- United States

- /

- Aerospace & Defense

- /

- NYSE:RDW

Redwire (RDW): Assessing Valuation After Major Axiom Space Contract and New Defense Facility Launch

Reviewed by Kshitija Bhandaru

Redwire (NYSE:RDW) saw its stock climb 4% after news broke that it secured a contract from Axiom Space to supply solar array wings for the company’s commercial space station module. The announcement also coincided with Redwire launching a new facility dedicated to space-based defense systems in Albuquerque, which underscores its expanding presence in both commercial and defense markets.

See our latest analysis for Redwire.

This string of contract wins and facility launches comes against a backdrop of modest but steady performance for Redwire, with the past year’s total shareholder return up nearly 0.5%. While short-term share price movements have stayed relatively muted, these recent developments suggest renewed momentum and highlight how investor sentiment can shift quickly on fresh growth signals.

Curious about what else is advancing in aerospace and defense? It might be the right moment to discover See the full list for free.

With such strong contract wins and robust revenue growth, is Redwire trading at a discount compared to its intrinsic value, or have these growth prospects already been fully reflected in the stock price? Could this be the next buying opportunity, or is the market ahead of itself?

Most Popular Narrative: 40.6% Undervalued

Redwire’s most popular valuation narrative sees its fair value at $18.06, which is significantly above its last close of $10.73. This suggests that, based on consensus estimates, the market may be underappreciating some major growth catalysts. Here is a key excerpt from the widely followed view driving that target:

Redwire is positioned to benefit from accelerated global investment in space exploration and defense, evidenced by new commitments from NATO allies, significant funding initiatives in the U.S. (such as Golden Dome and NASA Gateway), and increasing space budgets in allied countries. These trends are likely to drive robust top-line revenue growth and future contract backlogs.

Want to know what’s fueling this aggressive upside? The narrative leans on projections involving rapid revenue expansion and a game-changing turnaround in profitability. Discover how this narrative justifies such a premium and what assumptions are baked into the sky-high valuation.

Result: Fair Value of $18.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent volatility in U.S. government contracts and competition in key markets could still challenge Redwire's growth outlook and margin expansion.

Find out about the key risks to this Redwire narrative.

Another View: What About Market Multiples?

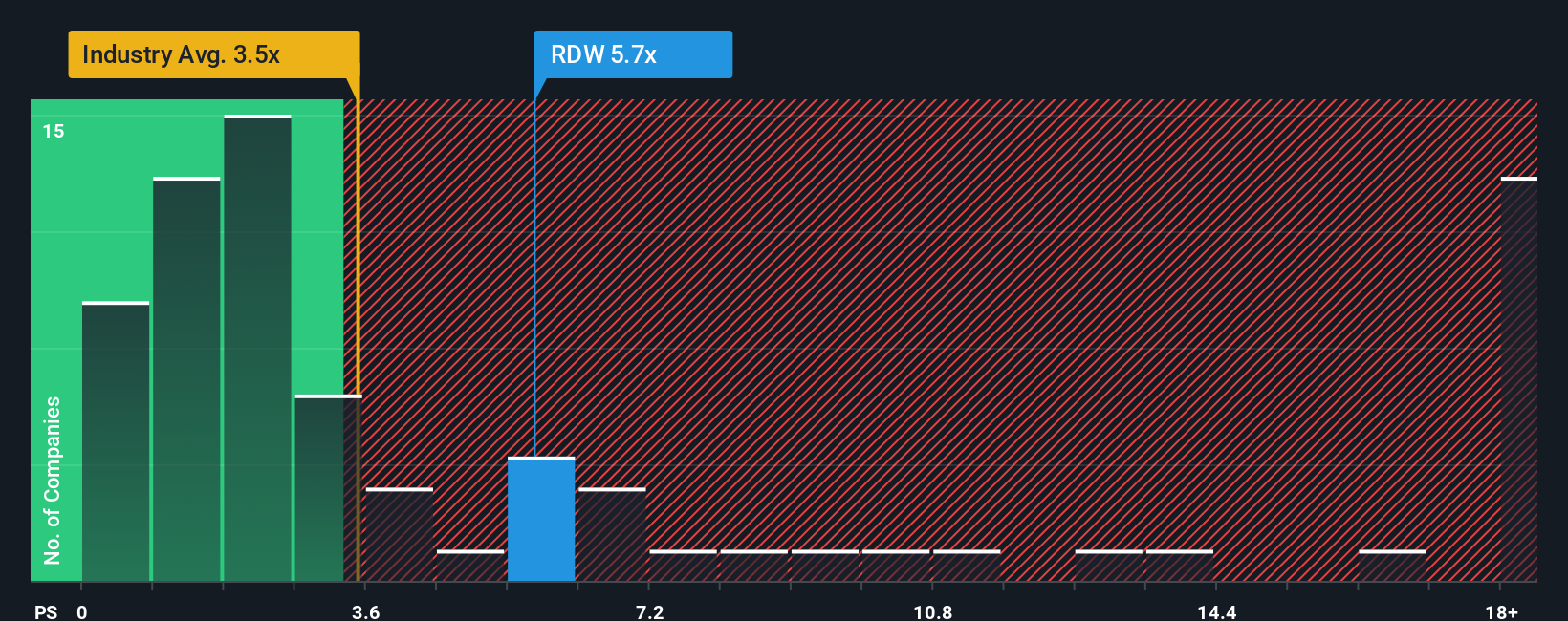

While the headline narrative sees Redwire as deeply undervalued, a look at its price-to-sales ratio tells a different story. The company's ratio stands at 6.4x, which is steep compared to both the U.S. Aerospace & Defense industry average of 3.3x and the peer average of 1.7x. Even relative to a fair ratio of 2.6x, there is a significant premium. This gap suggests that the market may already be factoring in aggressive growth expectations. So is there really a hidden bargain, or is risk mounting at this price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Redwire Narrative

If you're not convinced by the prevailing narratives or want to dig into the numbers on your own terms, you can build your own perspective in just minutes. Do it your way

A great starting point for your Redwire research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't miss your chance to spot smart opportunities before the crowd. Use the Simply Wall Street Screener to find stocks that match your investing style and goals.

- Maximize your income with companies offering impressive yields by checking out these 19 dividend stocks with yields > 3% for stable and consistent returns.

- Be ahead of the curve as artificial intelligence reshapes industries by tracking potential market leaders using these 24 AI penny stocks.

- Capitalize on undervalued gems overlooked by the market by searching through these 896 undervalued stocks based on cash flows and make your next move confidently.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDW

Redwire

Provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives