- United States

- /

- Machinery

- /

- NYSE:REVG

REV Group (REVG): Gauging Valuation After Strong RV Sales and New Model Launches

Reviewed by Kshitija Bhandaru

REV Group’s Recreational Vehicles segment enjoyed a boost at two industry shows after unveiling both the triple-slide Valencia and a refreshed Vienna model. These models drew strong attendee interest and led to higher sales compared to last year.

See our latest analysis for REV Group.

Investor enthusiasm has been building around REV Group, as momentum from the successful RV launches appears to be fueling the stock’s rally. With a 1-year share price return of 86.75% and an impressive 107.07% total shareholder return over the past year, sentiment is clearly strong. The longer-term picture also appears positive, with a five-year total return north of 790%.

If the buzz from REV’s big year has you wondering what else is on the move, now’s a great time to discover See the full list for free.

Yet with shares surging nearly 87% over the past year, the key question for investors now is whether REV Group remains undervalued or if the market is already factoring in future growth, which may leave limited room for upside.

Most Popular Narrative: 9.6% Undervalued

With the narrative fair value at $65.75 and REV Group closing last at $59.46, market optimism trails analysts’ conviction. Here is what the most-followed narrative sees as a driving force for REV’s future opportunities.

Continued operational investments, such as the Spartan Emergency Response facility expansion, enhance production capacity and efficiency, positioning REV Group to capitalize on sustained municipal demand for fire and emergency vehicles as aging fleets require replacement, supporting long-term revenue growth and scale-driven margin improvements.

Want to know how much future growth, margin expansion, and a lower profit multiple unlock this higher fair value? The narrative hints at a massive turnaround driven by operational shifts and big leaps in future earnings. Which bold financial assumptions are key? The details might surprise you. Explore what is really powering the calculation.

Result: Fair Value of $65.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation or a slowdown in municipal budgets could easily derail these bullish expectations. This may make future gains less certain.

Find out about the key risks to this REV Group narrative.

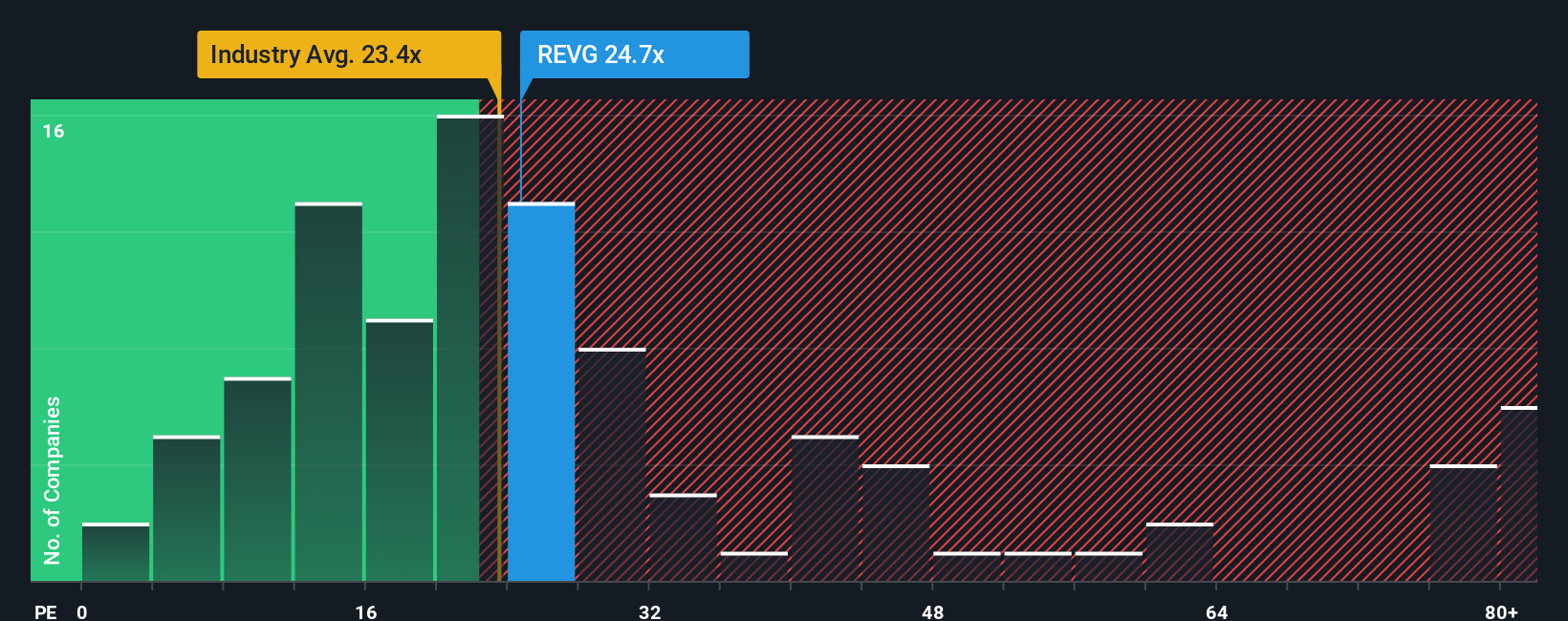

Another View: The Multiples Debate

Looking at valuation from a different angle, REV Group’s price-to-earnings ratio currently sits at 26.9x, which is well above both its peer average of 16.7x and the broader US Machinery industry standard of 24.1x. The fair ratio, which the market could eventually trend toward, stands even higher at 33.4x. This discrepancy signals a meaningful valuation gap and raises the possibility of risk if sentiment shifts or opportunity if the business delivers. What does this divergence say about the company’s future pricing power?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own REV Group Narrative

If you see things differently or prefer hands-on analysis, you can dive in and build your own take on REV Group’s story in under three minutes. Do it your way

A great starting point for your REV Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your next smart move by checking out top investment themes. The right opportunities are waiting, but only if you take action now.

- Unlock passive income streams with attractive yields by tapping into these 17 dividend stocks with yields > 3% yielding over 3% and see how dividends can accelerate portfolio growth.

- Capture tomorrow’s breakthroughs by targeting market disruptors with these 24 AI penny stocks that are poised to ride the unstoppable wave of artificial intelligence innovation.

- Position yourself ahead of the crowd and spot value plays among these 873 undervalued stocks based on cash flows to identify stocks trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:REVG

REV Group

Designs, manufactures, and distributes specialty vehicles, and related aftermarket parts and services in North America and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives