- United States

- /

- Aerospace & Defense

- /

- NYSE:RDW

Will Redwire’s (RDW) Leadership Shuffle and New Drone Partnership Reshape Its Defense Ambitions?

Reviewed by Sasha Jovanovic

- Earlier this month, Redwire Corporation announced a board reshuffle with the immediate resignation of John Bolton and the appointment of General (RET) James McConville and Dorothy D. Hayes, as well as the upcoming retirement of CFO Jonathan Baliff and the transition to Chris Edmunds as his successor.

- Additionally, Redwire’s subsidiary Edge Autonomy has partnered with Red Cat to integrate Teal’s Black Widow drone with Edge’s Stalker platform, targeting U.S. Army surveillance and reconnaissance needs and highlighting the company’s expanding role in defense technology solutions.

- With Redwire’s Edge Autonomy forging a partnership to enhance military drone capabilities, we'll explore how this collaboration informs the company's investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Redwire Investment Narrative Recap

Shareholders in Redwire need to believe in the long-term growth of the space and defense technology sectors and the company’s ability to translate its innovative partnerships, like the recent Edge Autonomy and Red Cat collaboration, into tangibly higher recurring revenues. While these news events confirm active positioning in defense markets, they do not meaningfully change the most urgent catalyst: converting contract wins into revenue against the backdrop of unstable US government contracting cycles. The biggest risk remains shifting revenue recognition and unpredictable earnings tied to large, complex contracts, which has not been directly addressed by the latest board or management changes. Among recent announcements, the appointment of General (RET) James McConville and Dorothy D. Hayes to the board stands out due to their backgrounds in military leadership and financial oversight. This move, following the Edge Autonomy drone partnership, is relevant as it may support Redwire’s efforts to deepen defense sector ties and enhance governance, important as the company aims to stabilize earnings and reduce risk from contract-driven volatility. Investors will want to see whether these governance enhancements show up in improved execution and margin consistency ahead. In contrast, what often gets overlooked is how persistent volatility in contract timing can impact near-term revenue and is something investors should be aware of before...

Read the full narrative on Redwire (it's free!)

Redwire's outlook projects $887.3 million in revenue and $73.2 million in earnings by 2028. This requires 50.3% annual revenue growth and a $322.7 million earnings increase from current earnings of -$249.5 million.

Uncover how Redwire's forecasts yield a $18.06 fair value, a 127% upside to its current price.

Exploring Other Perspectives

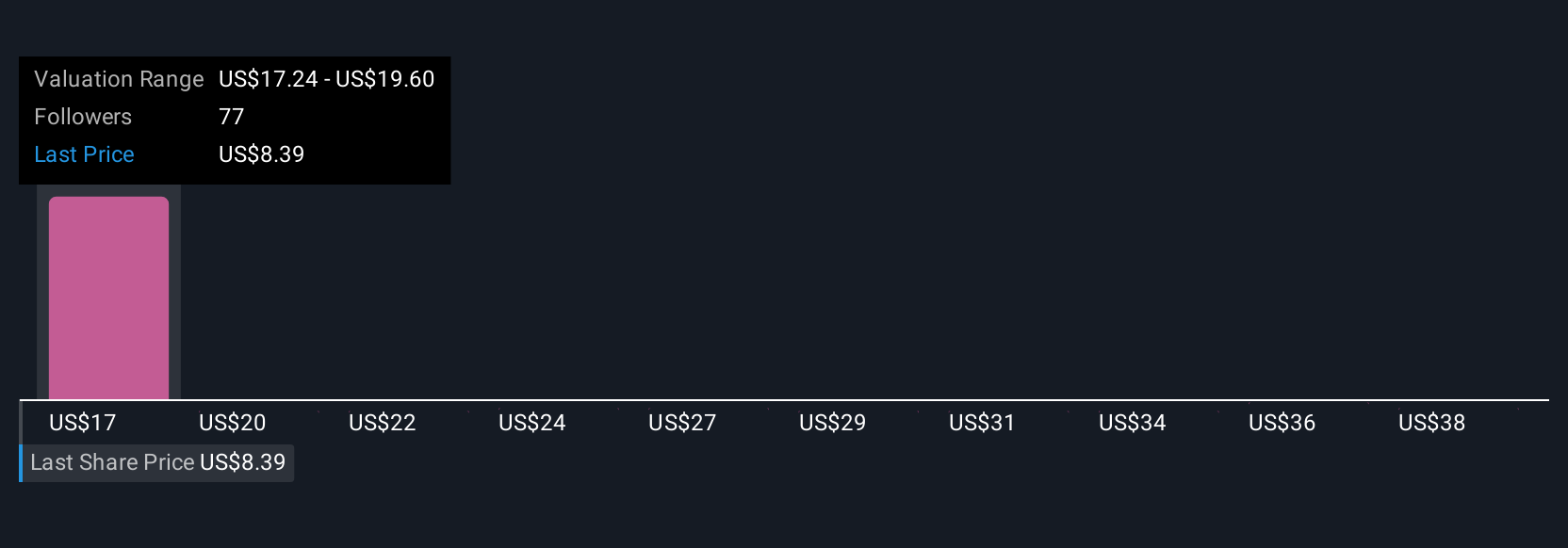

Ten individual perspectives from the Simply Wall St Community estimate Redwire’s fair value ranging from US$17.24 to US$40.80 per share. Yet as attention turns to the ongoing unpredictability of revenue recognition, you’ll find wide differences in how people weigh future outcomes.

Explore 10 other fair value estimates on Redwire - why the stock might be worth just $17.24!

Build Your Own Redwire Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Redwire research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Redwire research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Redwire's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDW

Redwire

Provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives