- United States

- /

- Aerospace & Defense

- /

- NYSE:RTX

RTX (NYSE:RTX) Reports Decline In Net Income Despite Revenue Increase

Reviewed by Simply Wall St

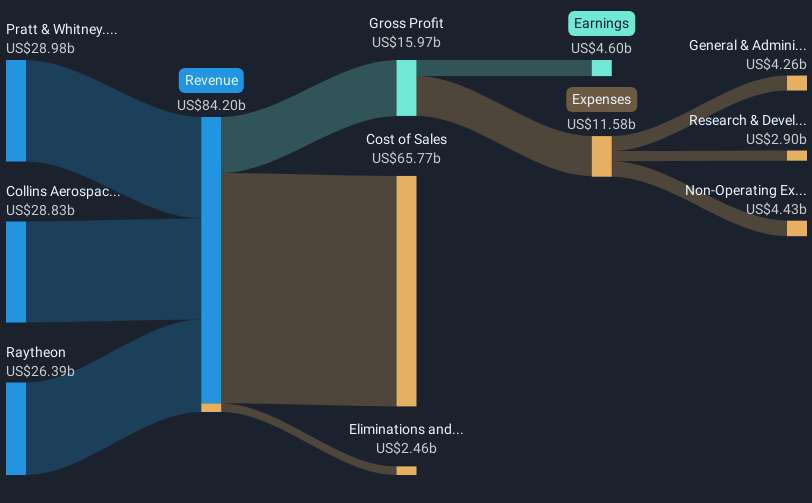

RTX (NYSE:RTX) recently announced an increase in quarterly revenue yet experienced declines in net income and earnings per share, which might initially seem at odds with the company's share price movement of 10% over the last week. However, positive developments such as the progress in Collins Aerospace's military sensor integration technology and continued success in the share repurchase program add weight to this movement. Meanwhile, broader market indices, facing pressure from economic contraction and mixed earnings results, slightly declined. Thus, RTX's stock move may indicate investor confidence in its technological advancements and financial strategies, contrasting with broader market trends.

We've spotted 3 weaknesses for RTX you should be aware of, and 1 of them is concerning.

The recent developments at RTX, particularly concerning Collins Aerospace's military sensor integration technology and the successful share repurchase program, hint at potential positive impacts on the company's long-term narrative. These advancements could enhance RTX's future revenue and earnings projections, providing a solid base for continued growth. With the company's focus on core innovations like the GTF Advantage and LTAMDS, they align well with anticipated global defense budget increases, which may further stabilize revenue streams. However, risks remain with potential global tariffs and supply chain challenges, potentially impacting profitability.

Over the past five years, RTX has achieved a total shareholder return of 141.42%, which underscores its solid performance in the aerospace and defense sector. In the shorter term, the company's performance outpaced both the US market's 9.9% return and the Aerospace & Defense industry's 19.3% return over the past year, showcasing its relative strength. This aligns with its 32.3% earnings growth over the previous year, surpassing the industry's 22.5% growth.

Considering the recent share price movement of 10% and current price levels at US$113.75, relative to an analyst consensus price target of US$140.74, RTX's valuation suggests there is a 19.2% potential upside. The positive developments mentioned could influence analyst forecasts, with projected annual revenue growth at 4.6% and earnings poised to reach US$8.4 billion by April 2028. However, for the company to meet or exceed these expectations and align with the analyst price target, careful navigation of operational risks and external challenges will be crucial.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade RTX, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RTX

RTX

An aerospace and defense company, provides systems and services for the commercial, military, and government customers in the United States and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives