- United States

- /

- Aerospace & Defense

- /

- NYSE:RDW

Even With A 31% Surge, Cautious Investors Are Not Rewarding Redwire Corporation's (NYSE:RDW) Performance Completely

Despite an already strong run, Redwire Corporation (NYSE:RDW) shares have been powering on, with a gain of 31% in the last thirty days. The annual gain comes to 109% following the latest surge, making investors sit up and take notice.

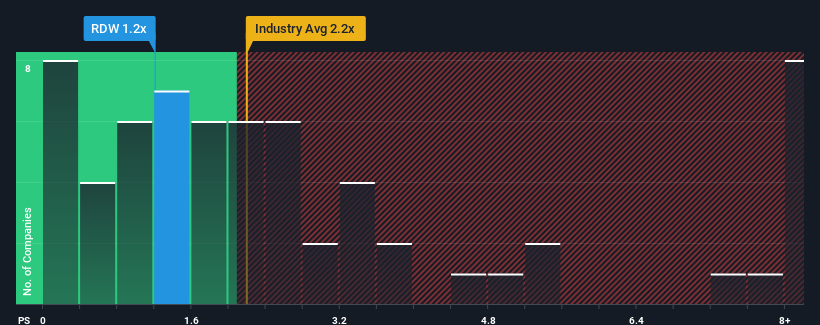

Although its price has surged higher, Redwire may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.2x, since almost half of all companies in the Aerospace & Defense industry in the United States have P/S ratios greater than 2.2x and even P/S higher than 5x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Redwire

How Has Redwire Performed Recently?

Redwire certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Redwire will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Redwire?

In order to justify its P/S ratio, Redwire would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 48% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 17% per year during the coming three years according to the five analysts following the company. With the industry only predicted to deliver 2.5% each year, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Redwire's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Despite Redwire's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Redwire's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with Redwire.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RDW

Redwire

Provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives