- United States

- /

- Electrical

- /

- NYSE:RRX

Will Analyst Optimism for Regal Rexnord (RRX) Hold Up as Growth Moves Beyond Acquisitions?

Reviewed by Sasha Jovanovic

- Regal Rexnord Corporation recently announced it will release its third quarter 2025 financial results after market close on October 29, 2025, with a conference call to follow the next morning.

- Investor enthusiasm has been fueled by analyst upgrades and strong positioning in energy-efficient and automation markets, as well as recent acquisitions and a growing backlog.

- We'll explore how renewed analyst optimism and Regal Rexnord's expansion in energy-efficient solutions affect the company's investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Regal Rexnord Investment Narrative Recap

To be a Regal Rexnord shareholder, you have to believe that growth in energy-efficient and automation markets will sustain demand for the company's solutions, driving long-term revenue and margin expansion. The latest announcement of third quarter results coming on October 29, 2025 is a short-term focus for the market, but unless guidance or delivery changes substantially, the event is unlikely to alter the main catalysts or biggest risks like supply chain volatility and competitive pressure.

The most relevant announcement to this news event is the collaboration with ABB Robotics integrating Regal Rexnord’s GoFa™ cobots into a broader ecosystem. This supports Regal Rexnord’s positioning in automation, which is vital for future backlog conversion and margin expansion as adoption of energy-efficient solutions accelerates.

But while these advances are important, investors should also be mindful of the risk that rare earth magnet supply chain pressures could quickly disrupt...

Read the full narrative on Regal Rexnord (it's free!)

Regal Rexnord's outlook forecasts $6.5 billion in revenue and $695.5 million in earnings by 2028. This implies 3.5% annual revenue growth and an earnings increase of $445.1 million from the current $250.4 million level.

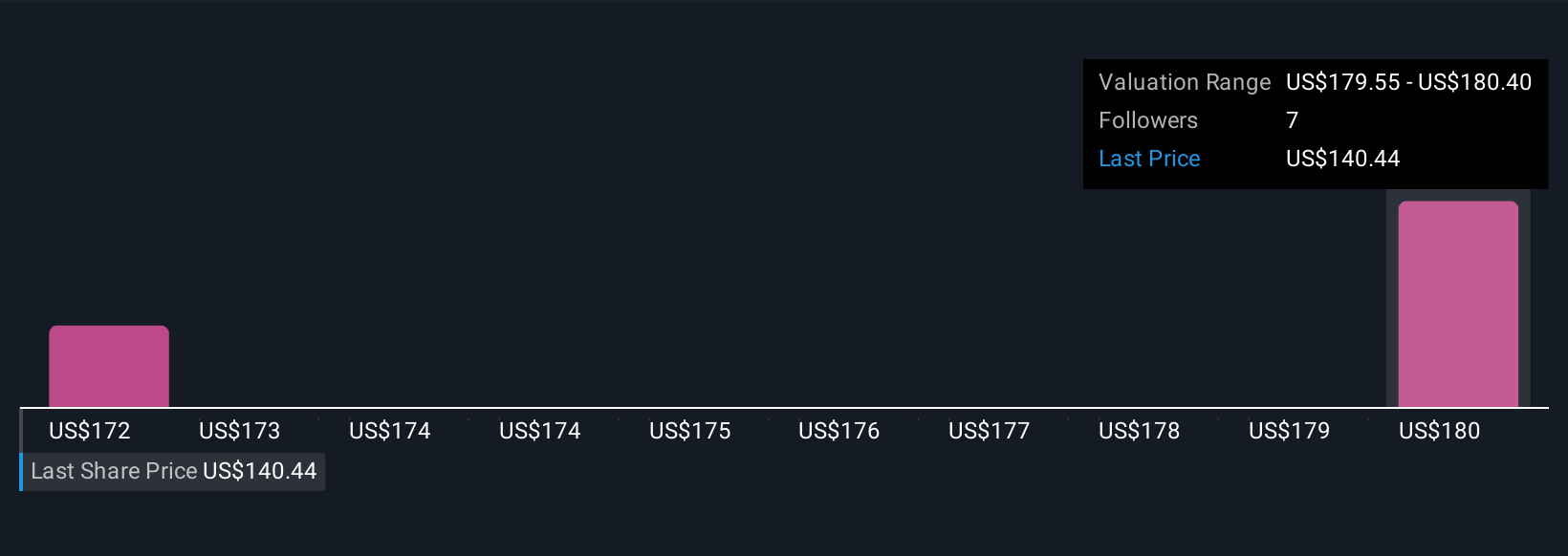

Uncover how Regal Rexnord's forecasts yield a $180.40 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates for Regal Rexnord range from US$175.84 to US$180.40 per share. While views differ, many recognize that the adoption of energy-efficient solutions could have broader implications for future growth, challenge your perspective by exploring these alternative viewpoints.

Explore 2 other fair value estimates on Regal Rexnord - why the stock might be worth just $175.84!

Build Your Own Regal Rexnord Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regal Rexnord research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Regal Rexnord research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regal Rexnord's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RRX

Regal Rexnord

Provides sustainable solutions for power, transmit, and control motion products in the North America, Asia, Europe, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives