- United States

- /

- Electrical

- /

- NYSE:RRX

Regal Rexnord (RRX): Assessing Valuation as Core Business Challenges Raise Growth Questions

Reviewed by Kshitija Bhandaru

Regal Rexnord (RRX) recently landed in the spotlight as challenges with its core business and decreasing earnings per share caught investors’ attention. This has sparked questions about the company’s growth plans and long-term outlook.

See our latest analysis for Regal Rexnord.

Regal Rexnord’s share price has lost ground this year, reflecting weaker sentiment as investors digest declining core performance and softer earnings. The 1-year total shareholder return stands at -19.9%. Despite occasional short-term rallies, broader momentum is fading compared with previous years.

If recent swings in industrial stocks have you rethinking your next move, now is a smart moment to broaden your perspective with fast growing stocks with high insider ownership

With Regal Rexnord trading well below analysts’ price targets but facing real business headwinds, investors now face a crucial question: is there untapped value here, or is the market already factoring in weaker growth ahead?

Most Popular Narrative: 22% Undervalued

With Regal Rexnord’s fair value estimated at $180.4, the recent closing price of $140.44 suggests room for upside if forecasts play out. Investors want to know what’s driving this gap and whether the business can deliver on bullish predictions.

The accelerating adoption of energy-efficient and electrification solutions across industrial and commercial sectors continues to drive incremental demand for high-efficiency motors, subsystem solutions, and customized powertrain products. These are segments where Regal Rexnord is gaining traction, supported by regulatory tailwinds and sustainability initiatives. This positions the company for outsized revenue growth and improved pricing power over the medium and long term.

Want to understand what’s fueling such a big valuation gap? The answer lies in major shifts in long-term revenue and profit expectations. Discover how aggressive growth projections are turning heads and why industry dynamics could create a tipping point for Regal Rexnord’s future share price.

Result: Fair Value of $180.4 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing supply chain issues and weakness in key end markets could present challenges for Regal Rexnord's ability to deliver on these optimistic forecasts.

Find out about the key risks to this Regal Rexnord narrative.

Another View: Is the Market Missing Something?

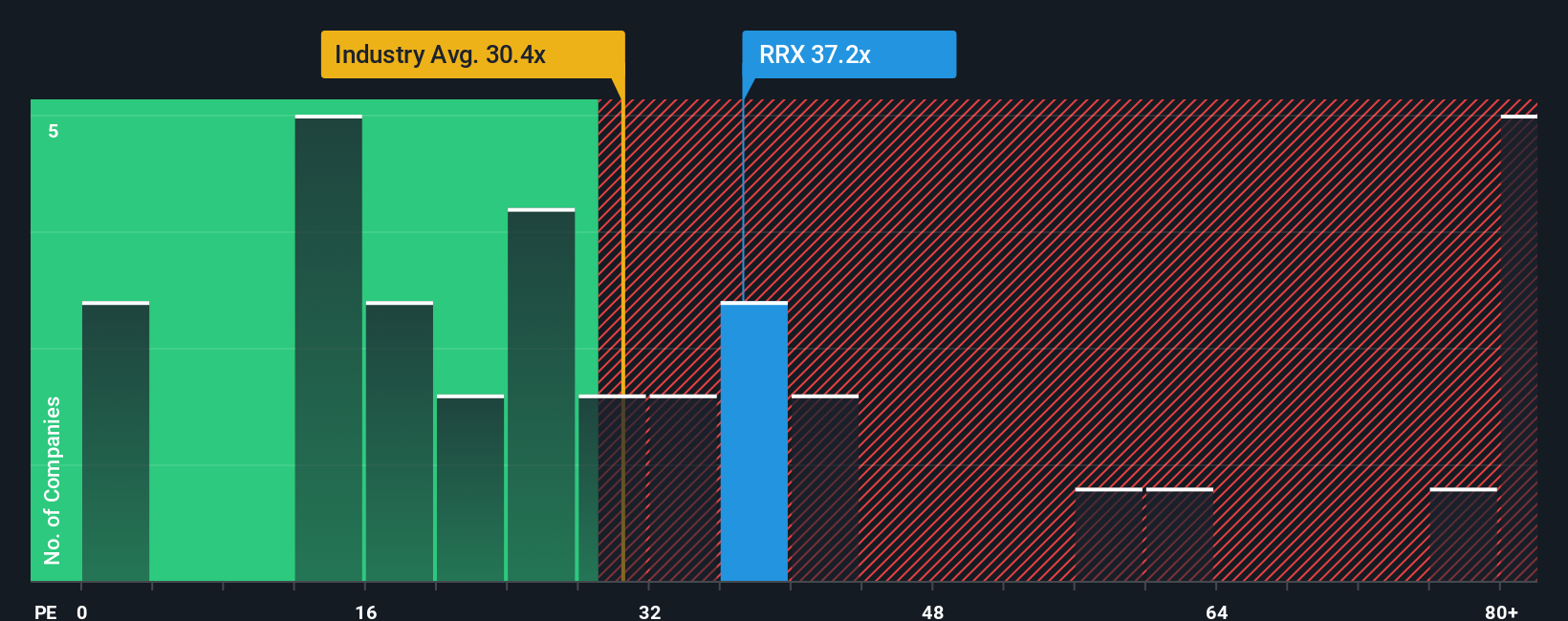

Looking through the lens of earnings multiples, Regal Rexnord trades at a Price-to-Earnings ratio of 37.2x. This is higher than both its industry peers (30.4x) and the peer group average (36.1x). However, it remains below the fair ratio estimate of 47.8x, which the market could eventually approach. This gap signals both upside potential and the risk that high expectations are already baked in. So, are investors paying up for too much future growth, or is there value that others don’t see?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Regal Rexnord Narrative

If you see things differently or want to look deeper into Regal Rexnord’s numbers, why not investigate yourself and shape your own take in just a few minutes with Do it your way.

A great starting point for your Regal Rexnord research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t limit yourself to just one play. With the right tools, you could spot undervalued gems or rising stars before the crowd catches on.

- Tap into earnings power by targeting value stocks others are overlooking with these 878 undervalued stocks based on cash flows.

- Boost your portfolio with consistent income by checking out these 18 dividend stocks with yields > 3%, which offers strong yields over 3%.

- Stay ahead of tech trends by starting with these 24 AI penny stocks to follow companies at the forefront of artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RRX

Regal Rexnord

Provides sustainable solutions for power, transmit, and control motion products in the North America, Asia, Europe, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives