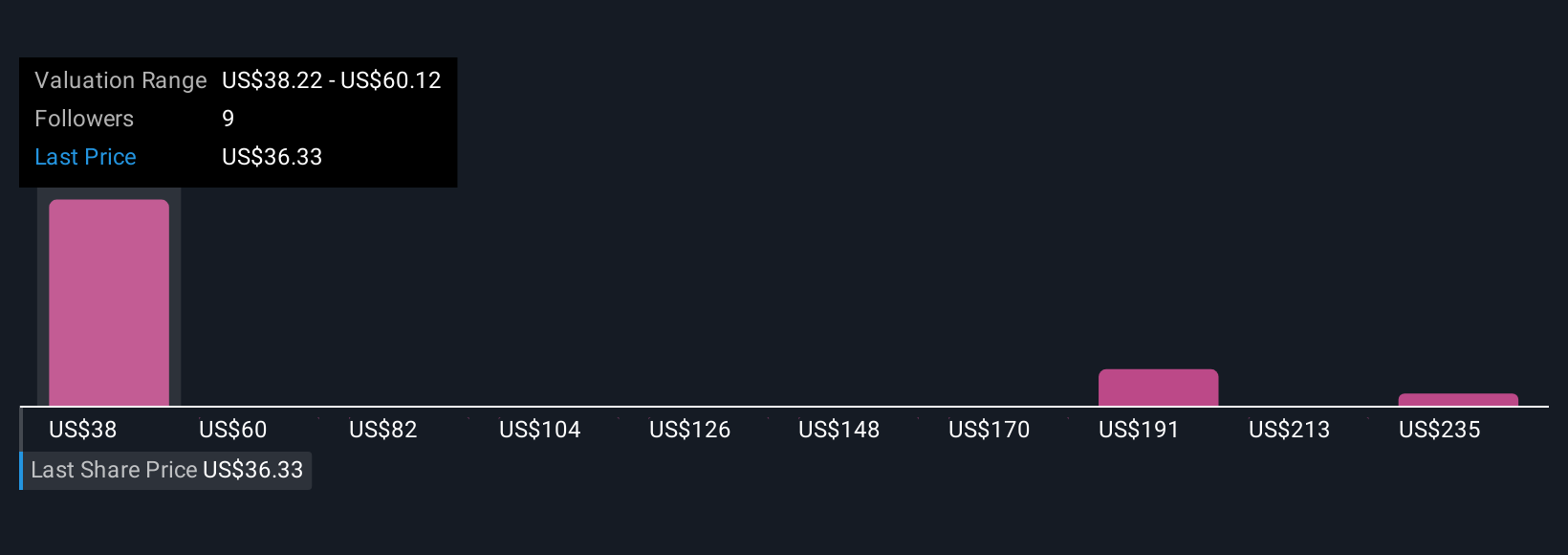

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company, where you connect your view of its future with concrete numbers like expected revenue growth, profit margins and what you think a fair value should be. Narratives link three things together: the business story, the financial forecasts that flow from that story, and the fair value those forecasts imply. On Simply Wall St, Narratives are easy to create and explore on the Community page, where millions of investors share how they see companies evolving. They help you evaluate your decisions by constantly comparing each Narrative’s Fair Value to the current market price. As new information comes in, such as earnings results or major news, the Narrative’s numbers and implied fair value update automatically. For Spirit AeroSystems Holdings, one investor might build a Narrative with strong aircraft demand, higher margins and a much higher fair value, while another assumes slower recovery, tighter margins and a far lower fair value.

Do you think there's more to the story for Spirit AeroSystems Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPR

Spirit AeroSystems Holdings

Engages in the design, engineering, manufacture, and marketing of commercial aerostructures worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026