- United States

- /

- Aerospace & Defense

- /

- NYSE:SPCE

Virgin Galactic’s Purdue Partnership and Delta Spaceplane Plans Could Be a Game Changer for SPCE

Reviewed by Sasha Jovanovic

- Virgin Galactic recently resolved a shareholder lawsuit with a settlement of approximately US$2.9 million and announced a partnership mission with Purdue University, aimed at expanding into research payloads beyond space tourism.

- This shift toward research collaborations and next-generation Delta Class spaceplane development highlights efforts to diversify revenue and accelerate long-term commercial viability in human spaceflight.

- We'll explore how the Purdue partnership and Delta Class development shape Virgin Galactic's broader investment narrative in commercial spaceflight expansion.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Virgin Galactic Holdings' Investment Narrative?

Virgin Galactic’s story has always been anchored in its ambition to make commercial spaceflight routine and profitable, despite persistent challenges around ongoing losses, diluted shareholder value, and questions on cash runway. The recent resolution of the US$2.9 million shareholder lawsuit removes a notable headline risk, potentially freeing management to focus more intently on execution. Meanwhile, the Purdue University partnership and renewed focus on research payloads could influence near-term catalysts by possibly expanding revenue streams, but these efforts are unlikely to have an immediate material impact given current quarterly revenue levels and the timeline for Delta Class spaceplane development. The key risk remains the pace and cost of scaling operations against a backdrop of sustained losses and heavy reliance on external funding. While these recent moves could shift the focus longer term, the near-term calculus around profitability and liquidity concerns is largely unchanged. In contrast, the ability to consistently fund operations remains a concern that investors should be aware of.

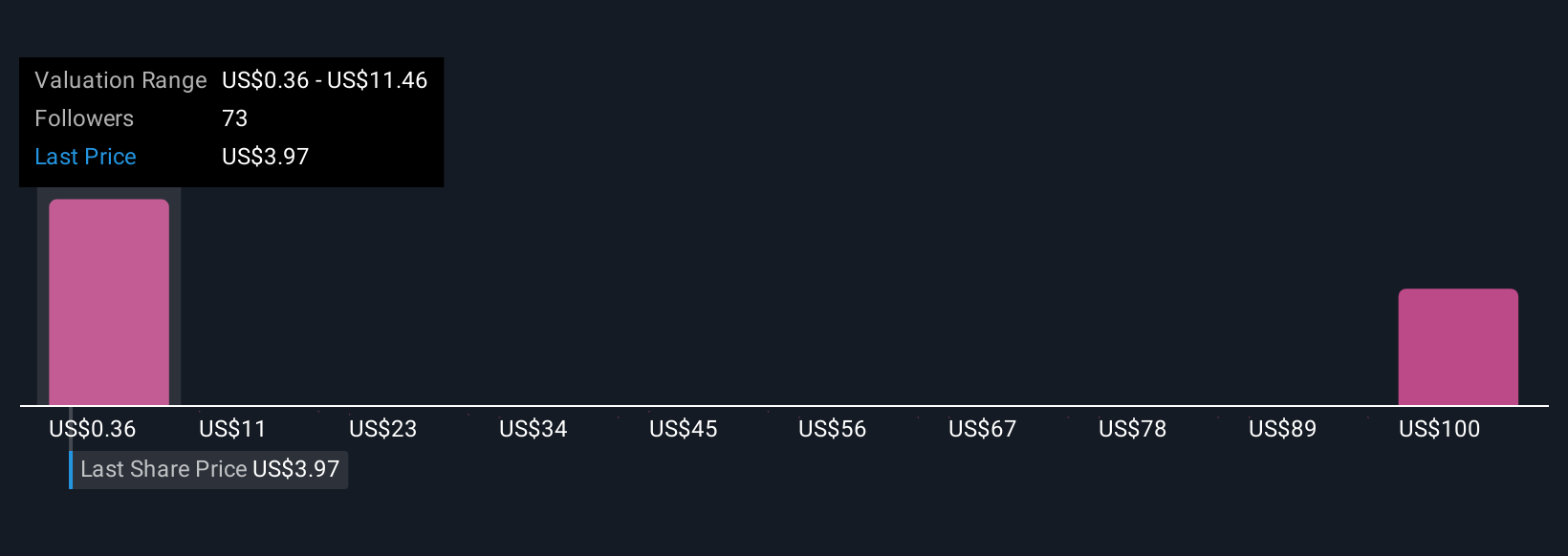

Despite retreating, Virgin Galactic Holdings' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 18 other fair value estimates on Virgin Galactic Holdings - why the stock might be worth less than half the current price!

Build Your Own Virgin Galactic Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Virgin Galactic Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Virgin Galactic Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Virgin Galactic Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPCE

Virgin Galactic Holdings

An aerospace and space travel company, focuses on the development, manufacture, and operation of spaceships and related technologies.

High growth potential and good value.

Market Insights

Community Narratives