- United States

- /

- Trade Distributors

- /

- NYSE:SITE

SiteOne Landscape Supply (SITE): Taking Stock of Valuation After Barclays Upgrade and New Media Strategy Push

Reviewed by Simply Wall St

Barclays just bumped SiteOne Landscape Supply (SITE) up to Equal Weight, pointing to cleaner SG&A execution and steady pricing, while a fresh media partnership and continued analyst support are reshaping how investors are sizing up the stock.

See our latest analysis for SiteOne Landscape Supply.

Even with the Barclays upgrade and the new media partnership signaling operational and growth momentum, the stock’s 1 year total shareholder return of -14.88 percent and 90 day share price return of -12.32 percent suggest sentiment is still in repair mode rather than in a full upswing.

If you are weighing SITE alongside other ideas, this could be a good moment to explore fast growing stocks with high insider ownership as a way to spot under the radar growth stories with aligned insiders.

With SiteOne trading at a sizable discount to analyst targets despite improving margins and renewed growth efforts, investors now face a key question: is this a mispriced turnaround story, or is the market already baking in the recovery?

Most Popular Narrative: 19.7% Undervalued

With SiteOne closing at $125.59 against a narrative fair value of $156.40, the valuation story leans positive as earnings power and margins scale up.

Ongoing acquisition of smaller, high margin businesses in a fragmented market allows SiteOne to consolidate market share, introduce higher margin products, and leverage operational synergies, leading to long term revenue growth and potential margin expansion. Investment in digital tools (siteone.com, DispatchTrack) and e commerce initiatives is accelerating customer engagement, growing digital sales by over 130% and improving salesforce productivity, which is likely to enhance operating leverage and drive higher EBITDA and EPS growth.

Want to see why this growth blueprint points to a richer future earnings base, even with a lower profit multiple than today? The narrative unpacks how revenue, margins, and per share earnings are modeled to compound together into that higher fair value. The most surprising piece is how much of the upside rides on one specific shift in the business mix.

Result: Fair Value of $156.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside hinges on successful integration of acquisitions and on resilience in soft residential and renovation markets that remain vulnerable to macro setbacks.

Find out about the key risks to this SiteOne Landscape Supply narrative.

Another Take on Value

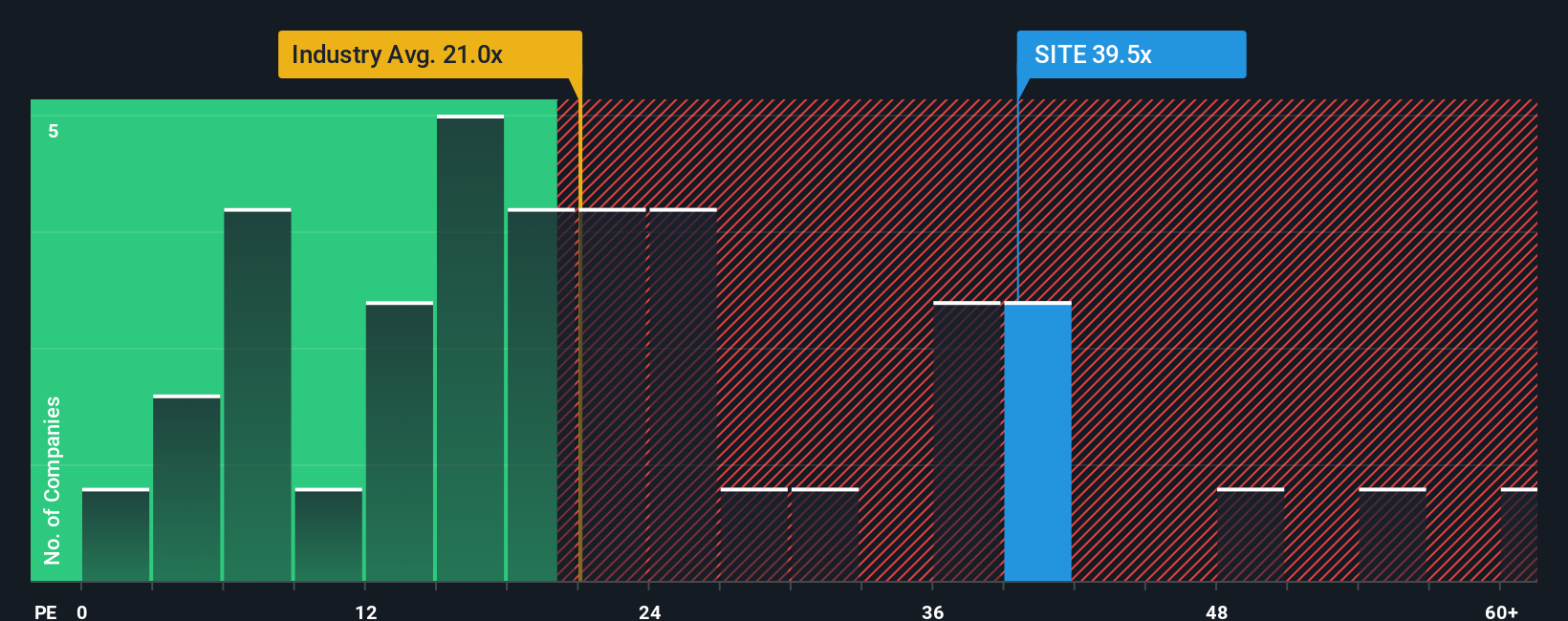

While the narrative fair value points to upside, the earnings multiple tells a tougher story. SITE trades on about 40 times earnings, far richer than the US Trade Distributors industry at 19.5 times and its own fair ratio of 29.3 times, suggesting real downside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SiteOne Landscape Supply Narrative

If you would rather dive into the numbers yourself and challenge these assumptions, you can build a personalized view in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding SiteOne Landscape Supply.

Looking for more investment ideas?

Act now and put Simply Wall St’s tools to work so you are not left watching from the sidelines while sharper investors move on fresh opportunities.

- Lock in potential mispricings early by scanning these 903 undervalued stocks based on cash flows that still trade below what their cash flows suggest they are worth.

- Ride structural shifts in healthcare by targeting these 30 healthcare AI stocks using data driven tools and clinical innovation to reshape patient outcomes.

- Capitalize on market volatility by focusing on these 80 cryptocurrency and blockchain stocks positioned to benefit from growing adoption of blockchain infrastructure and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SITE

SiteOne Landscape Supply

Engages in the wholesale distribution of landscape supplies in the United States and Canada.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026