- United States

- /

- Electrical

- /

- NYSE:SES

Why SES AI (SES) Is Up 10.8% After Launching Its Rapid AI Battery Discovery Platform

Reviewed by Sasha Jovanovic

- SES AI recently launched MU-1, an AI-driven software and service platform designed to accelerate battery material discovery for electric vehicles, robotics, and energy storage applications.

- By reducing the battery material discovery timeline from years to minutes, MU-1 could fundamentally reshape innovation speed across key energy industries.

- To assess the full impact, we'll examine how MU-1's end-to-end AI material discovery capability shapes SES AI’s broader investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

SES AI Investment Narrative Recap

To be a shareholder in SES AI, an investor needs conviction in the transformative potential of AI-powered battery materials discovery to drive rapid industry adoption and revenue growth. While the MU-1 launch underscores SES AI's innovation lead, the main short-term catalyst remains validation and commercial adoption of the software by enterprise customers; the biggest risk is whether customers perceive the platform to outperform traditional research, as continued delays in this proof could stall new contracts. At this stage, the news validates SES AI's direction but may not materially alter near-term risks or catalysts until real-world adoption data emerge.

Among recent announcements, the July launch of Molecular Universe MU-0.5, featuring Deep Space to accelerate battery R&D, directly aligns with the MU-1 release. Both amplify SES AI's pitch for faster, AI-driven innovation cycles, supporting its ambition to carve out a unique niche in battery technology. Progress with these products remains linked to customer validation as a key revenue driver.

However, investors should note that even with MU-1, risks around slow enterprise adoption still linger if customers decide the platform does not yet...

Read the full narrative on SES AI (it's free!)

SES AI's outlook anticipates $199.7 million in revenue and $19.9 million in earnings by 2028. This is based on an assumed 160.0% annual revenue growth, representing a $119.7 million increase in earnings from the current level of -$99.8 million.

Uncover how SES AI's forecasts yield a $1.50 fair value, a 27% downside to its current price.

Exploring Other Perspectives

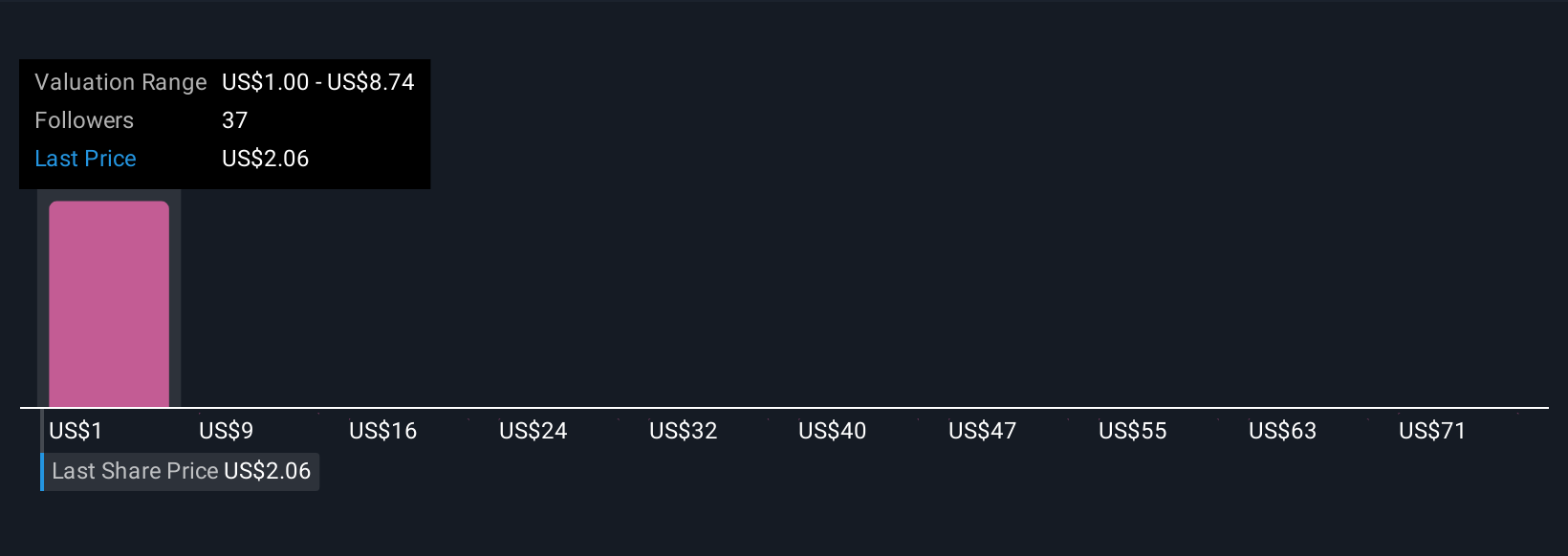

Nine Simply Wall St Community members value SES AI between US$1 and US$78.38 per share. With opinions spread this widely, it is essential to consider the ongoing risk that customer trials of MU-1 could delay major contracts and impact future growth.

Explore 9 other fair value estimates on SES AI - why the stock might be a potential multi-bagger!

Build Your Own SES AI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SES AI research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free SES AI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SES AI's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SES

SES AI

Develops and produces AI enhanced lithium metal and lithium ion rechargeable battery technologies for electric vehicles, urban air mobility, drones, robotics, battery energy storage systems, and other applications.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives