- United States

- /

- Electrical

- /

- NYSE:ROK

Can Rockwell’s Strong 24% Rally in 2025 Keep Up After Digital Manufacturing Surge?

Reviewed by Bailey Pemberton

If you are following Rockwell Automation, you have probably noticed the stock’s steady climb this year. It closed at $349.4 recently, up 1.4% over the past week, 2.8% for the month, and an impressive 24.4% year-to-date. For long-haul investors, those gains compound to more than 33% over the past year and over 56% in five years. These are definitely numbers that demand a closer look.

What’s driving this momentum? Much of the action seems to be shaped by growing confidence in factory automation and industrial technology. Recent market developments, such as increased investment in digital manufacturing, have raised both the profile and perceived stability of companies like Rockwell Automation. With so much buzz around automation reshaping global supply chains, it is no surprise to see the market rewarding those with a clear technological edge.

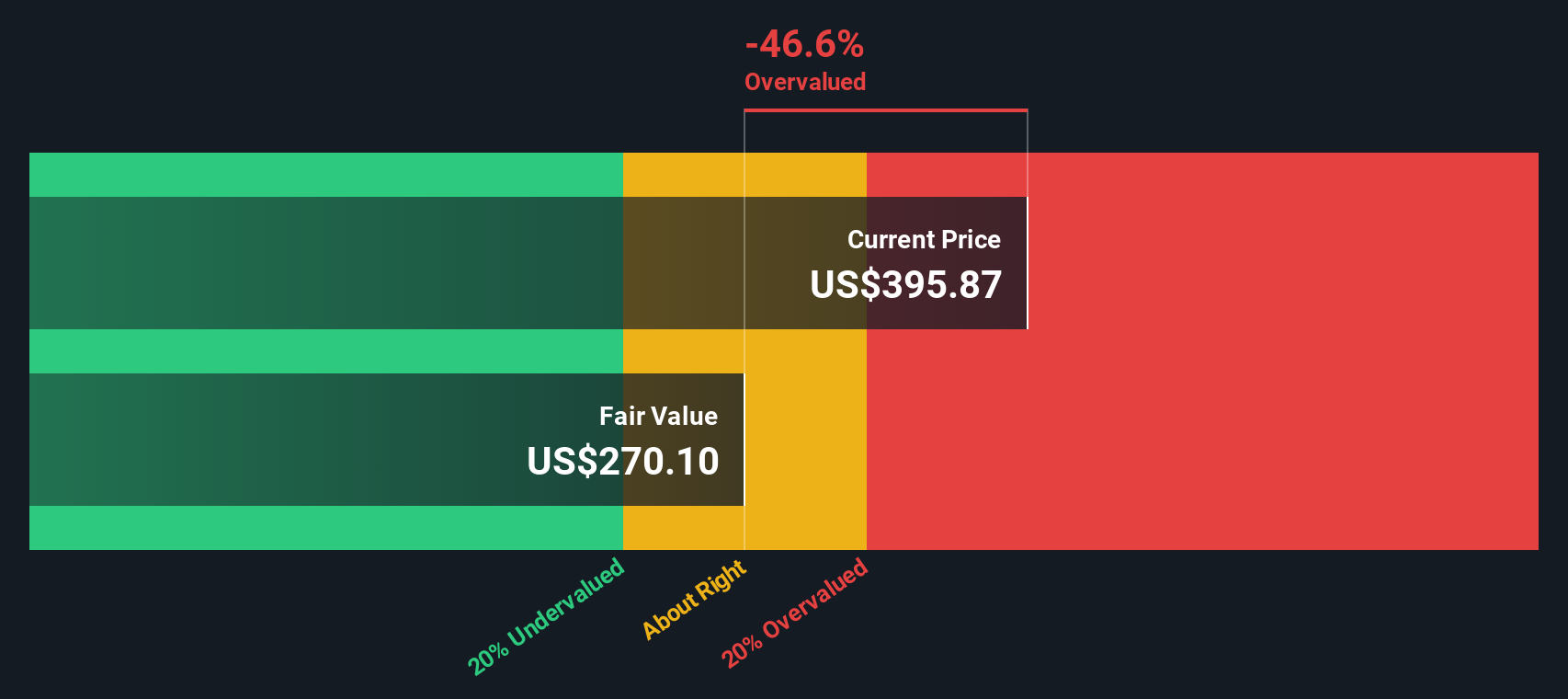

But the question remains: do these price levels reflect Rockwell Automation’s true value, or is there room for further growth? To get a clearer answer, it helps to turn to the numbers. On a strict valuation basis, Rockwell scores just a 1 out of 6 when it comes to being undervalued. That might give value-focused investors pause, but it is only part of the story.

Let’s dive into the main valuation methods used for companies like Rockwell Automation and see how this current score stacks up. Plus, I will share an often-overlooked way to gauge valuation that could put everything in perspective.

Rockwell Automation scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Rockwell Automation Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future cash flows and then discounting those amounts back to today’s dollars. This allows investors to compare Rockwell Automation’s actual share price with what its stream of future earnings may truly be worth.

Currently, Rockwell Automation generates Free Cash Flow (FCF) of about $1.34 billion. Analysts provide detailed FCF forecasts for the next five years, and Simply Wall St extrapolates further projections up to ten years. Those forecasts predict FCF will increase to roughly $2.0 billion by 2035, reflecting steady growth year over year.

After discounting all of these expected cash flows to the current dollar value, the DCF calculation arrives at an intrinsic value for Rockwell Automation of $217.74 per share. With the current market price sitting near $349.40, the DCF suggests the stock is about 60.5% overvalued using this methodology.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rockwell Automation may be overvalued by 60.5%. Find undervalued stocks or create your own screener to find better value opportunities.

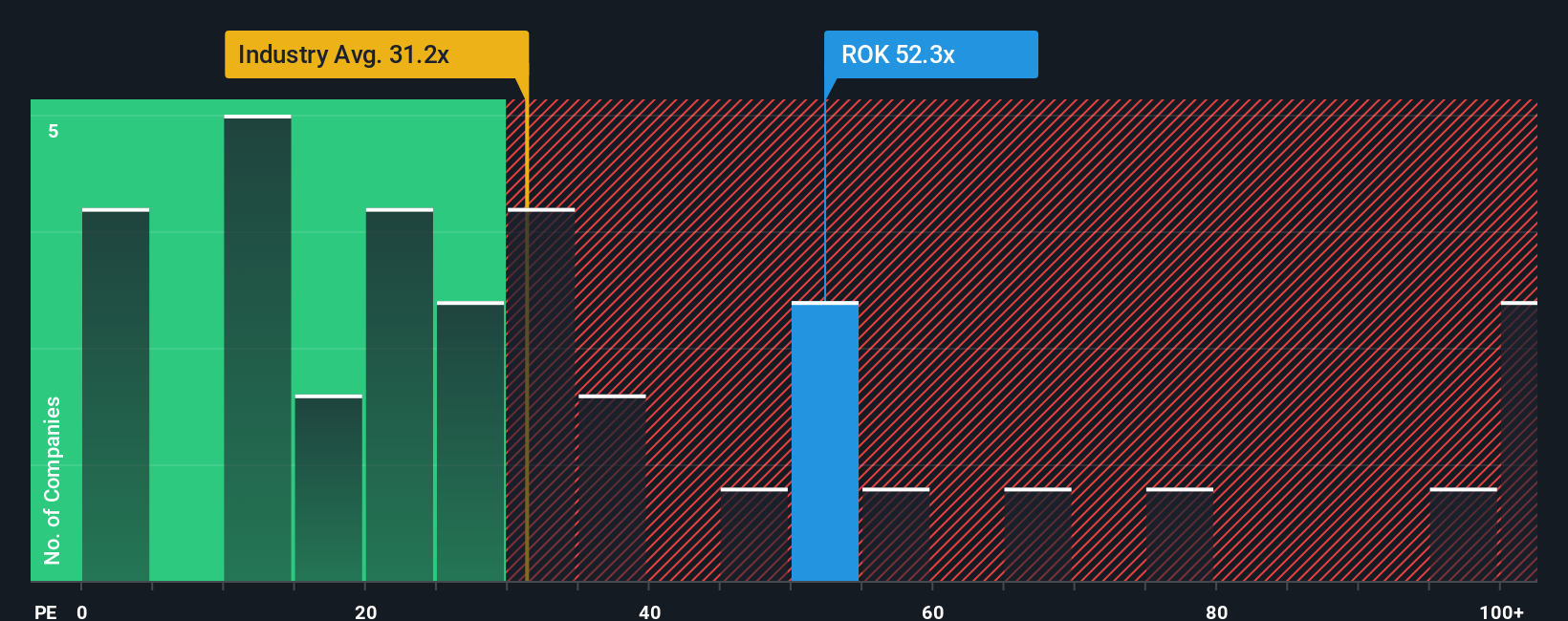

Approach 2: Rockwell Automation Price vs Earnings

For profitable companies like Rockwell Automation, the Price-to-Earnings (PE) ratio stands out as a widely used and effective valuation metric. The PE ratio tells investors how much they are paying for each dollar of earnings, serving as a quick check on how the market values the company’s profit potential.

Interpreting what counts as a “normal” or “fair” PE ratio depends on two main factors: expected earnings growth and associated risks. Companies with higher growth prospects or more stable earnings typically trade at higher PE multiples, while those with lower growth or higher risks trade at discounted multiples.

Currently, Rockwell Automation’s PE ratio sits at 40.7x, close to its peer group’s average of 41.4x and significantly above the electrical industry’s average of 28.8x. However, purely comparing to peers or industry averages can miss important context. Simply Wall St’s Fair Ratio offers a more tailored benchmark for Rockwell Automation by factoring in not just growth and profit margin, but also the company’s risk profile, market cap, and industry trends. In Rockwell’s case, its Fair Ratio is calculated at 30.6x. This means the stock is trading well above the level justified by its unique fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rockwell Automation Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are a tool that allows you to define your own story for a company, linking your view of Rockwell Automation’s future, such as expected revenue growth, profit margins, and risks, to a concrete financial forecast. This then calculates a fair value you can easily compare with today’s share price.

Rather than relying solely on traditional ratios or analyst targets, Narratives let investors express their specific outlook on the company from within Simply Wall St’s Community page, which is used by millions of investors. By connecting numbers with your perspective, you create a dynamic valuation that adapts as news or earnings are released. Narratives update automatically, so your estimate always reflects the latest information.

This makes it simple for anyone to decide whether Rockwell Automation is attractive at the current price. For example, bullish investors believe Rockwell’s strong automation demand and digital expansion justify a price target as high as $410, while more cautious users see risks from global spending delays and set their Narrative’s fair value at just $229. Whatever your view, Narratives help you invest with clarity and confidence.

Do you think there's more to the story for Rockwell Automation? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROK

Rockwell Automation

Provides industrial automation and digital transformation solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives