- United States

- /

- Construction

- /

- NYSE:SOL

Investors Still Aren't Entirely Convinced By Emeren Group Ltd's (NYSE:SOL) Revenues Despite 27% Price Jump

Those holding Emeren Group Ltd (NYSE:SOL) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 54% share price decline over the last year.

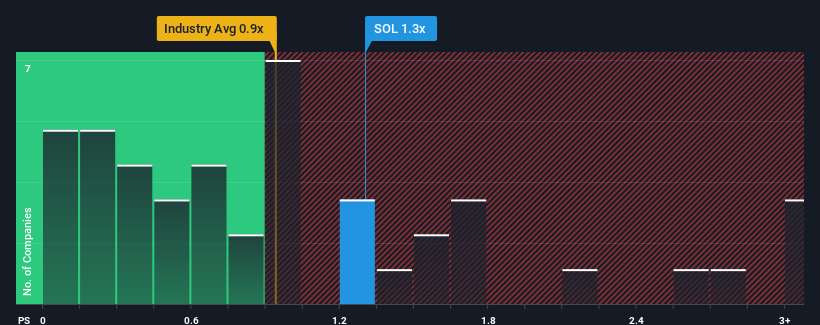

Even after such a large jump in price, there still wouldn't be many who think Emeren Group's price-to-sales (or "P/S") ratio of 1.3x is worth a mention when the median P/S in the United States' Construction industry is similar at about 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Emeren Group

What Does Emeren Group's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Emeren Group has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Emeren Group.How Is Emeren Group's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Emeren Group's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 28% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 2.7% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 68% as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 9.2% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Emeren Group's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Emeren Group's P/S Mean For Investors?

Emeren Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Emeren Group's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Emeren Group (1 is potentially serious!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Emeren Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SOL

Excellent balance sheet with reasonable growth potential.