- United States

- /

- Electrical

- /

- NYSE:SMR

A Look at NuScale Power’s Valuation Following Historic U.S. Small Modular Reactor Expansion

Reviewed by Simply Wall St

NuScale Power (NYSE:SMR) just helped kick off the largest small modular reactor deployment program in U.S. history. Backing ENTRA1 Energy’s agreement with the Tennessee Valley Authority, the company is set to see its NRC-approved SMR technology rolled out across a massive service region, supplying enough carbon-free power to energize the equivalent of the entire Dallas-Fort Worth metro area. For investors, this moment signals a major milestone that could reshape how markets value NuScale’s role in the nation’s energy future.

This announcement adds fuel to an already dynamic year for NuScale Power, building on momentum from expanding partnerships and its status as the only NRC-approved SMR ready for market. Despite lingering questions around profitability, shares are up around 3% over the past year, with double-digit gains since the start of the year that reflect renewed confidence in the company's growth prospects. While recent competitors are accelerating their own tech, NuScale remains at center stage as commercialization accelerates.

The real question now is whether NuScale Power’s current stock price undervalues its next phase, or if the surge is already capturing all that future growth. Do you see a real buying window here, or are the markets already one step ahead?

Most Popular Narrative: 11.9% Undervalued

According to the most widely followed narrative, NuScale Power is trading below its fair value, signaling potential upside for investors who share the bullish growth assumptions driving the current analyst consensus.

NuScale's involvement in the RoPower 6-module small modular reactor (SMR) power plant in Romania indicates future meaningful revenue and cash flow through its partnership in the Fluor-led Front-End Engineering and Design (FEED) Phase 2. This project enhances NuScale's revenue prospects.

Ready to uncover why NuScale is catching Wall Street’s attention? The main factors are aggressive growth forecasts, a profit margin transition, and a notable forward price multiple. Curious which core assumptions analysts are betting on? Unlock the full narrative and see what is driving this surprising valuation story.

Result: Fair Value of $42.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent uncertainties around long-term contracts and potential supply chain disruptions could easily change the outlook for NuScale’s future growth story.

Find out about the key risks to this NuScale Power narrative.Another View: DCF Model Paints a Different Picture

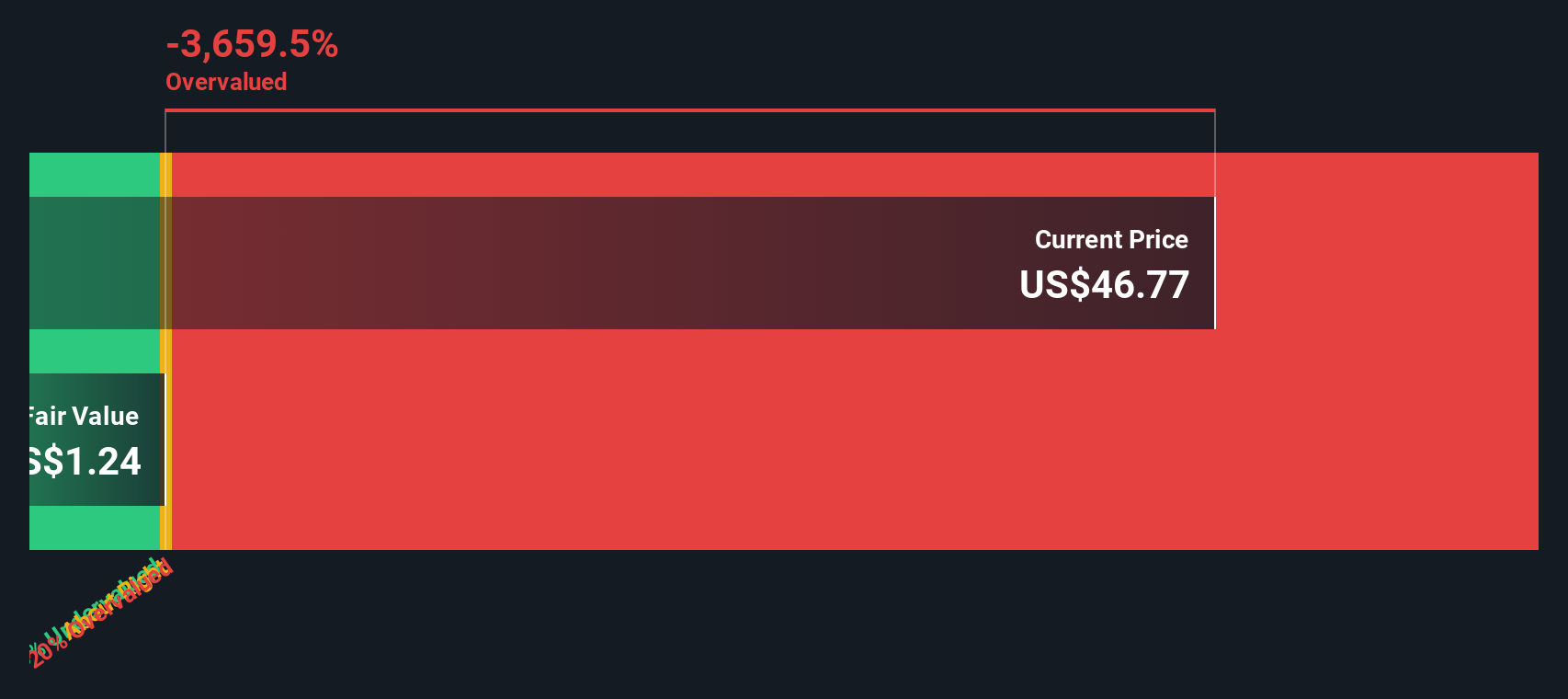

While analysts see upside based on growth forecasts and future margins, our SWS DCF model reaches a strikingly different conclusion. It suggests the stock could be overvalued right now. Which lens aligns with reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NuScale Power Narrative

If you have a different angle or want to dig into the details on your own terms, start building your own view in just a few minutes with Do it your way.

A great starting point for your NuScale Power research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let a great opportunity pass by. Open up your investing options with a powerful stock screener and gain access to the most promising trends and value plays in the market. Insights like these could help you transform your strategy and get ahead of the crowd.

- Unlock hidden gems among fast-growing upstarts by checking out penny stocks with strong financials. These companies are showing robust financial strength where it counts.

- Catch the next wave in medicine and patient care through healthcare AI stocks, your window into the future of healthcare powered by artificial intelligence.

- Spot stocks that analysts think are trading below their true worth using undervalued stocks based on cash flows for more potential bargains built on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NuScale Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMR

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives