- United States

- /

- Electrical

- /

- NYSE:SMR

NuScale Power (SMR) Announces 6GW Partnership With ENTRA1 Energy

Reviewed by Simply Wall St

NuScale Power (SMR) recently announced a significant partnership with ENTRA1 Energy to deploy up to 6 gigawatts of SMR capacity across the Tennessee Valley Authority's service region, marking a historic leap in U.S. nuclear energy. Despite this landmark event, the company experienced a 10% share price decline over the last month. This move counters the broader market trend, which has seen major indexes approach record highs amid expectations of a Federal Reserve rate cut. The partnership, a milestone in clean energy solutions, may not have been enough to bolster investor confidence amidst broader market dynamics.

You should learn about the 2 weaknesses we've spotted with NuScale Power.

The recently announced partnership between NuScale Power and ENTRA1 Energy is pivotal, indicating a substantial expansion in the company's SMR deployment capabilities. While this collaboration underscores NuScale's potential in the nuclear energy sector, it has yet to translate into short-term share price gains, as evidenced by the 10% drop over the past month. Nevertheless, looking at the longer-term performance, NuScale's total shareholder returns were extremely large at 292.56% over the last year. This indicates significant growth, despite recent volatility, highlighting a divergence from its monthly decline.

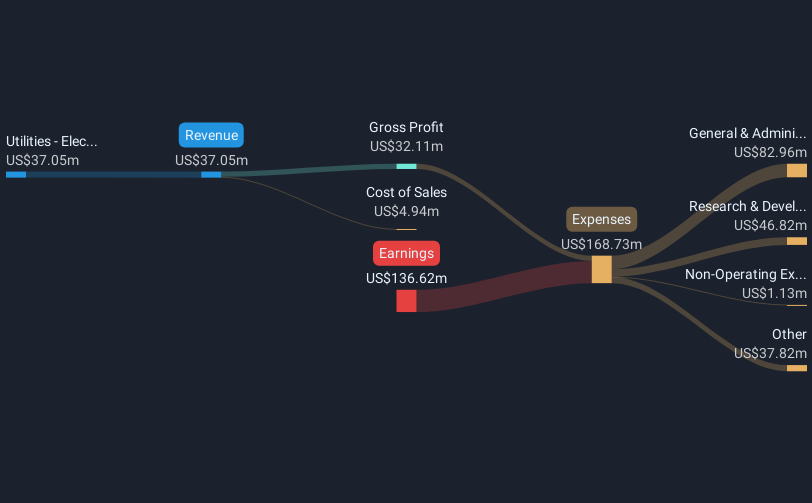

Relative to broader market and industry conditions, while NuScale outpaced the US Market's 19.1% and the US Electrical industry’s 53.6% return over the past year, it still faces hurdles in terms of immediate market sentiment, reflecting in its current trading price. The share price of US$34.31 sits below the consensus analyst price target of US$42.30, marking a significant discount and indicating potential room for upward movement should projected revenue and earnings materialize.

This strategic partnership with ENTRA1 Energy holds implications for future revenue streams and earnings forecasts. Analysts are optimistic about substantial revenue growth driven by these developments, yet profitability challenges remain persistent. The projected increase in revenue adds potential optimism, though NuScale's ongoing unprofitability and its below-industry-average price-to-book ratio underscore the need for careful consideration. Keeping an eye on operational efficiencies and successful completion of strategic projects will be key areas to evaluate for future financial performance.

Evaluate NuScale Power's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NuScale Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMR

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives