- United States

- /

- Electrical

- /

- NYSE:SES

Is SES AI (SES) Quietly Rewiring Its Battery Economics With Molecular Universe And UZ Energy?

Reviewed by Sasha Jovanovic

- In recent months, SES AI Corporation has accelerated its push into next-generation lithium batteries by acquiring UZ Energy, lifting revenue guidance, and improving its financial results while publicly releasing its Molecular Universe AI platform to speed up battery material discovery.

- This combination of AI-driven innovation, broader energy storage ambitions, and early software commercialization signals an attempt to build a differentiated, higher-margin battery technology ecosystem.

- We’ll now explore how the Molecular Universe AI rollout and broader production push could reshape SES AI’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

SES AI Investment Narrative Recap

To own SES AI shares, you need confidence that its AI enabled battery platform can turn early traction into durable, profitable commercialization. The recent UZ Energy acquisition and higher 2025 revenue guidance sharpen the near term catalyst around scaling energy storage and software revenues, while also amplifying the key risk that rapid expansion and integration could strain operations and keep net margins under pressure if execution slips.

Among the recent developments, the public rollout of the Molecular Universe platform is especially relevant, because it turns SES AI’s core AI research into a commercial software and materials engine that can support both EV and grid storage partnerships. How quickly enterprise trials convert into meaningful contracts will be central to validating this higher margin opportunity and testing whether the company’s increased revenue targets are sustainable beyond early adopters.

Yet while excitement around AI enhanced batteries is growing fast, investors should also be aware that...

Read the full narrative on SES AI (it's free!)

SES AI's narrative projects $199.7 million revenue and $19.9 million earnings by 2028.

Uncover how SES AI's forecasts yield a $3.00 fair value, a 31% upside to its current price.

Exploring Other Perspectives

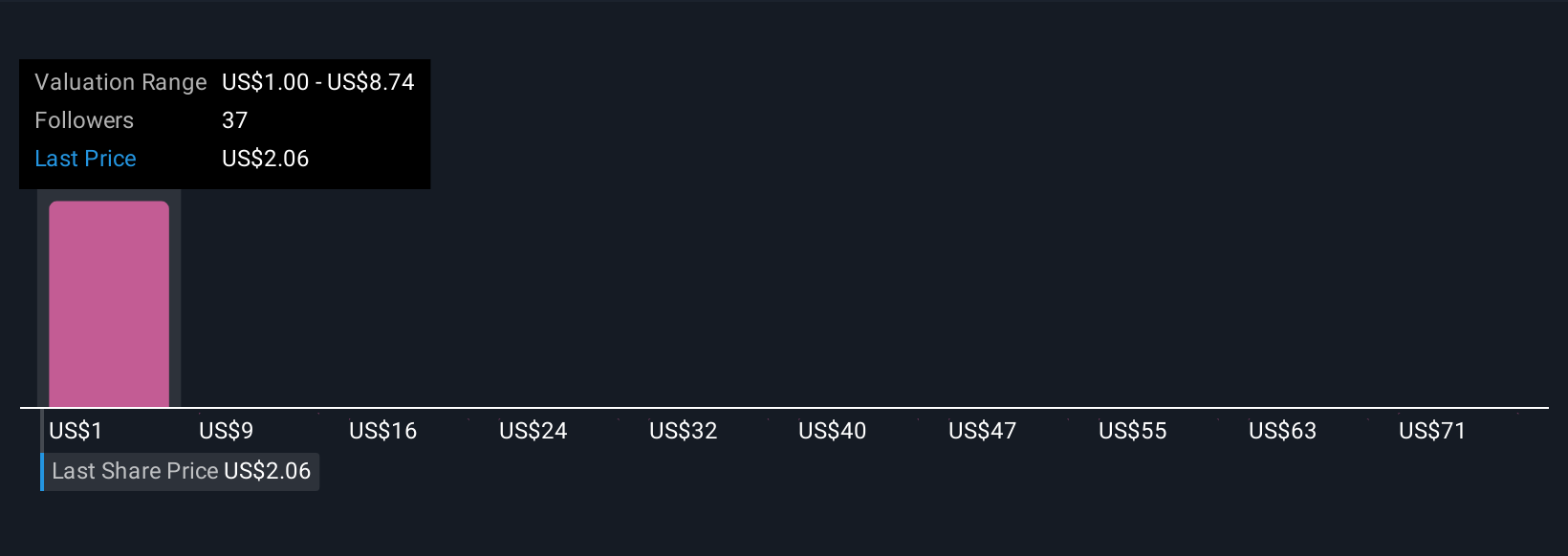

Eight fair value estimates from the Simply Wall St Community span roughly US$1 to over US$78 per share, underlining how differently you can judge SES AI’s potential. When you set those views against the company’s heavy reliance on converting Molecular Universe trials into long term contracts, it becomes even more important to compare several perspectives before forming an opinion.

Explore 8 other fair value estimates on SES AI - why the stock might be a potential multi-bagger!

Build Your Own SES AI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SES AI research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free SES AI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SES AI's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SES

SES AI

Develops and produces AI enhanced lithium metal and lithium ion rechargeable battery technologies for electric vehicles, urban air mobility, drones, robotics, battery energy storage systems, and other applications.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026