- United States

- /

- Electrical

- /

- NYSE:SMR

Is NuScale’s Authorized Share Doubling Reshaping The Investment Case For NuScale Power (SMR)?

Reviewed by Sasha Jovanovic

- At a Special Meeting of Stockholders held on December 16, 2025, NuScale Power Corporation approved an amendment to its Certificate of Incorporation to increase authorized Class A common shares from 332,000,000 to 662,000,000, supporting future equity issuance for its small modular reactor (SMR) projects.

- This sizable expansion of potential share capital underpins NuScale’s efforts to fund NRC-approved SMR deployments, including its Tennessee Valley Authority agreement and international projects.

- We’ll now examine how the newly approved authorized share increase could reshape NuScale’s investment narrative and funding outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

NuScale Power Investment Narrative Recap

To own NuScale, you have to believe its NRC approved SMR design and early project wins can turn today’s small, loss making business into a future nuclear platform. The newly approved authorized share increase mainly reinforces NuScale’s ability to raise equity for long lead projects, but it also heightens near term dilution risk, which ties directly into the company’s most important short term catalyst: securing and funding commercially viable deployments.

The Tennessee Valley Authority and ENTRA1 Energy agreement for up to 6 gigawatts of SMR capacity is the announcement that matters most in this context, because scaling that pipeline will likely require significant new capital. The expanded pool of authorized Class A shares gives NuScale more room to support this program and its Romanian RoPower project, while investors weigh funding needs against execution risk and long timelines to meaningful revenue.

Yet behind the growth story, investors should be aware of how share issuance and project delays could affect...

Read the full narrative on NuScale Power (it's free!)

NuScale Power's narrative projects $402.3 million revenue and $42.2 million earnings by 2028. This requires 121.5% yearly revenue growth and a $178.8 million earnings increase from $-136.6 million today.

Uncover how NuScale Power's forecasts yield a $40.50 fair value, a 114% upside to its current price.

Exploring Other Perspectives

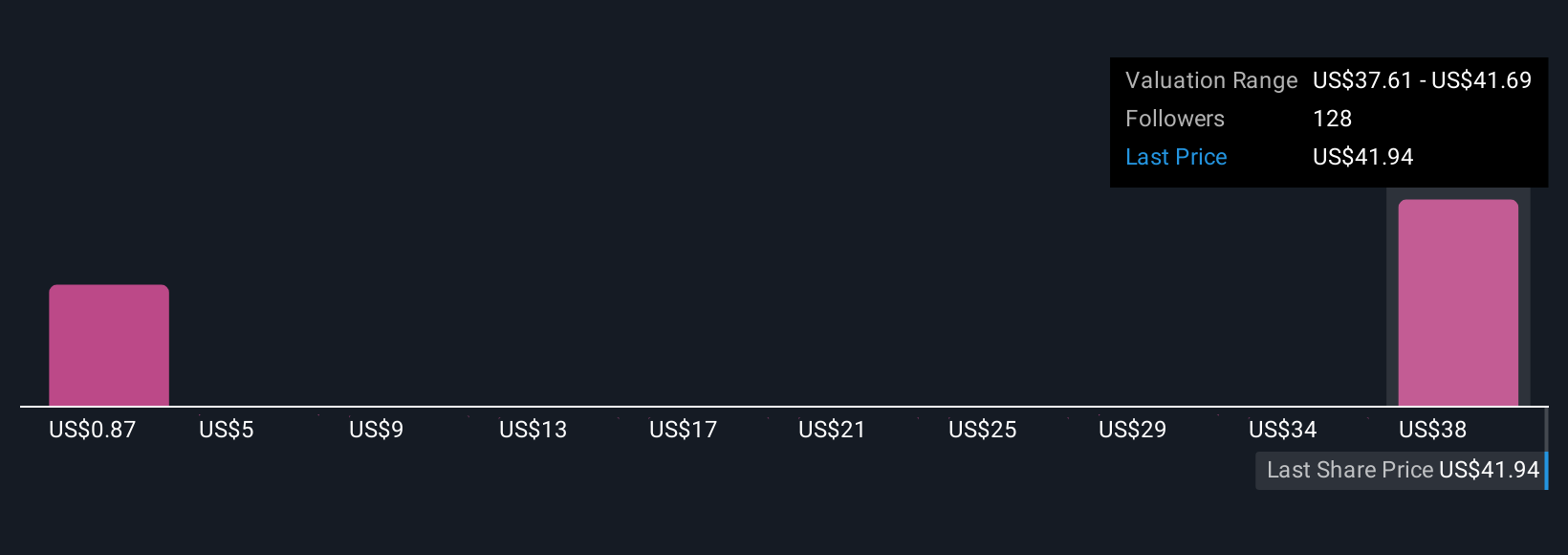

Thirteen fair value estimates from the Simply Wall St Community span roughly US$1 to US$40 per share, underlining how far apart individual views on NuScale’s prospects can be. When you set those expectations against NuScale’s dependence on complex long term power purchase agreements, it becomes clear why exploring several viewpoints on potential project timing and funding needs matters.

Explore 13 other fair value estimates on NuScale Power - why the stock might be worth over 2x more than the current price!

Build Your Own NuScale Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NuScale Power research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free NuScale Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NuScale Power's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NuScale Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMR

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026