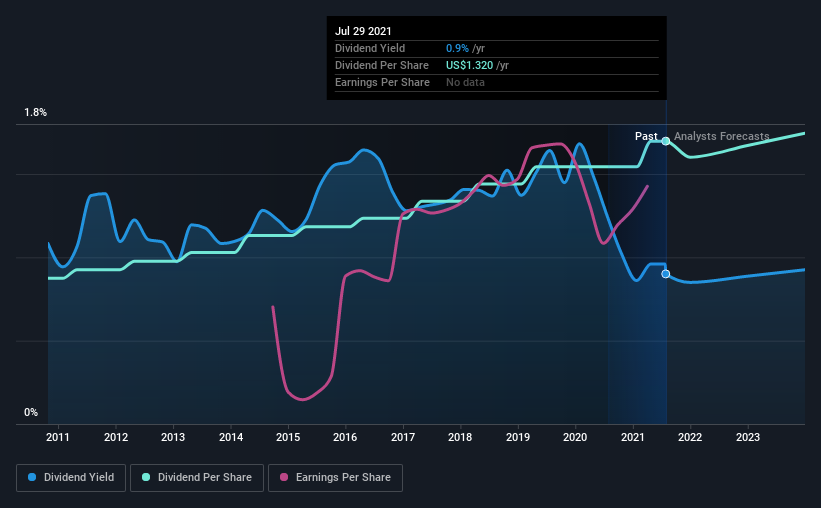

Regal Beloit Corporation (NYSE:RBC) has announced that it will be increasing its dividend on the 15th of October to US$0.33. Despite this raise, the dividend yield of 0.9% is only a modest boost to shareholder returns.

Check out our latest analysis for Regal Beloit

Regal Beloit's Dividend Is Well Covered By Earnings

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. However, prior to this announcement, Regal Beloit's dividend was comfortably covered by both cash flow and earnings. This means that most of its earnings are being retained to grow the business.

The next year is set to see EPS grow by 43.3%. If the dividend continues on this path, the payout ratio could be 18% by next year, which we think can be pretty sustainable going forward.

Regal Beloit Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The dividend has gone from US$0.68 in 2011 to the most recent annual payment of US$1.32. This works out to be a compound annual growth rate (CAGR) of approximately 6.9% a year over that time. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

Regal Beloit Could Grow Its Dividend

The company's investors will be pleased to have been receiving dividend income for some time. We are encouraged to see that Regal Beloit has grown earnings per share at 9.2% per year over the past five years. Regal Beloit definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio.

We Really Like Regal Beloit's Dividend

Overall, a dividend increase is always good, and we think that Regal Beloit is a strong income stock thanks to its track record and growing earnings. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All of these factors considered, we think this has solid potential as a dividend stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 1 warning sign for Regal Beloit that investors need to be conscious of moving forward. We have also put together a list of global stocks with a solid dividend.

When trading Regal Beloit or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:RRX

Regal Rexnord

Provides sustainable solutions for power, transmit, and control motion products in the North America, Asia, Europe, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives