- United States

- /

- Building

- /

- NYSE:REZI

Can Resideo Technologies' (REZI) Revenue Optimism Offset Concerns Raised by Its Recent Net Loss?

Reviewed by Simply Wall St

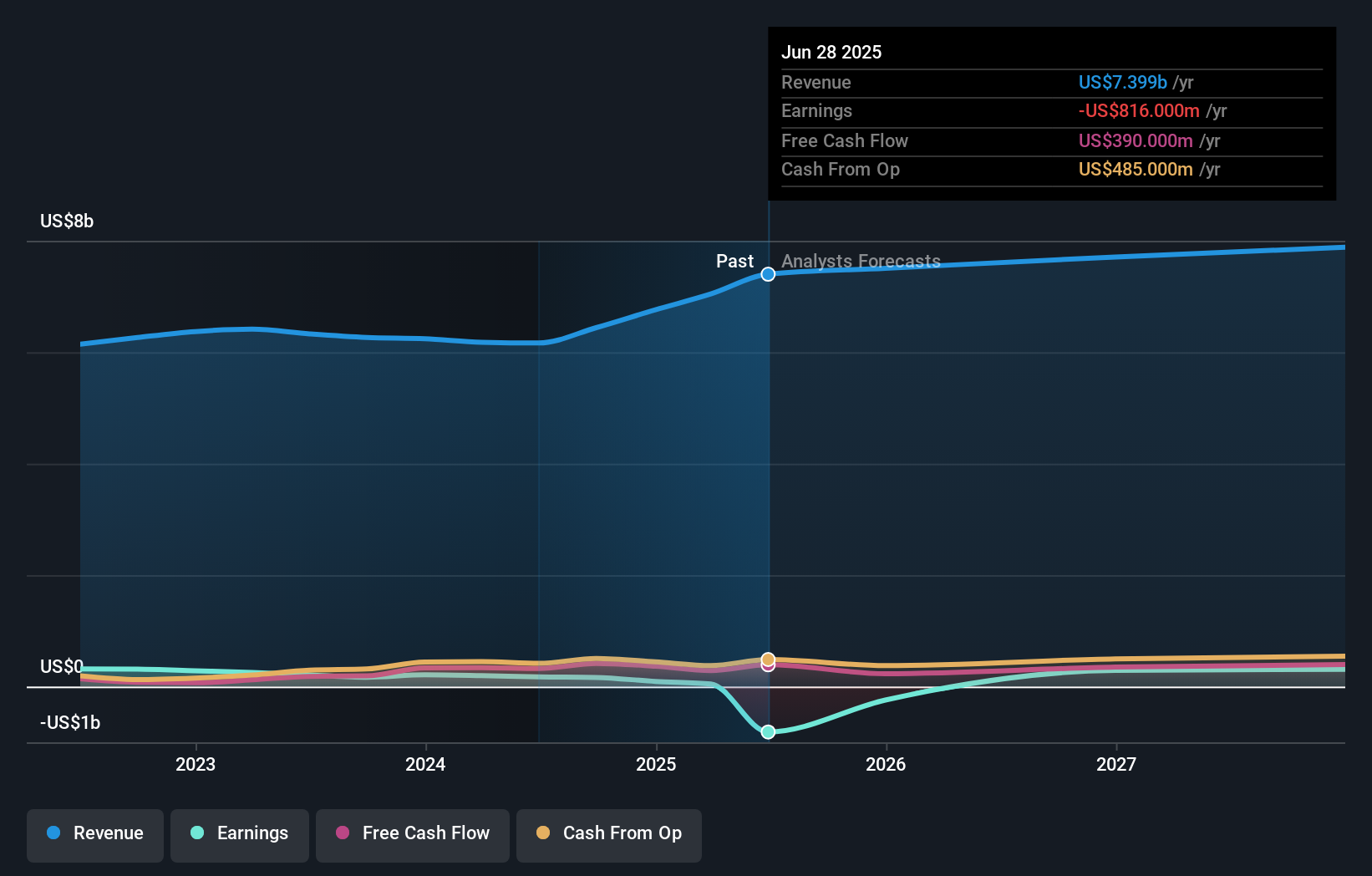

- Earlier this month, Resideo Technologies reported second quarter 2025 results showing net sales of US$1.94 billion with a net loss of US$825 million, and raised its full-year revenue guidance to US$7.45–7.55 billion.

- This combination of higher sales alongside a significant net loss, coupled with an improved outlook for annual revenue, points to both operational challenges and management’s confidence in sustained top-line momentum.

- We'll examine how the sharp swing to a net loss impacts Resideo’s investment narrative amid its raised full-year revenue forecast.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Resideo Technologies Investment Narrative Recap

Being a Resideo Technologies shareholder today means believing the company can turn robust revenue growth into lasting profitability, even as it confronts operational turbulence and transformation in smart home technology. The recent Q2 net loss of US$825 million, despite higher sales and a raised annual outlook, brings the risk of further earnings volatility to the forefront, potentially challenging confidence in management’s turnaround strategy. This event adds fresh urgency to the question of whether near-term profitability is achievable, or delayed by persistent market headwinds, without materially changing the core investment catalyst of new product adoption.

Of the recent announcements, the company’s decision to raise its full-year revenue guidance to US$7.45–7.55 billion stands out as particularly relevant. While this signals continued strength in sales and optimism from leadership, it must be weighed against the sharp swing to losses, especially with competitive pressures and innovation lag from legacy product lines lingering as big-picture risks.

By contrast, while revenue momentum is positive, the scale of the loss highlights an earnings risk investors should be aware of if...

Read the full narrative on Resideo Technologies (it's free!)

Resideo Technologies' narrative projects $8.0 billion revenue and $641.6 million earnings by 2028. This requires 2.6% yearly revenue growth and a $1,457.6 million increase in earnings from the current $-816.0 million.

Uncover how Resideo Technologies' forecasts yield a $35.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted fair value estimates for Resideo Technologies ranging from US$16.02 to US$45.15, across three distinct perspectives. With new product launches a leading catalyst, these diverse outlooks reflect differing views on the company’s ability to convert sales growth into future profitability and resilience, highlighting that your assessment of potential will depend on the priorities you bring to the table.

Explore 3 other fair value estimates on Resideo Technologies - why the stock might be worth as much as 42% more than the current price!

Build Your Own Resideo Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Resideo Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Resideo Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Resideo Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:REZI

Resideo Technologies

Develops, manufactures, sells, and distributes comfort, energy management, and safety and security solutions in the United States, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives