- United States

- /

- Electrical

- /

- NYSE:SMR

NuScale Power (NYSE:SMR) Expands Education Efforts With New E2 Centers

Reviewed by Simply Wall St

NuScale Power (NYSE:SMR) is expanding its educational initiatives with the recent opening of Energy Exploration (E2) Centers, which aim to develop a nuclear-ready workforce and engage communities through hands-on learning and outreach. Despite these positive developments, the company experienced a 12% decline in share price over the past week. This drop aligns with broader market struggles, as major indices like the Dow Jones and Nasdaq Composite have also faced significant declines due to fears of an escalating global trade war affecting corporate profits and economic growth, contributing to bearish market sentiment impacting NuScale's stock performance.

NuScale Power has 4 weaknesses we think you should know about.

Over the last year, NuScale Power achieved a total return of 129.55%, significantly outperforming the US Market's 3.3% return and the US Electrical industry’s decline of 6.2%. This impressive performance came despite challenges, including substantial insider selling over the past three months and high share price volatility recently.

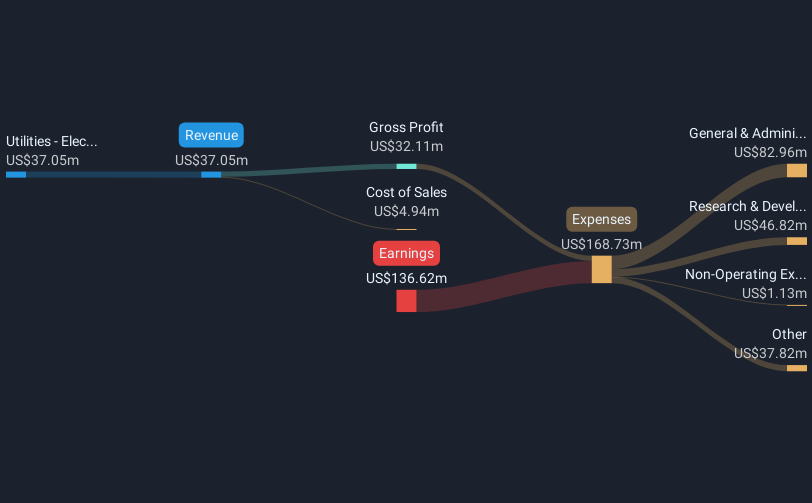

Key events like the opening of multiple Energy Exploration Centers in early 2025 and an upcoming $200 million follow-on equity offering in November 2024 may have bolstered investor confidence, contributing to the company's strong performance. On the financial side, despite increased net losses over the year, the company saw sales growth from US$22.81 million to US$37.05 million by December 2024's end. However, a removal from the Russell 2000 indices in July 2024 and a continued status as unprofitable underscore some ongoing challenges for the company.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade NuScale Power, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NuScale Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMR

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives