- United States

- /

- Electrical

- /

- NYSE:RRX

Assessing Regal Rexnord’s 2025 Outlook After Shares Slip 6% This Year

Reviewed by Bailey Pemberton

Trying to decide what to do with Regal Rexnord shares? You’re not alone. This stock has given investors plenty to think about over the past few years, bouncing with market shifts but still keeping its long-term uptrend intact. Even as some names in the industrial sector have soared or stumbled, Regal Rexnord’s recent performance has been a little more mixed. Over the past seven days, the stock nudged up by 0.4%, but when you zoom out, the picture looks more complex: down 1.1% in the last month and off by 6.1% year-to-date. One-year returns sit in the red at -12.1%, but step back a few years and you’ll find that it’s still up a sturdy 60.4% over the last five years.

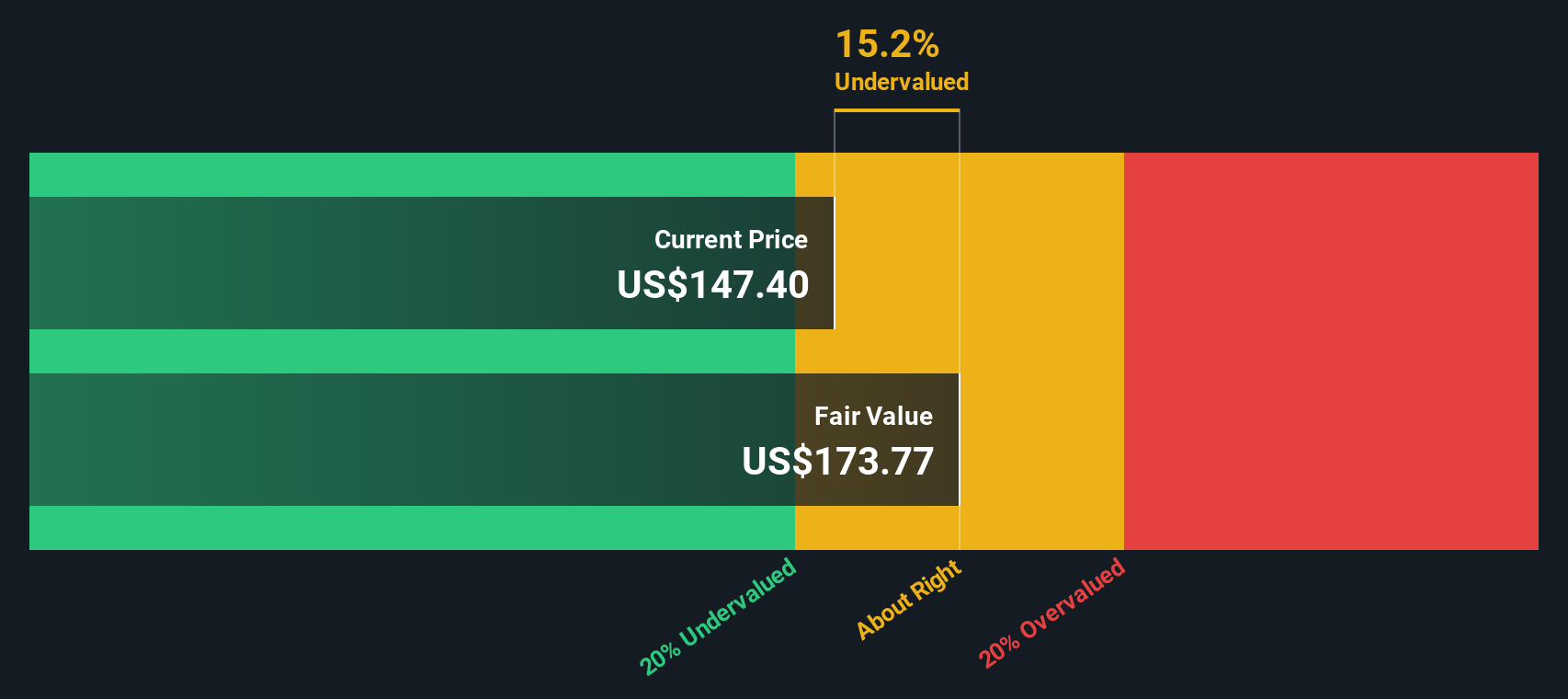

A lot of this ebb and flow can be traced to evolving investor sentiment across the broader industrial space. Changing market dynamics and shifting expectations about economic momentum have played into price movements recently, though no single headline stands out as the clear driver. What’s interesting is that, even with this up-and-down ride, Regal Rexnord sports a valuation score of 3 out of 6, suggesting it screens as undervalued on half of the main criteria analysts use.

So, is this evidence Regal Rexnord is actually a bargain, or could there be more than meets the eye? Let’s look at which valuation methods make the strongest case for the stock’s current price, and see if there’s an even better way to get the full picture by the end of this article.

Why Regal Rexnord is lagging behind its peers

Approach 1: Regal Rexnord Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to today. This gives investors a sense of what the business is truly worth in present terms. This approach is especially useful for companies like Regal Rexnord, where analysts and investors are keenly interested in forecasting financial health over the long term.

For Regal Rexnord, the most recent annual Free Cash Flow (FCF) is $885.9 million, and projections show a steady climb in future years. Analysts estimate FCF to reach approximately $803.7 million in 2026 and $939 million by 2027, with further growth extrapolations by Simply Wall St for the years that follow. Over a 10-year horizon, projected cash flows rise gradually, demonstrating an expectation of consistent, if not spectacular, company performance.

Basing its calculation on a "2 Stage Free Cash Flow to Equity" model, the DCF analysis arrives at an intrinsic value of $177.35 per share for Regal Rexnord. With the stock currently trading at an implied 18.8 percent discount to this intrinsic value, the valuation signals the stock is undervalued by a noteworthy margin.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Regal Rexnord is undervalued by 18.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Regal Rexnord Price vs Earnings

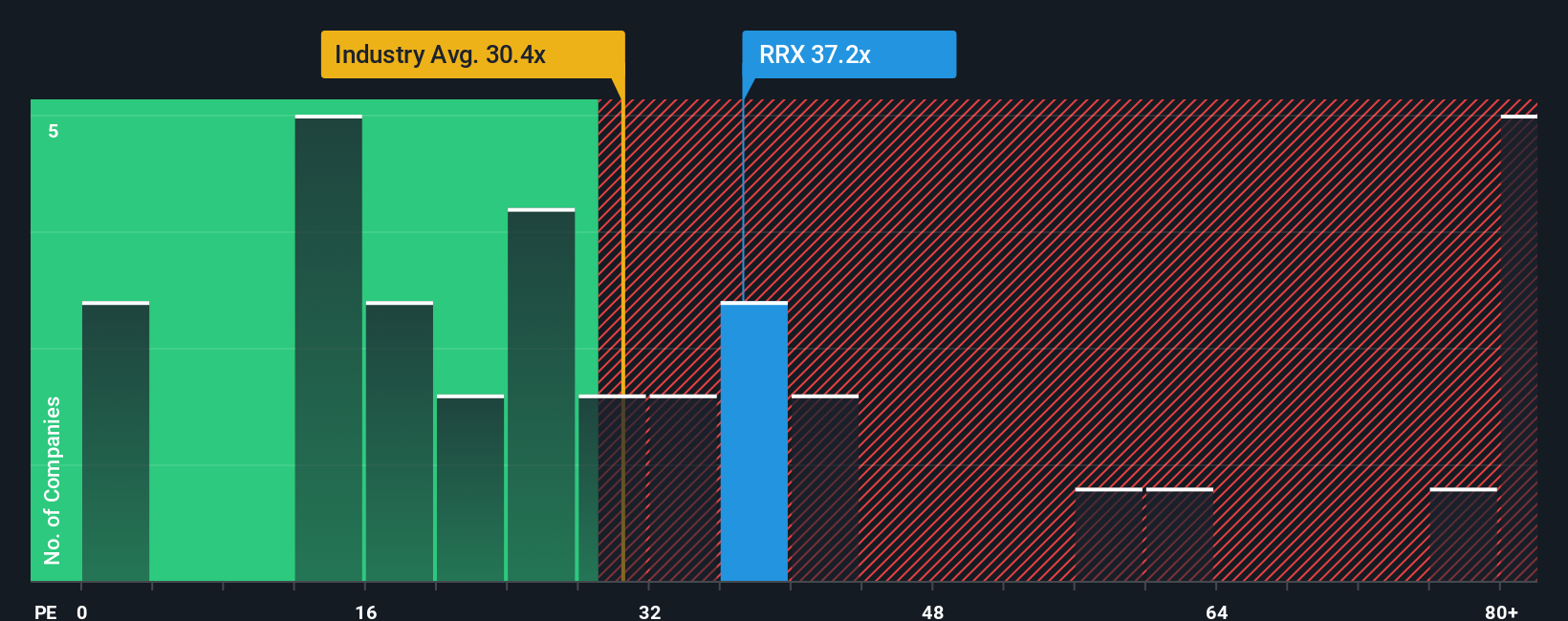

For profitable companies like Regal Rexnord, the Price-to-Earnings (PE) ratio is a popular way to understand whether a stock is fairly valued. The PE ratio compares a company’s share price to its earnings per share, which helps investors see how much they are paying for current profits. Typically, a higher PE can be justified if there are strong growth expectations or the business is seen as lower risk. Lower ratios may point to slower growth or elevated uncertainty.

Regal Rexnord currently trades at a PE multiple of 38.2x. That is noticeably higher than the Electrical industry average of 28.2x and the peer average of 33.8x. At first glance, this might make the stock look a bit expensive compared to its peers and its wider sector, raising questions about whether future growth or defensive qualities justify the premium.

This is where Simply Wall St's proprietary "Fair Ratio" steps in. Unlike standard industry comparisons, the Fair Ratio estimates what Regal Rexnord’s PE should be based on a custom blend of factors like earnings growth, industry trends, profit margins, market cap, and specific company risks. For Regal Rexnord, the Fair Ratio comes out to 49.4x, notably higher than both its actual PE and industry benchmarks.

The difference between Regal Rexnord’s Fair Ratio (49.4x) and its current PE (38.2x) suggests the stock is trading below the level justified by its company-specific prospects and fundamentals. That means even with a premium to peers, the shares could still be considered undervalued when adjusted for the bigger picture.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Regal Rexnord Narrative

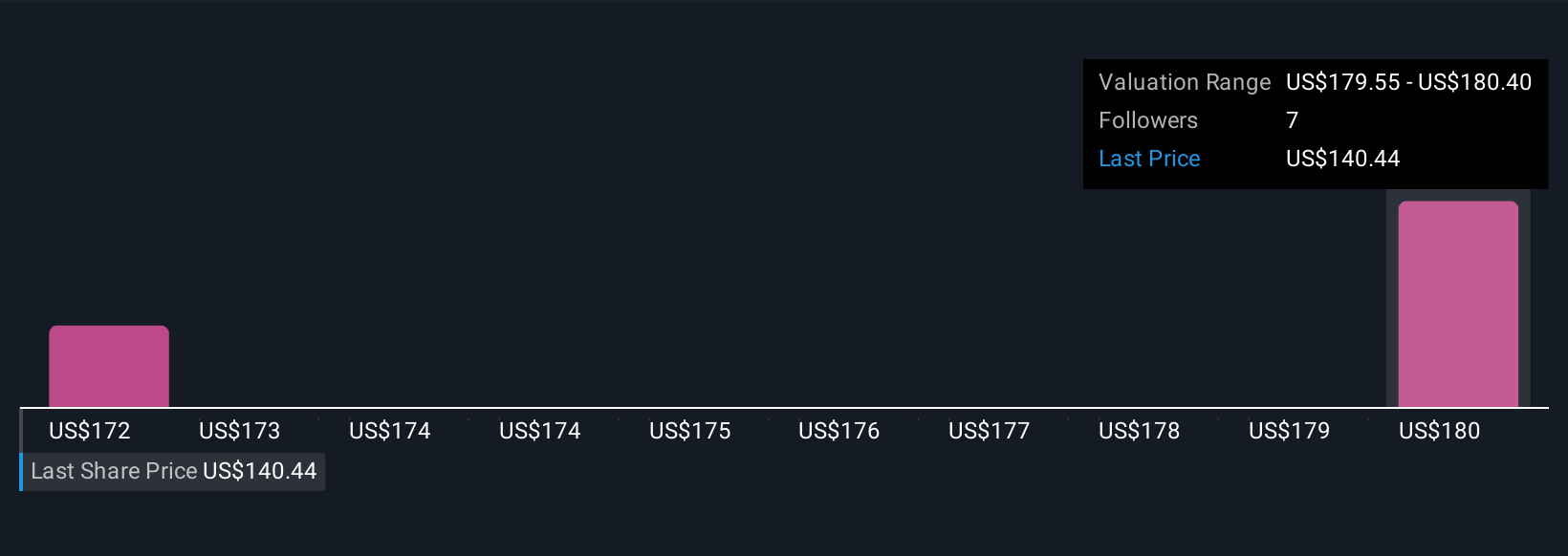

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, yet powerful, tool that lets you connect your own story about a company to the key numbers that drive its value, such as what you believe about future revenue, earnings, margins, and the fair price for the share.

With a Narrative, you can outline why you think Regal Rexnord will perform well, or highlight risks you see on the horizon, then translate those beliefs into a financial forecast and a fair value estimate. Narratives are not just for experts, either. They are easy to use, available right within Simply Wall St's Community page, and relied upon by millions of investors globally.

Armed with your Narrative, you can quickly see if your fair value is above or below today's price, making it easier to decide whether now is the right time to buy, sell, or hold. Plus, Narratives adapt dynamically each time fresh news or new company results are released, so your perspective always reflects the latest information.

For Regal Rexnord, for example, some investors see strong long-term value and set fair values as high as $204.0, while others take a more cautious approach with estimates as low as $163.0. This demonstrates how Narratives help tailor investment decisions to your unique outlook.

Do you think there's more to the story for Regal Rexnord? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RRX

Regal Rexnord

Provides sustainable solutions for power, transmit, and control motion products in the North America, Asia, Europe, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives