- United States

- /

- Electrical

- /

- NYSE:SES

Will SES AI’s (SES) New Software Platform Reshape Its Long-Term Competitive Edge?

Reviewed by Sasha Jovanovic

- SES AI Corporation recently announced the upcoming launch of Molecular Universe 1.0 (MU-1), its new battery material discovery software platform and expanded subscription services, building on early revenue from enterprise clients and additional go-to-market hires.

- MU-1 introduces senior scientist-level AI capabilities and a vast molecular database, aiming to significantly accelerate and scale material discovery for battery-related industries.

- We'll examine how the introduction of MU-1's advanced AI platform may influence SES AI's investment narrative and future growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

SES AI Investment Narrative Recap

To be a shareholder in SES AI, you need to believe that AI-driven breakthroughs in battery materials can generate scalable, high-margin growth, and that rapid adoption of the Molecular Universe platform will offset ongoing losses and customer concentration risk. The announcement of MU-1, SES's most advanced battery material discovery software, boosts the company’s tech credentials and may quickly accelerate software revenue, but short-term performance still hinges on converting trial customers into recurring contracts; this news doesn’t alter the immediate catalyst or main risk of validation delays.

The July 2025 release of Molecular Universe MU-0.5 was the prior step toward this launch, introducing Deep Space, an AI that mimics senior scientist reasoning, MU-1 meaningfully builds on these capabilities and extends SES AI’s offering for enterprise clients, reinforcing its focus on recurring software revenue as a key catalyst for financial improvement.

But before assuming the upside is automatic, investors should also consider the risk that if broader industry uptake slows or major customers hesitate...

Read the full narrative on SES AI (it's free!)

SES AI's outlook anticipates $199.7 million in revenue and $19.9 million in earnings by 2028. This is based on an annual revenue growth rate of 160.0% and a $119.7 million increase in earnings from the current level of -$99.8 million.

Uncover how SES AI's forecasts yield a $1.50 fair value, a 50% downside to its current price.

Exploring Other Perspectives

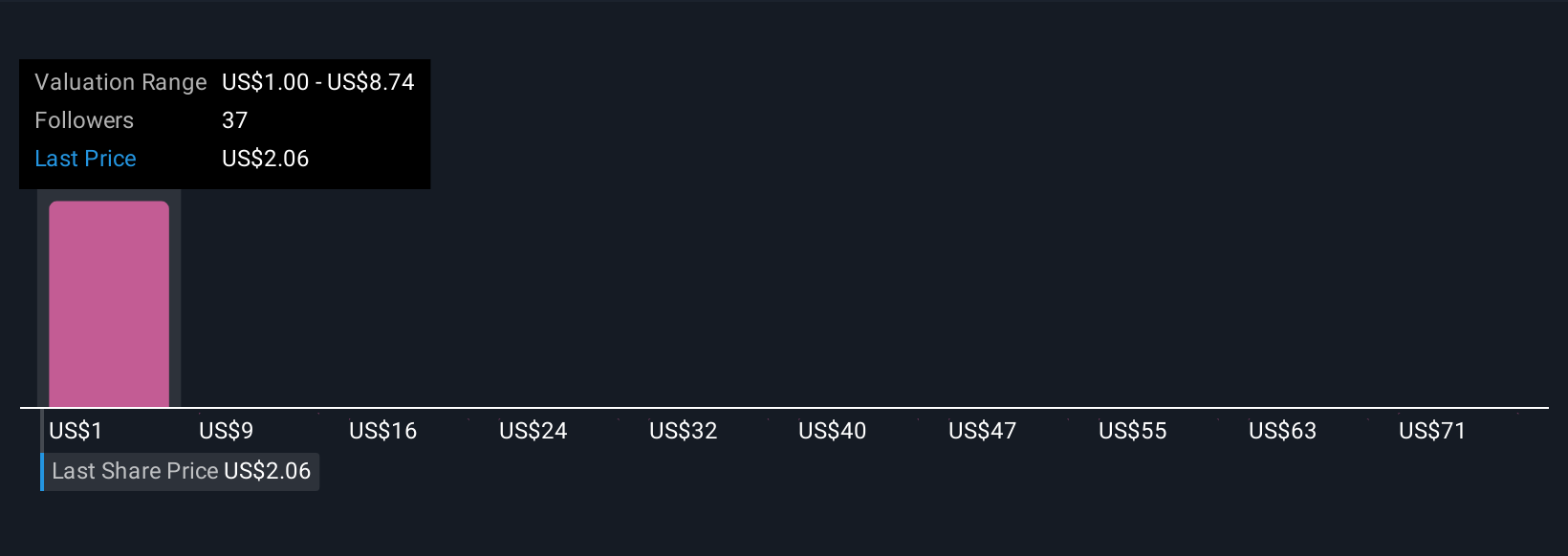

Simply Wall St Community members posted nine SES AI fair value estimates, ranging from US$1 to US$78.38 per share, reflecting significant splits in growth expectations. While the new Molecular Universe launch is cited as a catalyst, many continue to focus on whether SES AI can prove its AI platform’s edge and convert trial users into long-term customers, explore these different outlooks and see which aligns with your own expectations.

Explore 9 other fair value estimates on SES AI - why the stock might be worth less than half the current price!

Build Your Own SES AI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SES AI research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free SES AI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SES AI's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SES

SES AI

Develops and produces AI enhanced lithium metal and lithium ion rechargeable battery technologies for electric vehicles, urban air mobility, drones, robotics, battery energy storage systems, and other applications.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.