- United States

- /

- Aerospace & Defense

- /

- NYSE:RDW

Does Redwire’s Share Price Drop Signal a Market Overreaction in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Redwire? You are not alone. The company’s rollercoaster run has had even seasoned investors watching closely. While Redwire’s stock recently closed at $8.55 and has fallen 11.4% over the past week, longer-term holders have seen nearly three years of eye-opening growth with a staggering 273.4% return in that time. Despite a nearly 50% drop year-to-date, the 1-year return is still positive at 0.8%. This blend of short-term volatility and long-term performance has everyone wondering if the market really sees Redwire’s growth potential, or if rising uncertainty is causing a recalibration in risk.

Part of the recent moves reflects how investors are digesting market developments and reassessing the company’s position. There is growing chatter about the broader space sector, which can drive both heightened interest and caution as trends shift in and out of favor. Amid these moves, Redwire currently holds a value score of 2 out of 6, meaning it is considered undervalued in 2 key areas compared to standard valuation checks. Does that mean it is a bargain, or just more complicated than it looks at first glance?

We are about to dig into exactly how Redwire stacks up on traditional valuation methods and, more importantly, introduce an approach at the end that could give you an even clearer answer about what the stock is really worth.

Redwire scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Redwire Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to today’s value. For Redwire, this method uses cash flow forecasts to help investors gauge what the business could be worth based on fundamental performance, instead of just market sentiment.

Currently, Redwire’s free cash flow sits at -$154.07 Million, meaning the company is spending more cash than it generates. Despite this, analysts expect an impressive turnaround, with free cash flow projected to reach $45.83 Million in 2026 and $73.10 Million in 2027. Over the next ten years, projections, partly based on analyst estimates and partly on extrapolation, see free cash flows growing steadily, reaching over $202 Million by 2035.

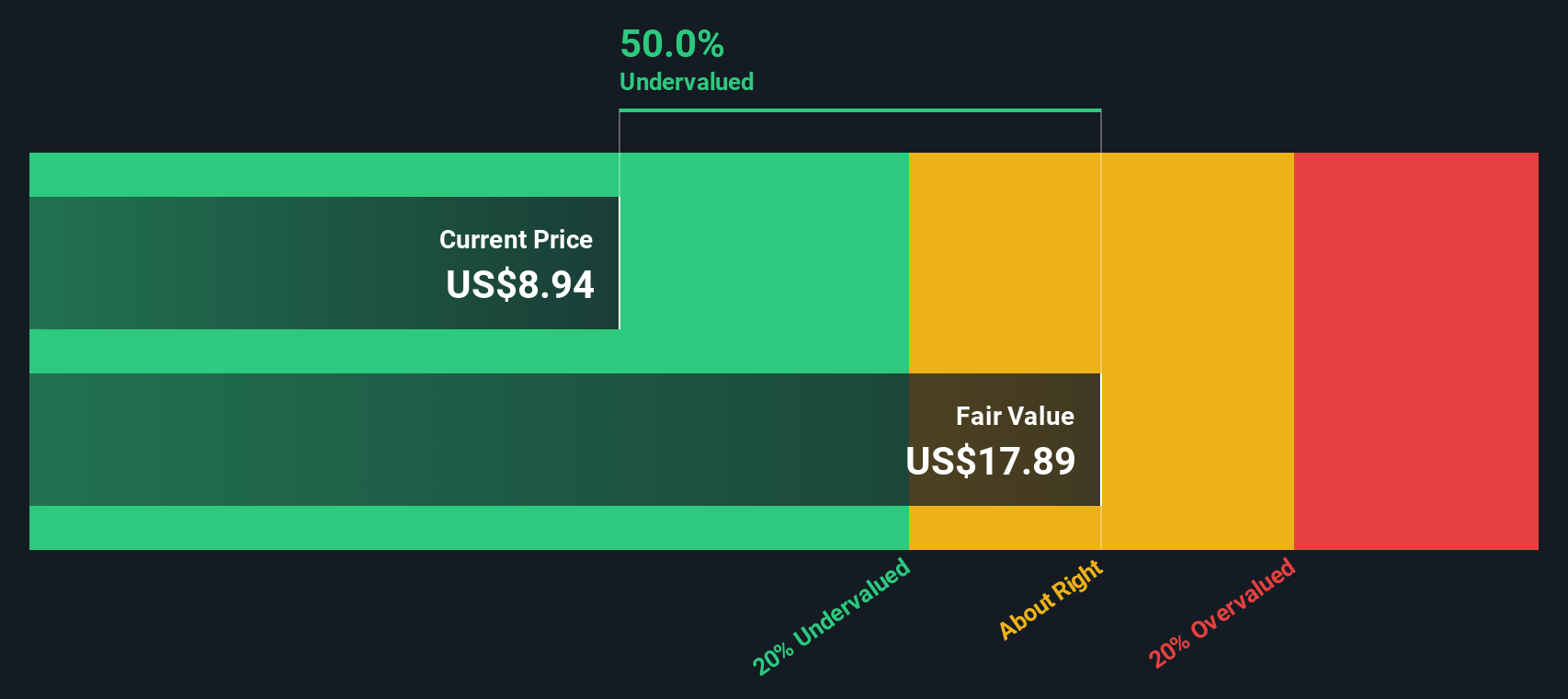

Based on these projections and using the 2 Stage Free Cash Flow to Equity model, the DCF approach pegs Redwire’s fair value at $17.76 per share. With the current share price at $8.55, the model suggests Redwire is trading at a 51.9% discount to its estimated intrinsic value. This may indicate that the market is undervaluing the company’s long-term potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Redwire is undervalued by 51.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Redwire Price vs Sales

For companies still building profitability, such as Redwire, the Price-to-Sales (P/S) ratio is a popular valuation metric. It allows investors to assess how much they are paying for each dollar of the company’s revenue. This measure is especially useful when earnings are volatile or negative, as profits do not yet reflect the business’s sales momentum or market opportunity.

The baseline for judging what makes a “normal” P/S ratio depends on growth expectations and the risk investors associate with the company’s future sales. All else equal, firms with rapid, defensible growth can justify a higher ratio, while those facing uncertain demand or industry headwinds might trade at a discount.

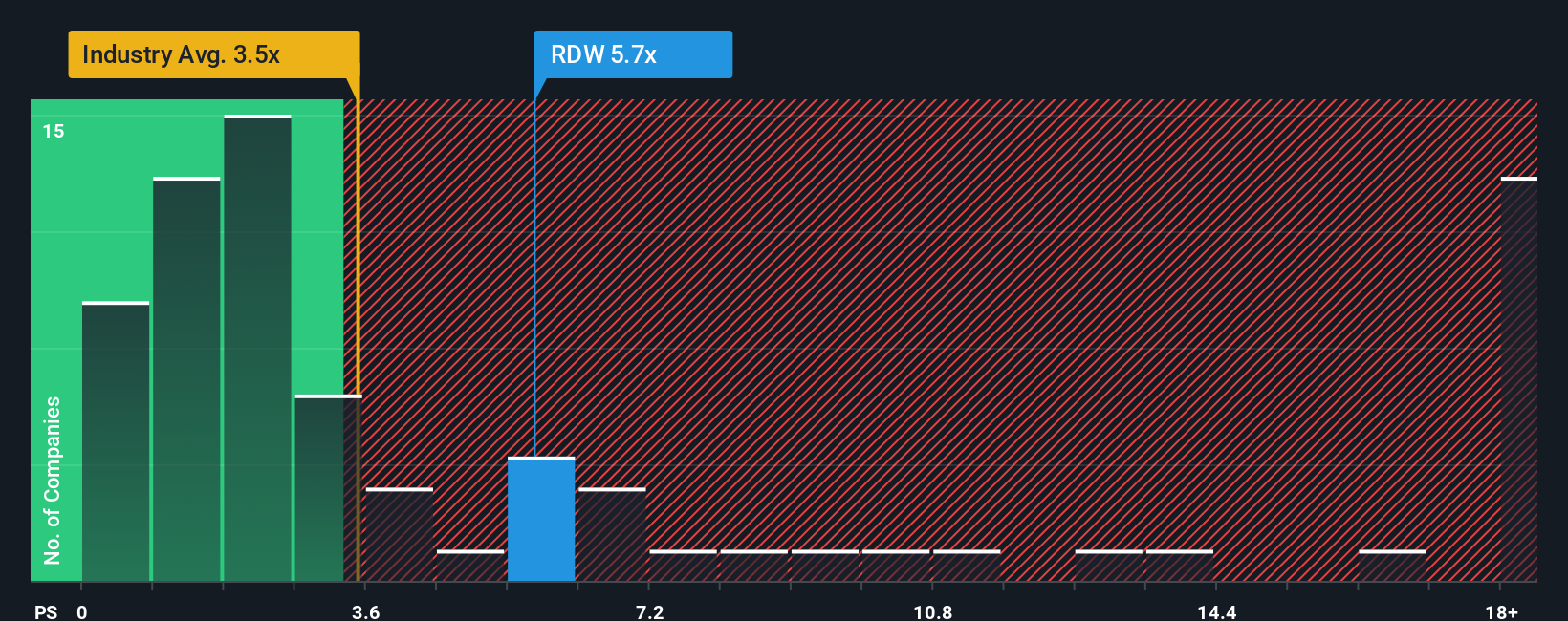

Redwire’s current P/S ratio is 5.08x, which is notably higher than both the Aerospace & Defense industry average of 3.13x and the peer average of 1.78x. However, Simply Wall St’s “Fair Ratio,” which factors in Redwire’s sales growth, margin profile, size, and sector risk, lands at 2.46x. Unlike industry comparisons, the Fair Ratio is tailored to the company’s actual prospects and risk, making it a more precise valuation yardstick for dynamic businesses like Redwire.

Because Redwire’s current P/S is well above its Fair Ratio, the market may be pricing in more growth or less risk than is truly justified.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Redwire Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply a story or perspective about a company’s future, grounded in clear expectations for things like revenue, earnings, and margins, that you can link directly to a financial forecast and fair value estimate.

Rather than relying purely on formulas, Narratives give investors a way to connect their view of a company’s strategy, risks, and industry drivers to the numbers. This approach puts the “why” behind every estimate. With Narratives available right on Simply Wall St’s Community page, investors of all levels can quickly craft or explore new perspectives and see how they translate into fair value and buy or sell decisions, using the same tools as millions of others.

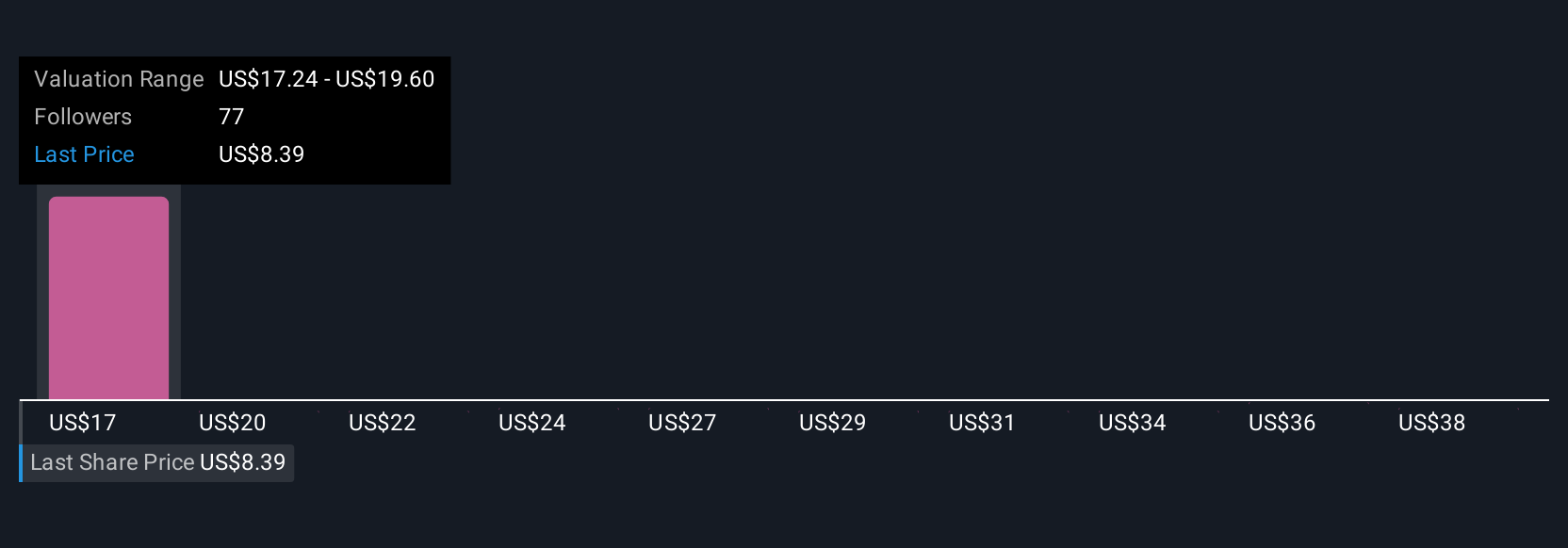

Narratives are particularly helpful because they update dynamically when new information, such as quarterly results or important news, is released. This helps keep your view accurate, relevant, and actionable. For example, some Redwire Narratives are led by bullish users, who see surging demand from NASA and NATO, expect high-margin new product growth, and value the stock as high as $28 per share. Others focus on government contract risks and rising costs, resulting in more cautious estimates as low as $10 per share.

Do you think there's more to the story for Redwire? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDW

Redwire

Provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives