- United States

- /

- Aerospace & Defense

- /

- NYSE:RTX

RTX (NYSE:RTX) Partners With Shield AI To Enhance Autonomous Defense Systems

Reviewed by Simply Wall St

RTX (NYSE:RTX) recently announced a partnership with Shield AI to enhance autonomous defense capabilities, fully funding the initiative without government investment. This collaboration, integral to RTX's innovative advancements, aligns with recent strategic developments like its addition to key indices such as the Russell 1000 Value-Defensive, which reflects growing market confidence. Despite a 9% dividend increase, RTX's stock gained 8% last quarter, consistent with broader market optimism as tech sectors rallied and indices rose. The strong defense sector performance, coupled with significant contracts and product upgrades, likely supported RTX’s positive momentum amid an overall upswing in the market.

We've identified 3 possible red flags for RTX (1 is a bit unpleasant) that you should be aware of.

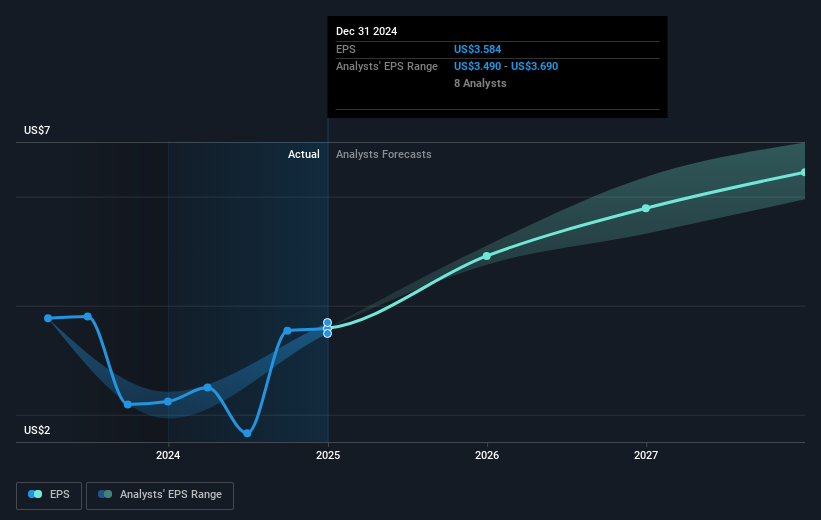

The recent partnership with Shield AI marks a significant step for RTX, potentially enhancing its innovation-driven growth trajectory. By boosting autonomous defense capabilities, this initiative could bolster revenue and earnings forecasts, especially in the defense segment, aligning well with increased global defense budgets. This collaboration may contribute to future revenue stability and support the projected strong organic sales growth and margin expansion that analysts have forecasted for RTX.

Over the past five years, RTX's total shareholder returns, including dividends and share price appreciation, reached 166.75%. This performance underscores the company's resilience and growth over the longer term. Comparatively, for the past year, RTX has kept pace with the US Aerospace & Defense industry, which achieved returns of 43.8%. This consistency reflects the broader market's outlook and confidence in the sector's enduring strength.

In light of recent developments and the market's positive momentum, RTX's stock continues to show promising movement. Currently trading at US$128.16, the stock's price remains below the analyst consensus price target of US$137.93 by about 7.1%. This indicates room for growth aligned with future earnings projections. The broader impact of recent strategic initiatives is likely to influence both revenue and earnings positively, as market confidence supports a gradual alignment with the consensus valuation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RTX

RTX

An aerospace and defense company, provides systems and services for the commercial, military, and government customers in the United States and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion