- United States

- /

- Machinery

- /

- NYSE:REVG

REV Group (REVG): Evaluating Valuation Following Spartan Facility Expansion and $20 Million Investment

Reviewed by Simply Wall St

REV Group (REVG) recently made headlines with the groundbreaking of its expanded Spartan Emergency Response facility. Supported by a $20 million investment and state government backing, this initiative is designed to increase production capacity by 40% for their fire truck business. The expansion reflects a significant effort to meet demand, accelerate deliveries, and improve efficiencies, while also bringing new jobs and benefits to the local community.

Investors are watching closely to see what this means for REV Group’s stock, which has risen 72% over the past year and 64% year-to-date. Momentum has increased in the past three months, with the expansion announcement following a series of earnings beats and positive growth updates. While revenue and profits are trending upward, the market appears to be reassessing both risk and long-term prospects in light of this recent development.

After such a strong performance, the question remains whether the facility expansion signals further potential, or if the recent optimism around REV Group is already priced in.

Most Popular Narrative: 3.9% Overvalued

According to community narrative, REV Group is currently seen as slightly overvalued compared to its fair value estimate based on projected earnings growth, expected margins, and key business trends.

The company is well-positioned to benefit from favorable macroeconomic trends, such as population growth and increasing demand for emergency and recreational vehicles, which can drive future revenue growth. Strong backlog within the Specialty Vehicles segment, providing 2 to 2.5 years of demand visibility, offers confidence in achieving financial targets. This supports future revenue stability and potential increases in net margins.

Curious about what is really fueling REV Group’s lofty valuation? Discover why their financial forecast hinges on aggressive performance gains and multiple tailwinds that the market might be underestimating. What financial assumptions are hiding beneath these bold price targets? The secret sauce to this valuation could surprise you. Keep reading to unlock the full story behind these numbers.

Result: Fair Value of $50.33 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in RV demand or lingering inflation could quickly undermine confidence in REV Group’s projected growth and margins.

Find out about the key risks to this REV Group narrative.Another View: What Does the DCF Say?

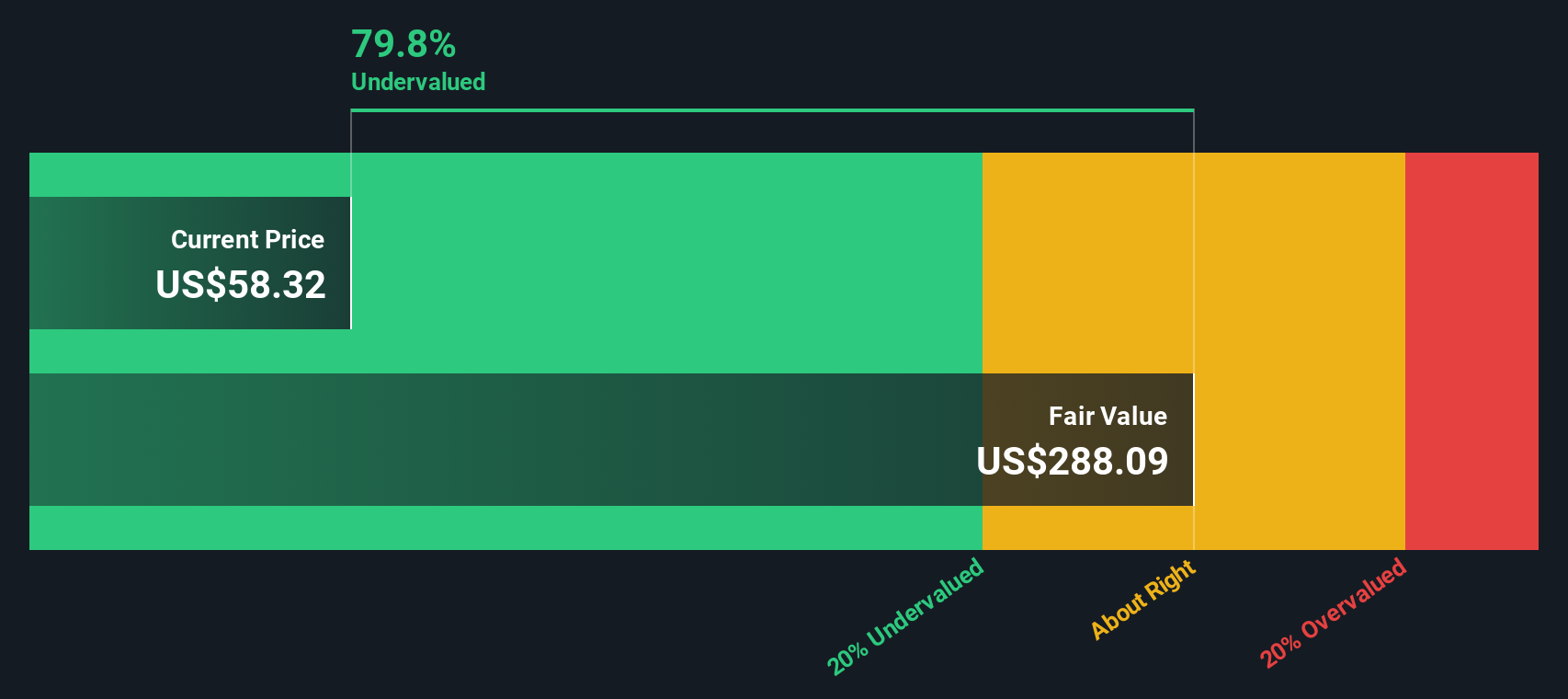

Looking at REV Group through the SWS DCF model changes the story. This approach sees the stock as undervalued, challenging the community’s current skepticism. Which method better captures the company’s true opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own REV Group Narrative

If you have your own perspective, or want to dive deeper into the numbers, you can craft and share your unique take in just minutes. do it your way.

A great starting point for your REV Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that opportunity rarely knocks twice. Stay ahead of the pack and give your portfolio an edge by checking out handpicked strategies below. Each one unlocks a unique pool of stocks that could transform your returns sooner than you think. Do not let new possibilities pass you by.

- Capitalize on the growth of artificial intelligence by uncovering innovative companies at the forefront through AI penny stocks.

- Maximize your yield potential as you pinpoint companies offering robust pay-outs using dividend stocks with yields > 3%.

- Strengthen your portfolio’s stability and future prospects by zeroing in on healthcare pioneers harnessing AI with healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:REVG

REV Group

Designs, manufactures, and distributes specialty vehicles, and related aftermarket parts and services in North America and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives