- United States

- /

- Building

- /

- NYSE:REZI

Is Now the Right Time to Reevaluate Resideo After Its Smart Home Partnership?

Reviewed by Bailey Pemberton

- Ever wondered if Resideo Technologies might be a hidden value opportunity or if the hype is getting ahead of itself? You are in the right place to find out how the numbers stack up.

- Resideo’s stock has certainly kept investors on their toes lately, jumping 10.7% over the past week despite a wild 24.4% pullback in the last month. It is still sitting on an impressive 45.0% gain year-to-date.

- Much of this recent price action comes in the wake of Resideo's announcement of a multi-year partnership in the smart home space, as well as ongoing speculation about potential strategic acquisitions. Industry chatter suggests these moves could be catalysts for a new phase of growth or bring fresh risks, depending on how the strategy plays out.

- If you are curious about the company’s underlying value, Resideo scores a 5 out of 6 on our undervaluation checks, so the valuation story is clearly intriguing. Let's break down the standard ways to look at value and preview a more insightful approach that may change the way you see Resideo’s prospects by the end of this article.

Approach 1: Resideo Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation method that estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to today's dollars. For Resideo Technologies, this method considers projections of free cash flow over the next decade, carefully adjusting those future amounts to reflect their value today.

Currently, Resideo reports a trailing twelve months free cash flow of -$1,349 million, highlighting recent pressure on operations. However, projections anticipate a strong turnaround, with analysts forecasting free cash flows to reach $394 million by 2027. Looking even further, Simply Wall St extrapolates this growth and expects free cash flow to climb steadily to around $598 million by 2035.

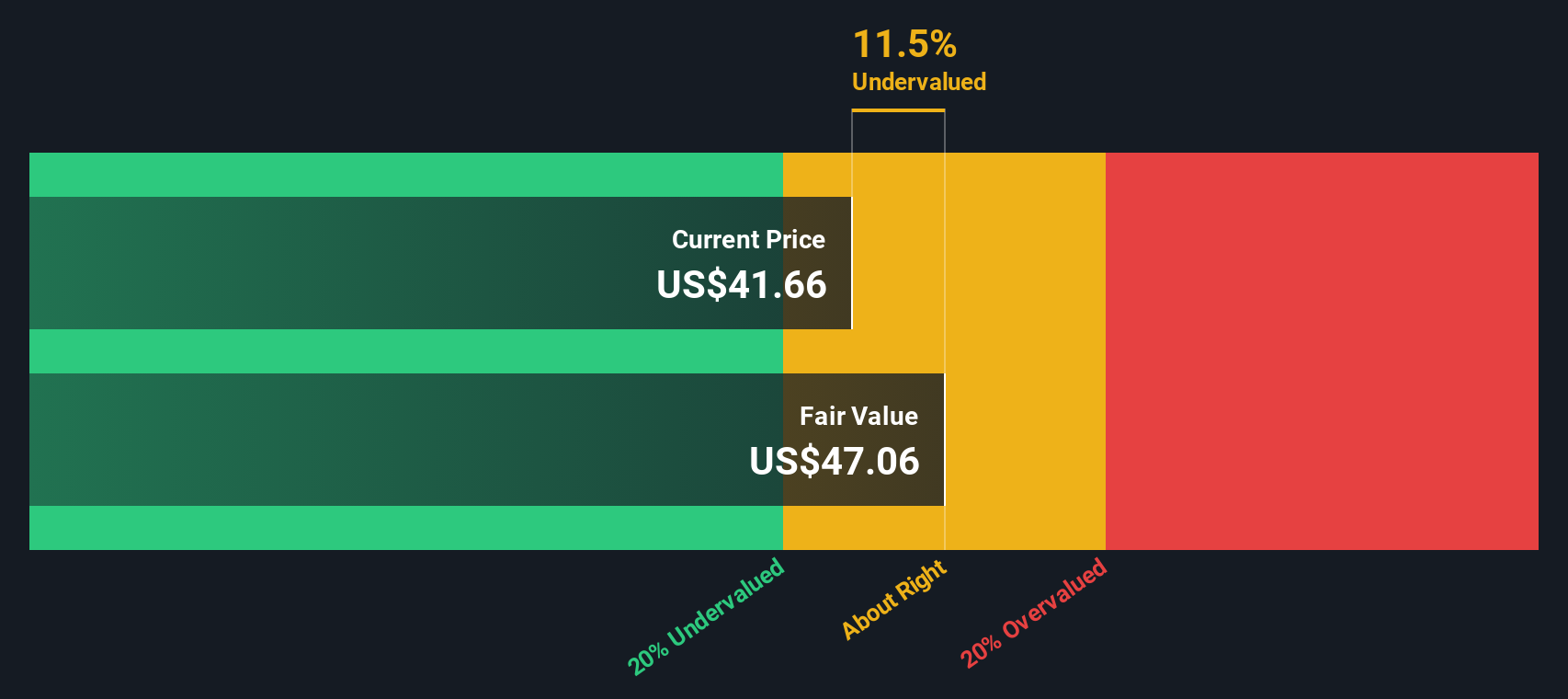

Based on these cash flow forecasts and applying the DCF technique, the estimated intrinsic value per share is $41.33. This result indicates that Resideo Technologies is trading at about a 20.1% discount compared to its fair value, which suggests considerable upside potential for investors if projections are realized.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Resideo Technologies is undervalued by 20.1%. Track this in your watchlist or portfolio, or discover 924 more undervalued stocks based on cash flows.

Approach 2: Resideo Technologies Price vs Sales

The Price-to-Sales (P/S) ratio is a favored valuation metric, especially when companies may not yet be highly profitable but generate substantial revenue. For companies like Resideo Technologies, which have fluctuating earnings due to recent operating pressures, the P/S ratio can provide a clearer signal of value by focusing on sales rather than bottom-line profitability.

Growth expectations and risk play central roles in what qualifies as a “normal” or “fair” P/S ratio. Investors are typically willing to pay a higher multiple for businesses with strong sales growth and predictable financial performance. Riskier or slower-growing firms tend to trade at lower multiples.

At the moment, Resideo trades at a P/S ratio of 0.66x. For comparison, the average P/S ratio of its industry peers stands at 3.07x, with the broader Building industry averaging 1.38x. These figures suggest that Resideo’s stock is priced below both its direct peers and the wider industry group.

Simply Wall St introduces the concept of a “Fair Ratio,” which for Resideo stands at 1.60x. The Fair Ratio goes beyond simple benchmarks by factoring in company-specific elements such as forecast growth, profit margins, risk profile, market cap, and its place in the overall industry. This comprehensive perspective delivers a tailored benchmark and offers a more accurate assessment of valuation than peer or industry averages alone.

Comparing the Fair Ratio of 1.60x with Resideo’s actual P/S of 0.66x shows the company is trading meaningfully below where it should be, even after accounting for its unique characteristics and risks. This points to the stock being undervalued according to this model.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1438 companies where insiders are betting big on explosive growth.

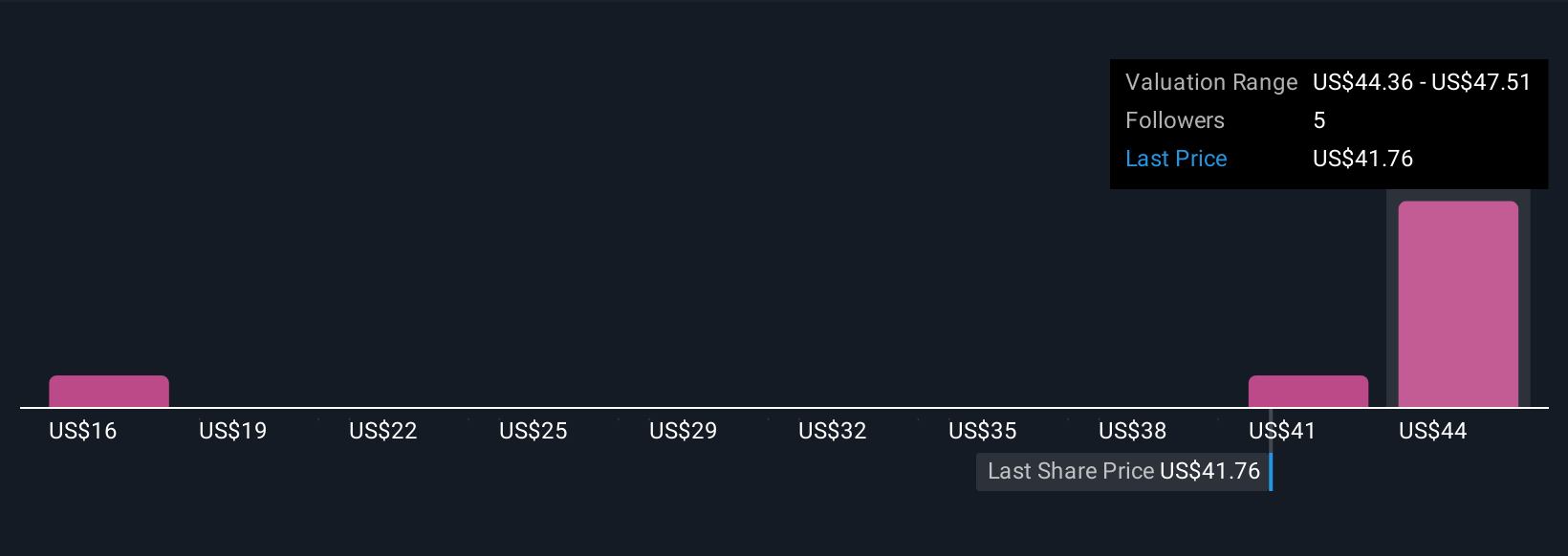

Upgrade Your Decision Making: Choose your Resideo Technologies Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your chance to tell the story behind Resideo Technologies' numbers, combining your perspective on its future revenue, earnings, margins, and fair value into a view that fits your understanding of the company's next chapter.

Narratives link a company’s story to a custom financial forecast and fair value estimate, allowing you to see how your outlook compares with others. On Simply Wall St’s Community page, millions of investors use Narratives as an accessible tool to capture their investment case and instantly compare fair value to the current price, helping them decide when to buy or sell.

What makes Narratives powerful is their dynamic nature: as news breaks or earnings are released, your fair value and supporting figures update automatically based on the information you’ve used. For example, some Resideo investors forecast robust growth from smart home adoption and strategic partnerships, leading them to set a bullish fair value as high as $41.50. Others focus on competition and margin pressures, resulting in more cautious estimates around $35.00.

Do you think there's more to the story for Resideo Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:REZI

Resideo Technologies

Develops, manufactures, sells, and distributes comfort, energy management, and safety and security solutions in the United States, Europe, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.