- United States

- /

- Electrical

- /

- NYSE:ROK

Rockwell Automation (ROK): Evaluating Valuation as Sustainability Partnerships and Analyst Support Fuel Investor Optimism

Reviewed by Kshitija Bhandaru

Rockwell Automation (ROK) shares have been gaining on a wave of positive sentiment. Investors are focusing on the company’s expanded sustainability partnerships and ongoing analyst support, which together highlight its growth potential in the evolving industrial technology sector.

See our latest analysis for Rockwell Automation.

The momentum behind Rockwell Automation’s shares seems to be building, as excitement over expanded sustainability partnerships and key leadership appointments is helping to offset last year’s earnings dip. Investors have taken note of the company’s resilience and long-term growth prospects, which is reflected in a strong 1-year total shareholder return and renewed confidence ahead of the upcoming investor meeting.

If the focus on industrial transformation interests you, it is worth taking the next step to explore fresh opportunities in automation with our See the full list for free.

But with Rockwell Automation shares trading near analysts’ price targets after a strong run, the real question is whether there is still room for upside or if the market is already factoring in that anticipated growth.

Most Popular Narrative: Fairly Valued

With Rockwell Automation trading just below its widely followed consensus fair value, the current price suggests investors and analysts are largely on the same page. The stage is set as future growth assumptions take center spotlight in the debate over the company’s premium valuation.

Substantial investment, $2 billion over the next 5 years, in plants, digital infrastructure, and talent is aimed at building competitive capacity, operational efficiency, and supporting higher-margin growth areas. This lays the groundwork for future margin expansion and long-term EPS growth. Sustained megatrends such as reshoring and nearshoring, along with manufacturing supply chain diversification—especially in North America and Europe where Rockwell is strong—are leading to increased new capacity orders. This is expected to improve order intake and drive revenue visibility in coming years.

Want to peek behind the curtain of this fair valuation? The narrative’s credibility pivots on forecasts for rising recurring revenue and expanding profit margins. The numbers behind these bullish assumptions are anything but ordinary. Curious what really underpins the target price? Take a look at what’s driving these confident projections; there are bold financial bets you won’t want to miss.

Result: Fair Value of $350.5 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing delays in large customer CapEx projects and elevated geopolitical risk could quickly challenge these bullish margin and growth assumptions for Rockwell Automation.

Find out about the key risks to this Rockwell Automation narrative.

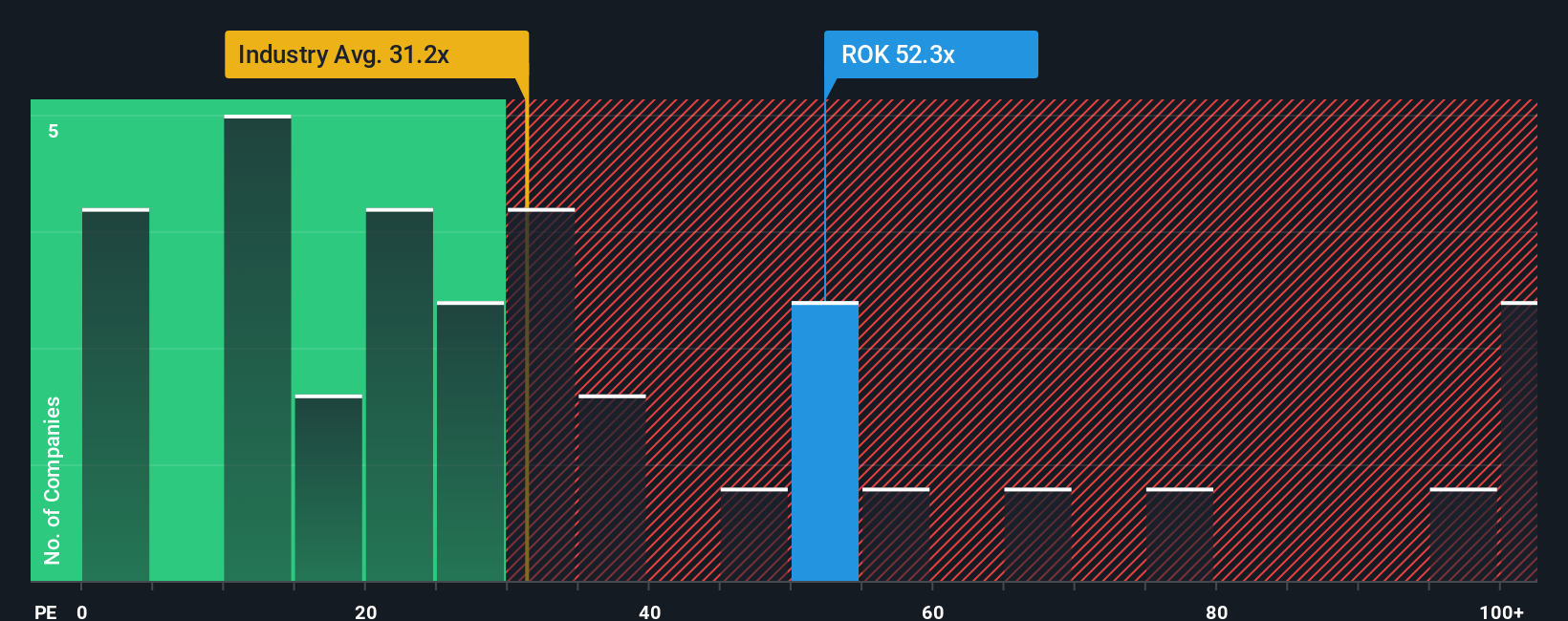

Another View: Multiple-Based Valuation Signals Caution

When comparing Rockwell Automation’s current price-to-earnings ratio of 40.6x to the US Electrical industry average of 29.4x and its own fair ratio of 30.6x, it is clear the shares are priced at a significant premium. That sizable gap could leave investors exposed if market momentum shifts. What happens if sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rockwell Automation Narrative

If you have a different perspective or would rather dig into the numbers on your terms, you can craft your own narrative in just a few minutes with Do it your way

A great starting point for your Rockwell Automation research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Open the door to your next potential winner right now. Let yourself be the first to spot what others might overlook by using these smart tools:

- Tap into overlooked potential by checking out these 3563 penny stocks with strong financials that are primed for strong financial performance and surprising resilience.

- Capture the future of healthcare by exploring these 31 healthcare AI stocks where technology transforms patient outcomes and boosts sector growth.

- Seize the chance to find value gems before the crowd by reviewing these 900 undervalued stocks based on cash flows that are poised for powerful cash flow-driven gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROK

Rockwell Automation

Provides industrial automation and digital transformation solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives